|

|

|

|

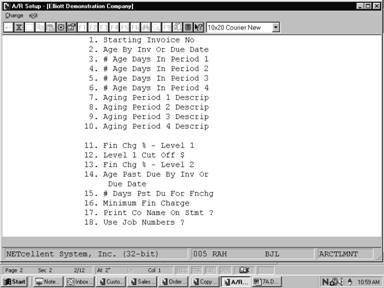

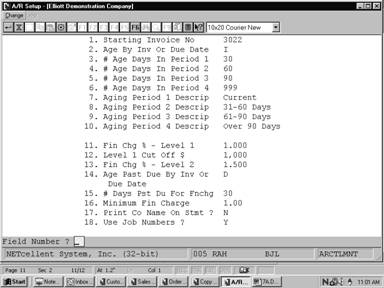

1.

Starting Invoice No

|

6

numeric digits (999999).

Enter

the first document number, which will be assigned during entry of sales

transactions or during printing of invoices if the COP package is in

use. This field will be incremented when the F1 key is pressed for the

document number in Sales & CR/DR Memo Processing or each time an

invoice is printed in Customer Order Processing.

|

|

2.

Age By Inv Or Due Date

|

1

alphanumeric character.

The

letter entered here determines whether the A/R open items will be aged

from the date of the invoice or from the date when payment is due. Enter the

letter I for aging by invoice date. Enter D for aging by due

date.

|

|

2.

Age By Inv Or Due Date

|

1

alphanumeric character.

The

letter entered here determines whether the A/R open items will be aged

from the date of the invoice or from the date when payment is due. Enter the

letter I for aging by invoice date. Enter D for aging by due

date.

|

|

3.

# Age Days In Period 1

|

3

numeric digits (999).

Enter

the number of days in the first aging period, which is the current or net

due period. Entries of from 1 to 999 days are allowed.

Suggested entry would be 30 days.

|

|

4.

# Age Days In Period 2

|

3

numeric digits (999).

Enter

the upper limit in days of the second aging period (first past due period).

Entries of from 1 to 999 days are allowed. Suggested entry

would be 60 days.

|

|

5.

# Age Days In Period 3

|

3

numeric digits (999).

Enter

the upper limit in days of the third aging period (second past due period).

Entries of from 1 to 999 days are allowed. Suggested entry

would be 90 days.

|

|

6.

# Age Days In Period 4

|

3

numeric digits (999).

Enter

the upper limit in days of the fourth aging period (third and last past due

period). Entries of from 1 to 999 days are allowed. It is

recommended that 999 be entered here to ensure that all documents

older than those in Period 3 are covered in this period.

|

|

7.

Aging Period 1 Descrip

|

12

alphanumeric characters.

|

|

Aging

Period 1 Descrip (continued)

|

For

each of the items 7 through 10 on the screen, enter a brief description for

that aging period. Each description may be up to 12 characters long,

containing letters and/or numbers. These descriptions will be printed on

aging reports to characterize A/R open items.

|

|

|

8.

Aging Period 2 Descrip

|

12

alphanumeric characters.

See

field #7.

|

|

|

9.

Aging Period 3 Descrip

|

12

alphanumeric characters.

See

field #7.

|

|

|

10.

Aging Period 4 Descrip

|

12

alphanumeric characters.

See

field #7.

|

|

|

11.

Fin Chg % ‑ Level 1

|

5

numeric digits with 3 decimal places (99.999).

If

two levels of finance charges exist, this entry is the finance charge

percentage on amounts up to a cut‑off level (level 1). For example, if

finance charges are computed at 1.5% on amounts up to $800 and 1% on the

amount exceeding $800, the finance charge percentage for level 1 would be

1.5. Entries from .001 to 99.999 are allowed. If the company

has only one finance charge percentage, you enter it here and skip over

items 11 and 12 on the screen (by pressing RETURN for those items).

|

|

|

13.

Fin Chg % ‑ Level 2

|

5

numeric digits with 3 decimal places (99.999).

Enter

a value here only if the company charges a different finance charge

percentage for past due amounts that exceed the level 1 cut off value. If

the company uses a single finance charge percentage for all past due

amounts, press RETURN to skip over this item. Entries from .001

to 99.999 are allowed.

|

|

|

14.

Age Past Due By Inv Or

Due Date

|

1

alphanumeric character.

The

value you enter here determines whether the age of overdue amounts will be

determined by the date of the invoice or the date payment was due, for

the purpose of computing finance charges. Enter the letter I

for aging by invoice date. Enter D for aging by due date.

|

|

|

15.

# Days Pst Du For Fnchg

|

3

numeric digits (999).

Enter

the value of the maximum number of days an open item may be past due before

finance charges will be calculated and added to it. Values from 1 to 999

are allowed.

|

|

|

16.

Minimum Fin Charge

|

4

numeric digits with 2 decimal places (99.99).

The

value entered here is the minimum finance charge that will be charged to a

customer with a past due account, regardless of the amount past due. Values

from 0.01 to 99.99 may be entered.

|

|

|

17.

Print Co Name On Stmt ?

|

Y or N.

If

you answer Y (for yes), the company's name and address that is stored

in the Company file will be printed by the computer on the customer

statements. If you answer N (for no), the company's name and address

will not be printed on the customer statements. Note that, if statements

have been pre‑printed with the company's name and address, you should

answer N to this question.

|

|

|

18.

Use Job Numbers ?

|

Y or N.

If

you wish to use job numbers in the A/R package, enter Y. The Job

Analysis Report application will be enabled and records will be posted to

the Job History file.

If

you would prefer not to use job numbers in the Accounts Receivable

package, enter N. The Job Analysis Report application will be

disabled, and records will not be posted to the Job History file.

|

|

|

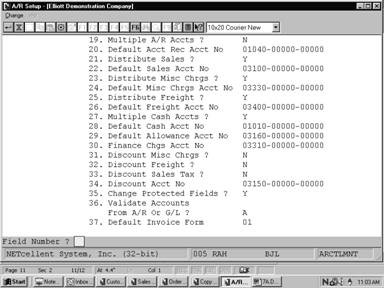

19.

Multiple A/R Accts ?

|

Y or N.

You

may want to keep track of different types of Accounts Receivable, such

as the Accounts Receivable generated from sales on the east coast and

the Accounts Receivable generated from west coast sales. If you do

want to keep separate A/R accounts, answer Y here.

|

|

|

20.

Default Acct Rec Acct No

|

An

account number in the standard account number format.

Enter

the default Accounts Receivable account number. If you have not

specified that you are using multiple A/R accounts, all Accounts

Receivable amounts will be posted to this default account.

|

|

|

21.

Distribute Sales ?

|

Y or N.

Answer

Y if sales transactions are to be distributed to various account

numbers when they are entered. Answer N if sales transactions are not

to be distributed to different sales accounts.

If

you answer N, all sales transactions will be posted to the default

sales account number entered for the next item of this screen.

This

field may not be accessed if there are unposted transactions in the Sales

Transaction file.

|

|

|

23.

Distribute Misc Chrgs ?

|

Y or N.

Answer

Y if miscellaneous charges are to be distributed to various

miscellaneous charges account numbers when sales transactions are entered.

Answer N if miscellaneous charges are not to be distributed.

If

you answer N, all miscellaneous charges entered will be posted to the

default miscellaneous charges account number entered for the next item of

this screen.

|

|

|

Distribute

Misc Chrgs ? (continued)

|

This

field may not be accessed if there are unposted transactions in the Sales

Transaction file.

|

|

|

24.

Default Misc Chrgs Acct

No

|

An

account number in the standard account number format.

This

is the default miscellaneous charges account that is used in Ship Via Code

File Maintenance.

|

|

|

25.

Distribute Freight ?

|

Y or N.

Answer

Y if freight charges are to be distributed to various freight charges

account numbers when sales transactions are entered. Answer N if

freight charges are not to be distributed. If you answer N, all

freight charges entered will be posted to the default freight account number

entered in the Ship Via Code File Maintenance application.

This

field may not be accessed if there are unposted transactions in the Sales

Transaction file.

|

|

|

26.

Default Freight Acct No

|

An

account number in the standard account number format.

This

is the default freight account that is used in Ship Via Code File

Maintenance.

|

|

|

27.

Multiple Cash Accts ?

|

Y or N.

Answer

Y if cash receipts are to be distributed to more than one cash

account. Answer N if all cash receipts are to be posted to the

default cash account number specified in the next item of this screen.

|

|

|

28.

Default Cash Acct No

|

An

account number in the standard account number format.

Enter

the default cash account number.

|

|

|

29.

Default Allowance Acct No

|

An

account number in the standard account number format.

Enter

the allowance account number. An allowance is some amount of additional

discount that you are giving to your customer for some purpose. The account

number you enter here will be the default allowance account number in those

applications where you are asked to enter an allowance account number.

|

|

|

30.

Finance Chgs Acct No

|

An

account number in the standard account number format.

Enter

the account number of the finance charges account. All finance charge

amounts will be posted to this finance charge account.

|

|

|

31.

Discount Misc Chrgs ?

|

Y or N.

Enter

whether miscellaneous charges are subject to discounts or not.

|

|

|

32.

Discount Freight ?

|

Y or N.

Enter

whether freight is subject to discounts or not.

|

|

|

33.

Discount Sales Tax ?

|

Y or N.

Enter

whether sales tax is subject to discounts or not.

|

|

|

34.

Discount Acct No

|

An

account number in the standard account number format.

Enter

the account number of the discount account used in the package. All

discounts taken on sales transactions throughout the A/R package will

be posted to this discount account.

|

|

|

35.

Change Protected Fields ?

|

Y or N.

Enter

whether you are going to allow changes to the protected fields using the F6

key or not.

This

answer will affect the ability to make changes to selected fields on the

second screen of Customer File Maintenance and Salesman File

Maintenance and the first screen of Tax Code File Maintenance.

|

|

|

37.

Default Invoice Form

|

2

numeric characters.

Enter

a valid Invoice form number that was previously defined in the Invoice

Form Setup application to be used by default when printing customer

invoices.

|

|

|

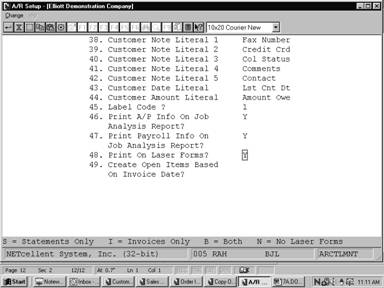

38.

Customer Note Literal 1

|

10

alphanumeric characters.

This

field serves to label the first literal description line of the Notes

field information. You may enter any expression that suits your needs.

|

|

|

39.

Customer Note Literal 2

|

10

alphanumeric characters.

This

field serves to label the second literal description line of the Notes

field information. You may enter any expression that suits your needs.

|

|

|

40.

Customer Note Literal 3

|

10

alphanumeric characters.

This

field serves to label the third literal description line of the Notes

field information. You may enter any expression that suits your needs.

|

|

|

41.

Customer Note Literal 4

|

10

alphanumeric characters.

This

field serves to label the fourth literal description line of the Notes

field information. You may enter any expression that suits your needs.

|

|

|

42.

Customer Note Literal 5

|

10

alphanumeric characters.

This

field serves to label the fifth literal description line of the Notes

field information. You may enter any expression that suits your needs.

|

|

|

43.

Customer Date Literal

|

10

alphanumeric characters.

This

field serves to label the literal description line of the date field

information. You may enter any expression that suits your needs.

|

|

|

44.

Customer Amount Literal

|

10

alphanumeric characters.

This

field serves to label the literal description line of the amount field

information. You may enter any amount that suits your needs.

|

|

|

|

|

|

|