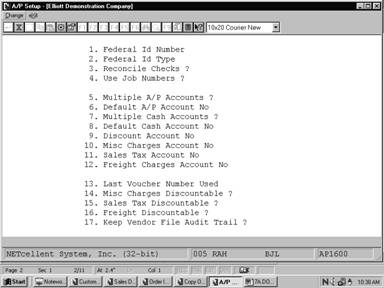

A/P Setup allows you to turn certain features of the

A/P package on and off and set package‑wide defaults. This allows you to

tailor the package to your own needs and increase throughput.

Select A/P Setup from the pull down A/P Util_setup

window. The following screen will then be displayed:

* To

exit press the ESC or F10 key when the cursor is positioned for entry of the

first field on the screen

To return to the menu bar, press the ESC or F10 key.

To leave this application, press X for EXIT when positioned at the menu bar.

|

Name

|

Type

and Description

|

|

1. Federal Id Number

|

9 numeric digits

(999999999).

Enter the federal ID number

for your company. This number will be printed on the Federal 1099 forms. If

you do not have a federal ID number, use your social security number.

|

|

2. Federal Id Type

|

1 alphabetic character.

If you entered a social security number above, enter

S. The number will be redisplayed in 999‑99‑9999 format.

If you entered an actual

federal ID number above, enter F. The number will be redisplayed in 99‑9999999

format.

|

|

3. Reconcile Checks ?

|

Y or N.

If you wish to turn on the Check Reconciliation

feature, enter Y. The Check Reconciliation application will be enabled and

records will be posted to the Check Reconciliation File when checks are

posted.

If you wish to turn off the Check Reconciliation

feature, enter N. The Check Reconciliation application will be disabled and

no records will be posted to the Check Reconciliation File. If later you

wish to turn this option back on you may, but the file will be empty until

some more checks are posted.

The default is N.

|

|

4. Use Job Numbers ?

|

Y or N.

Job numbers are used to help you track expenses on

particular projects and/or activities. Distribution of expenses when

entering new A/P transactions may become more time consuming when job numbers

must be entered, depending on how extensively the feature is used and how

difficult it is to determine which job or jobs a given invoice belongs.

If you wish to use job

numbers in the A/P package, enter Y. The Job Distribution Report application

will be enabled and records will be posted to the Job Distribution File.

|

|

Use Job Numbers ? (continued)

|

If you would prefer not to

use job numbers in the A/P package, enter N. The Job Distribution Report

application will be disabled and records will not be posted to the Job

Distribution File.

The default is N.

|

|

5. Multiple A/P Accounts ?

|

Y or N.

If you wish to turn on the Multiple A/P Accounts

feature, enter Y. Whenever a transaction is entered which affects A/P, the

correct A/P account number to affect will be requested on the screen.

If you wish to turn off the Multiple A/P Accounts

feature, enter N. Whenever a transaction is entered which affects A/P, the

default A/P account (next entry) will be affected.

The default is N.

|

|

6. Default A/P Account No

|

An account number in the

standard account number format.

If the Multiple A/P Accounts feature is turned on, this

will become the default value whenever the A/P account is entered.

If the Multiple A/P Accounts feature is turned off,

this will become the A/P account, which is always used by the A/P package.

The account number entered

here should be a liability account.

|

|

7. Multiple Cash Accounts ?

|

Y or N.

If you wish to turn on the Multiple Cash Accounts

feature, enter Y. Whenever a transaction is entered which affects cash, the

correct cash account to affect will be requested on the screen.

The default is N.

|

|

8. Default Cash Account No

|

An account number in the

standard account number format.

If the Multiple Cash Accounts feature is turned on,

this will become the default value whenever the cash account is entered.

If the Multiple Cash Accounts feature is turned off,

this will become the cash account, which is always used by the A/P package.

The account number entered

here should be an asset account.

|

|

9. Discount Account No

|

An account number in the

standard account number format.

This is the discounts taken account which will always

be used by the A/P package.

The account number entered

here should be a revenue account.

|

|

10. Misc Charges Account No

|

An account number in the

standard account number format.

Enter the miscellaneous charges expense account

number. Miscellaneous charges can be distributed to this expense account

automatically by pressing a function key while entering expense distributions

in A/P Transaction Processing.

If you do not want

miscellaneous charges to be distributed automatically to a particular

account, enter a dummy account number in this field that you will not use.

|

|

11. Sales Tax Account No

|

An account number in the

standard account number format.

Enter the sales tax expense account number. Sales tax

can be distributed to this expense account automatically by pressing a

function key while entering expense distributions in A/P Transaction

Processing.

If you do not want sales tax

charges to be distributed automatically to a particular account, enter a

dummy account number in this field that you will not use.

|

|

12. Freight Charges

Account No

|

An account number in the

standard account number format.

Enter the freight charges expense account number. Freight

charges can be distributed to this account automatically by pressing a

function key while entering expense distributions in A/P Transaction

Processing.

If you do not want freight

charges to be distributed automatically to a particular account, enter a

dummy account in this field that you will not use.

|

|

13. Last Voucher

Number Used

|

6 numeric digits (999999).

When first setting up the A/P package, the number

entered here should be one less than the first number that should

automatically be assigned during A/P Transaction Processing.

For example, if you wish to

have the first voucher number be 1, then enter zero here. If you want to

start at voucher number 10000, then enter 9999 here.

|

|

14. Misc Charges

Discountable ?

|

1 alphabetic character.

If miscellaneous charges are discountable, it means

that an early payment discount can be taken on the miscellaneous charges

amount as well as on the amount paid for goods.

There are five valid values for this field:

A = Miscellaneous

charges are always discountable.

X = Miscellaneous

charges are never discountable.

Y = Miscellaneous

charges are usually discountable.

N = Miscellaneous

charges are not usually discountable.

"" = Miscellaneous

charges are sometimes discountable and sometimes not.

If A is entered, the operator will not be asked during

A/P Transaction Processing if the miscellaneous charges are discountable.

It will be assumed that they are discountable.

If X is entered, the

operator will not be asked during A/P Transaction Processing if the miscellaneous

charges are discountable.

|

|

Misc Charges Discountable ?

|

If Y is entered, the

operator will be asked during A/P Transaction Processing if the miscellaneous

charges are discountable. The answer will default to Y.

If N is entered, the operator will be asked during A/P

Transaction Processing if the miscellaneous charges are discountable. The

answer will default to N.

If "" is entered,

the operator will be asked during A/P Transaction Processing if the miscellaneous

charges are discountable. The answer will not have a default. It will be

assumed that they are not discountable.

|

|

15. Sales Tax Discountable?

|

1 alphabetic character.

If sales tax is discountable, it means that you are to

pay sales tax on the price you are actually paying for goods. If sales tax

is not discountable, it means that you pay tax on the full price of

merchandise, regardless of whether you get an early payment discount.

There are five valid values for this field:

A = Sales

tax is always discountable.

X = Sales

tax is never discountable.

Y = Sales

tax is usually discountable.

N = Sales

tax is not usually discountable.

"" = Sales

tax is sometimes discountable and sometimes not.

If A is entered, the operator will not be asked during

A/P Transaction Processing if the sales tax is discountable. It will be

assumed that it is discountable.

If X is entered, the operator will not be asked during

A/P Transaction Processing if the sales tax is discountable. It will be

assumed that it is not discountable.

If Y is entered, the operator will be asked during A/P

Transaction Processing if the sales tax is discountable.

The answer will default to

Y.

|

|

Sales Tax Discountable ? (continued)

|

If N is entered, the

operator will be asked during A/P Transaction Processing if the sales tax is

discountable. The answer will default to N.

If "" is entered,

the operator will be asked during A/P Transaction Processing if the sales tax

is discountable. The answer will not have a default.

|

|

16. Freight Discountable ?

|

1 alphabetic character.

If freight is discountable, it means that an early

payment discount can be taken on the freight charges amount, as well as on

the amount paid for goods.

There are five valid values for this field:

A = Freight is always discountable.

X = Freight is never discountable.

Y = Freight is usually discountable.

N = Freight is not usually discountable.

"" = Freight is sometimes discountable and

sometimes not.

If A is entered, the operator will not be asked during

A/P Transaction Processing if the freight is discountable. It will be

assumed that it is discountable.

If X is entered, the operator will not be asked during

A/P Transaction Processing if the freight is discountable. It will be

assumed that it is not discountable.

If Y is entered, the operator will be asked during A/P

Transaction Processing if the freight is discountable. The answer will

default to Y.

If N is entered, the operator will be asked during A/P

Transaction Processing if the freight is discountable. The answer will default

to N.

If "" is entered,

the operator will be asked during A/P Transaction Processing if the freight

is discountable. The answer will not have a default.

|

|

17. Keep Vendor File

Audit Trail ?

|

Y or N.

If you wish to turn on the Vendor Audit Trail feature,

enter Y. Any additions, changes and deletions to the file will be logged in

the Vendor Audit Trail File and the Vendor Audit Trail Report can be printed.

If you wish to turn off the

Vendor Audit Trail feature, enter N. No records will be added to the Vendor

Audit Trail File and the Vendor Audit Trail Report will be disabled. If you

later want to turn this option on, you can do so.

|

|

Screen 2

18. Enter Vendor P/O Data ?

|

Y or N.

This answer determines whether you will be asked to enter

P/O data on the second screen of Vendor File Maintenance. If you answer N to

this question, the second screen of Vendor File Maintenance will not appear

and the default fields will be used.

This field defaults to Y.

|

|

19. Enter Transaction

P/O Data?

|

Y or N.

This answer determines whether you will be asked to

enter P/O data on the second screen of A/P Transaction Processing. If you

answer N to this question, the second screen of A/P Transaction Processing

will not include P/O data.

This field defaults to Y.

|

|

20. Default Fob Code

|

2 alphanumeric characters.

Enter the default FOB code to be used during data

entry.

This is the automatic

default if the Enter Vendor P/O Data flag is N.

|

|

21. Default Ship Via Code

|

2 alphanumeric characters.

Enter the default Ship Via Code to be used during data

entry.

This is the automatic

default if the Enter Vendor P/O Data flag is N.

|

|

22. Change Protected Fields ?

|

Y or N.

Enter whether you are going to allow changes to the

protected fields using the F6 key or not.

This field defaults to N.

|

|

23. Validate Accounts

From A/P Or G/L

|

A or G

If you enter A, account number entries are validated

against the A/P Account File.

If you enter G, account

number entries are validated against the G/L Account File.

|

|

24. - 28. Vendor Note

Literals

1 -5

|

10 alphanumeric characters.

These fields serve to define the literal label that

identifies each line of Notes field information.

You may enter any expression

that suits your needs.

|

|

29. Vendor Date Literal

|

10 alphanumeric characters.

This field labels the date expression that is entered

into vendor Notes.

You may enter any expression

that suits your needs.

|

|

30. Vendor Amount Literal

|

10 alphanumeric characters.

This field labels the amount expression that is entered

into vendor Notes.

You may enter any expression

that suits your needs.

|

|

31. Label Code ?

|

2 numeric characters.

Enter the Label Code that

was defined under the Elliott main menu bar of Util_setup.

|

|

32. Print A/R Job Info ?

|

Y or N.

If you answer Y, Job History

file information generated from Accounts Receivable will be printed on the

Job Analysis Report. If you answer N, Job History file information generated

from Accounts Receivable will not be printed on the Job Analysis Report.

|

|

33. Print Payroll Job Info ?

|

Y or N.

If you answer Y, Job History

file information generated from Payroll will be printed on the Job Analysis

and Job Distribution Reports. If you answer N, Job History file information

generated from Payroll will not be printed on the Job Analysis and Job

Distribution Reports.

|

|

34. Print Checks On Laser?

|

Y or N.

Enter Y to print A/P checks

on laser forms. Enter N to print checks on standard (continuous) forms.

|