|

|

Check ReconciliationApplication OverviewPeriodically, the bank will send a statement showing all checks, which have been paid out of your checking account as well as all deposits and charges, made. The canceled checks will be included with the statement. Each of these statements must be reconciled, that is you must ensure that there are no discrepancies between your records and the bank's records concerning the account.

The file can be purged to save disk space, or the information can be retained on file for future reference. The following is one procedure to use in reconciling checks:

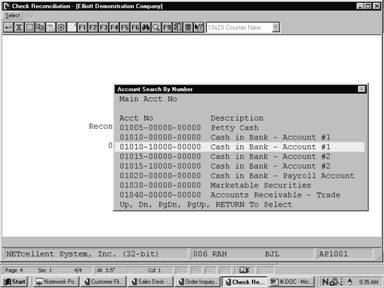

1) If you are using multiple cash accounts, enter the cash account number of the account you are reconciling.

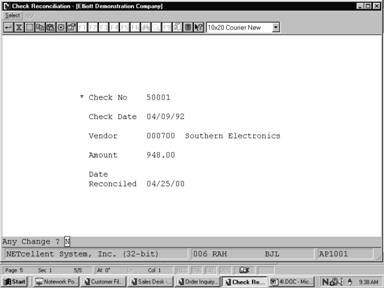

2) Enter the number of the first check on the stack. The information on file for the check number entered will be displayed on the screen. Ensure that the vendor and amount are correct; if not, make a note of it.

3) Enter the statement ending date on the screen where it says Date Reconciled. This field will default to the last date entered on subsequent entries.

4) Repeat steps 3 and 4 until all checks have been entered. You can press the F1 key when the cursor is positioned for entry of the check number to bring up the next check on file. This can save you some entry time.

5) After all the checks are entered, print the Check Reconciliation Report in the Reports pull down window for the correct cash account. Answer Y to Show Paid Checks, enter the statement date for the reconciliation date and the ending check date. Answer N to Purge Reconciled Checks.

6) A report will print showing all outstanding checks (those that the bank has not paid yet) and all checks, which were shown as, paid on the current statement.

7) Find out what the checkbook total was for the account on the statement ending date. This total, plus the total outstanding checks shown on the report, minus any charges shown in the statement should equal the account ending balance shown on the statement.

8) If these amounts are not equal, then you must figure out why. First, compare the total of reconciled checks to the figure on the bank statement. If they do not match, find which check amount is incorrect. Make sure that the last statement was properly reconciled. Make sure that there are no arithmetic errors in the checkbook. Correct any errors found.

9) Enter the charges shown on the statement into the checkbook.

10) The statement is now reconciled.

Run Instructions

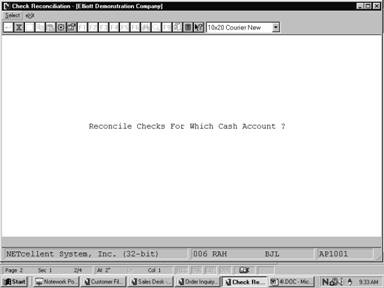

Select Check Reconciliation from the pull down A/P Processing window. The following screen will then be displayed:

Check Reconciliation Entry Screen

The following options are available:

* Select the desired mode from the Check Reconciliation menu bar * Enter the data requested on the screen * To select paid checks, enter the data per the Entry Field Descriptions * To print the a list of outstanding or reconciled checks, select the Check Reconciliation Report from the Reports pull down window * To exit press the ESC or F10 key when the cursor is positioned for entry of the first field on the screen

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar.

Entry Field Descriptions

Check Reconciliation (Account Search By Number)

Enter The Checks To Reconcile |