|

|

A/P Distribution to G/L ReportApplication Overview

The A/P Distribution to G/L Report is a list of all transactions from A/P, which affect the General Ledger. The report can be printed in detail, showing each entry with its vendor number and voucher number, or it can be printed in summary, showing only one entry per date per account. The report is printed from the A/P Distribution to G/L File, which is also used for the automatic interface within General Ledger. The report would normally be printed once every accounting period and then the file purged, but the information can be retained on file indefinitely if desired.

This Report is available in any combination of the following 5 Report Types:

Expense Distributions New A/P Added Checks Written Discounts Taken A/P Paid

Once you have selected your Report Types, you have the print to report by:

1. Interfaced Items 2. Non-Interfaced Items 3. Both Interfaced and Non-Interface

Expense Distributions

These are entries to be posted to the expense accounts. In the case of purchases of assets, such as inventory or office furniture, this section would contain asset accounts. Most of them will be debits, which were added to the A/P Distribution to G/L File when new A/P transactions were posted. They are normally counterbalanced by credits to an A/P account. For example, a voucher is entered for a shipment of $1,000 worth of computer supplies and $2,000 worth of office supplies, with a $40 freight charge. This transaction increases expenses (a debit) and increases A/P (a credit). Therefore, there might be a $1,000 debit to the computer supplies expense account, a $2,000 debit to the office supplies expense account, and a $40 debit to the freight expense account. These entries would be counterbalanced by a credit entry of $3040 to an A/P account, which would be found in the New A/P Added section of this report.

New A/P Added

These are entries to be posted to the A/P accounts. Most of them will be credits, which were added to the A/P Distribution to G/L File when new A/P transactions were posted. They are normally counterbalanced by debits to asset or expense accounts. See the example under Expense Distributions.

Checks Written

These are entries to be posted to the cash accounts. Most of them will be credits, which were added to the A/P Distribution to G/L File when a check was printed. They are normally counterbalanced by debits to an A/P account. For example, a check for $100 is written to pay a $100 invoice, which has previously been entered into the system as an A/P open item. This transaction decreases cash (a credit) and decreases A/P (a debit). Therefore, there would be a $100 credit to a cash account and a $100 debit to an A/P account.

Discounts Taken

These are entries to be posted to the discount accounts. Most of them will be credits, which were added to the A/P Distribution to G/L File when a check was written to pay an invoice with a discount. They are normally counterbalanced by debits to an A/P account. For example, a check for $95 is written to pay a $100 invoice with a $5 discount. This transaction decreases cash (a credit), increases discounts taken (a credit), and decreases A/P (a debit). Therefore, there would be a $95 credit to a cash account, a $5 credit to a discount account, and a $100 debit to an A/P account.

A/P Paid

These are entries to be posted to the A/P accounts. Most of them will be debits to the A/P accounts, which were added to the A/P Distribution to G/L file when a check was written to pay an invoice, which has previously been entered into the system as an A/P open item. See the examples under Checks Written Paid and Discounts Taken. Run Instructions

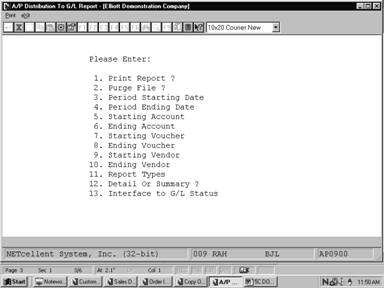

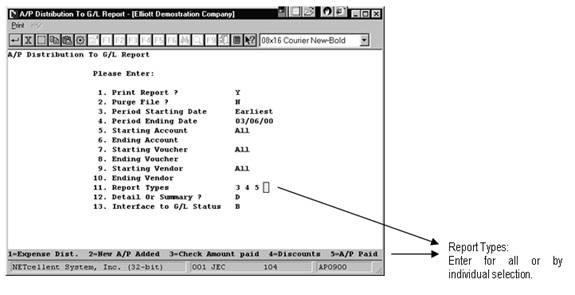

Select A/P Distribution To G/L Report from the pull down A/P Reports window. The following screen will then be displayed:

A/P Distribution To G/L Report Entry Screen

A C C O U N T S P A Y A B L E D I S T R I B U T I O N T O G E N E R A L L E D G E R R E P O R T

For The Period: Earliest To 01/24/93 In Detail Expense Distributions:

Account Description Vouchr Vendor Vendor Dist Journal Amount No No No Name Date Source Distributed

Expense Distributions:

01100‑00000‑00000 Inventory ‑ Raw Materials 500096 000700 Southern Electronics 02/18/92 AP0105 31,552.35 500098 000100 Computer Electronics Center 02/11/92 Apin 39.00

Total Debits: 31,591.35 Total Credits: .00 Account Total: 31,591.35

04230‑00000‑00000 Purchase Price Variance ‑ R/M 500096 000700 Southern Electronics 02/18/92 AP0105 26,552.35 CR

Total Debits: .00 Total Credits: 26,552.35 CR Account Total: 26,552.35 CR

04900‑00000‑00000 Inventory Clearing Account 500097 000100 Computer Electronics Center 02/11/92 Apin 78.00

Total Debits: 78.00 Total Credits: .00 Account Total: 78.00

Total: 5,117.00

A C C O U N T S P A Y A B L E P E R I O D S U M M A R Y

For The Period: Earliest To 01/24/93 In Summary Expense Distributions:

Account Description Invoice Amount No Date Distributed

Expense Distributions:

01100‑00000‑00000 Inventory ‑ Raw Materials 02/11/92 39.00 02/18/92 31,552.35

Account Total: 31,591.35

04230‑00000‑00000 Purchase Price Variance ‑ R/M 02/18/92 26,552.35 CR

Account Total: 26,552.35 CR

04900‑00000‑00000 Inventory Clearing Account 02/11/92 78.00

Account Total: 78.00

Total: 5,117.00

|