|

|

Print/Create 1099 FormsApplication Overview

The Print/Create 1099 Forms application should be run at the end of the year prior to clearing the YTD accumulators. It provides all necessary information on 1099‑MISC forms for individuals who receive compensation but who are not employees. One vendor's name, address, and federal ID number from the vendor file are printed on each form, along with a figure indicating the total payments made to the vendor during the course of the year. The original copy (Copy A) is sent to the IRS. Copy B is sent to the vendor. Copy C is kept in your files and the last copy is for the state.

The program will also allow the user to create the IRSTAX file on disk required by the Internal Revenue Service for magnetic media reporting. A file named IRSTAX will be created which can be copied to a diskette and forwarded to the IRS. For more information on magnetic media reporting, please refer to the appropriate IRS bulletin.

In the Vendor File, there is a field called 1099 category. This is a one‑character alphanumeric field. Any one‑character entry is allowed. Federal 1099 information returns can only be generated for one category at a time, so it is recommended that X be entered as the 1099 category for all vendors for whom 1099 returns are to be generated. In this way, all 1099 returns can be generated in a single run by selecting category X. Also see Processing Procedures in chapter one and Vendor File in the Maintenance section (chapter two) for additional information. The 1099 print application supports boxes one to eight on the 1990 1099-MISC tax form. The vendor category code controls which box the year-to-date payment is entered; for example, if the vendor category code contains a three, the payment amount would be printed in box three of the 1099. The following are the codes and 1099 boxes supported by Elliott:

1 - Rents 2 - Royalties 3 - Prizes, awards, etc. 4 - Federal income tax withheld 5 - Fishing boat proceeds 6 - Medical and health care payments 7 - Nonemployee compensation 8 - Substitute payments in lieu of dividends or interest

If the vendor category code in the vendor record is not one of the above, the year-to-date payment amount will print in box seven of the 1099, nonemployee compensation.

The proper 1099 forms to be used are available through NETcellent System Incorporated Forms Division.

Run Instructions

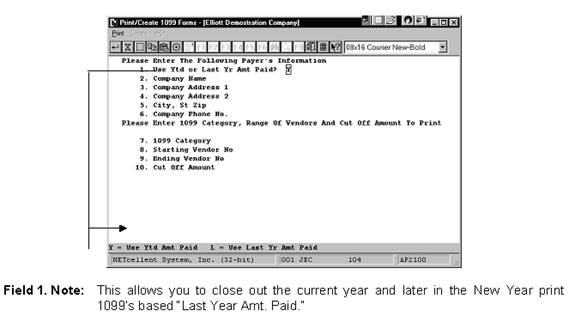

Select Print/Create 1099 Forms from the pull down A/P Processing window. The following screen will then be displayed:

Print/Create 1099 Forms Entry Screen

The following options are available:

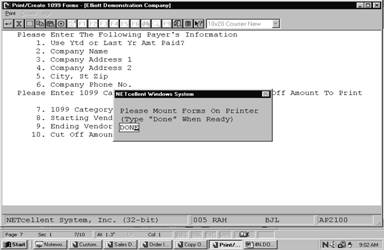

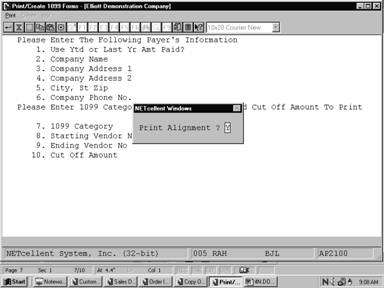

* Select the desired mode from the Print/Create 1099 Forms menu bar * A menu bar will then be displayed allowing you to choose one of these options: - Print 1099 forms - Create 1099 File * Select the option you wish to perform * Enter the data requested on the screen

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar.

Print 1099 Forms

|

|

Name |

Type and Description |

|

2. Company Name |

28 alphanumeric characters.

Enter the company name as you wish it to appear on the 1099 forms. |

|

3. Company Address 1 |

28 alphanumeric characters.

Enter the company address as you wish it to appear on the 1099 forms. |

|

4. Company Address 2 |

|

|

5. City, St Zip |

28 alphanumeric characters.

Enter the company city, state, and zip code as you wish it to appear on the 1099 forms.

This information must be entered according to the following format. City, St Zip Pomona, CA 91766 Please make sure to place a comma (,) between the city and abbreviated state. |

|

6. Company Phone No. |

XXX XXX-XXXX |

|

7. 1099 Category |

1 alphanumeric character.

Enter the 1099 category that you wish to print. The 1099 forms will be printed for vendors having this same 1099 category. |

|

8. Starting Vendor No |

6 alphanumeric characters.

Enter the starting vendor number in the range that you want to print.

The default is All vendors. |

|

9. Ending Vendor No |

6 alphanumeric characters.

Enter the ending vendor number in the range that you want to print.

The default is the starting vendor number to make it easy to print a 1099 form for one vendor. |

|

10. Cut Off Amount |

9 numeric characters with 2 decimal positions.

This is the cut‑off amount of vendor YTD payments to be reported. |

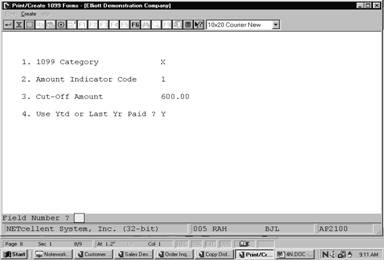

Create 1099 File

|

Name |

Type and Description |

|

1099 Category |

1 alphanumeric character.

Enter the 1099 category that you wish to report. Vendors having this 1099 category will be reported. |

|

Amount Indicator Code |

1 alphanumeric character.

Enter the proper amount indicator code from the IRS magnetic media reporting bulletin. |

|

Cut‑Off Amount |

9 numeric digits with 2 decimal positions.

This is the cut‑off amount of vendor YTD payments to be reported. If the vendor's YTD payments are equal to or greater than this amount, the vendor will be reported on the IRSTAX file. |

|

1. Payment Year |

4 numeric digits.

Enter the tax year being reported. |

|

2. Payer Name Control |

4 alphanumeric characters.

Enter the Payer Name Control assigned to your company by the IRS. |

|

3. Transmitter Control Code |

5 alphanumeric characters.

Enter the Transmitter Control Code assigned to your company by the IRS. |

|

4. Payer Federal Id No |

9 numeric digits.

Enter your company's Federal Employer ID Number. DO NOT enter all zeros or all nines. Defaults to the Federal ID Number in Accounts Payable Setup. |

|

5. Foreign Corp. Indicator |

1 alphanumeric character.

Enter 1 if the payer is a foreign corporation, otherwise enter blank. |

|

6. Transfer Agent Indicator |

1 numeric digit.

Enter 0 (zero) or 1 per the IRS magnetic media reporting bulletin. |

|

7. Payer Name One |

40 alphanumeric characters.

This should be the reporting company's name. Defaults to the company report name from the company file. |

|

8. Payer Name Two |

40 alphanumeric characters.

The contents of this field are dependent upon the Transfer Agent Indicator. If the Transfer Agent Indicator contains a 1, this field must contain the name of the Transfer Agent. If the Transfer Agent Indicator contains a 0 (zero), this field must contain either a continuation of the Payer Name One field or blanks. |

|

9. Payer Address One |

40 alphanumeric characters.

If the Transfer Agent Indicator is a 1, enter the shipping address of the Transfer Agent, otherwise enter the shipping address of the payer. |

|

10. Payer Address Two |

40 alphanumeric characters.

If the Transfer Agent Indicator is a 1, enter the City, State, and ZIP Code of the Transfer Agent, otherwise enter the City, State, and ZIP Code of the payer. |

|

11. Transmitter Name One |

40 alphanumeric characters.

Enter either the name of the transmitter, if different than the payer, or blanks. |

|

12. Transmitter Name Two |

40 alphanumeric characters.

Enter either a continuation of the Transmitter Name One or blanks. |

|

13. Transmitter Address One |

40 alphanumeric characters.

Enter either the shipping address of the transmitter or blanks. |

|

14. Transmitter Address Two |

40 alphanumeric characters.

Enter either the City, State, and ZIP Code of the transmitter or blanks. |

Print 1099 Forms (Screen #1)

Print 1099 Forms (Screen #2)

Create 1099 Forms (Screen #1)

Create 1099 Forms (Screen #2)

1 0 9 9 ‑ M I S C I N F O R M A T I O N R E T U R N S

Vendor # Vendor Name T‑I‑N Amount

000200 COMPUPART COMPUTER SERVICES 73‑4777343 3,254.98

Totals: 1 Vendors TOTAL AMOUNT REPORTED: 3,254.98