|

|

A/R Open Item File MaintenanceApplication Overview

The A/R Open Item File is the file where all transactions that occur between you and your customers are stored. As such, it is a very important file. Any time you want to know how much a customer owes you or how old an account is, the programs will refer to this file to find out.

Initial setup of the Accounts Receivable package will require entering all open items that are outstanding at the present time with your customers. The A/R Open Item File application is where you will do this data entry. This may be a considerable amount of data entry, but is necessary to set your customers’ balance and provide some detail on the customers’ statements.

When you finish entering the initial contents of the A/R Open Item File, you can then run the Set Customer Account Balance application. This application will read through all transactions for each customer, totaling them up as it goes. It will then set the Account Balance field in the customer's record to this total. This is a handy way to ensure that the customer's account balance as stored in his Customer record actually agrees with the contents of his account.

You should also be aware that the transactions you enter into a customer's account will not be posted to any Sales or Accounts Receivable account in the General Ledger, to any salesman in the salesman file, to any record in the commissions due file, or to any file other than the A/R Open Item File. If you are also using the General Ledger package, you will have to make manual entries into these accounts that correspond to the Sales and Accounts Receivable figures entered here.

Once you have entered into the A/R Open Item File its initial contents, you will probably never use this application again. From that time on, all sales transactions will be entered by way of the Sales Processing application and all payments will be entered through Cash Receipts processing.

These transaction applications will automatically record the amounts that are to be posted to General Ledger. You will no longer have to make manual entries to G/L once you start using Sales and Cash Receipts processing.

What does an open item mean? It is a record of some transaction in the customer's account that has not yet been fully paid off. For example, if a customer made a purchase from you in the amount of $500 the record of this transaction in the A/R Open Item File is called an open item.

Even when the open item is fully paid off, it still remains on file until you decide it is time to remove it. Elliott does not automatically remove every open item that is paid off from the Open Item File. The invoice and all payments that have been applied to it are kept on file. Otherwise, the statements that you send to customers would not properly reflect all the business activity that has transpired. When you have printed statements and are convinced that they are accurate, then run the Purge Closed Open Items File application to remove all fully paid open items.

Document Types

There are six different types of transactions that can be stored in the A/R Open Item File. When you are entering data during A/R Open Item File Load, one of the fields you will have to enter is the open item type. The six types of open items are:

I = Invoice. This is the record of a regular sale. The $500 purchase your customer made from your company would be recorded by way of an invoice.

P = Payment. A payment transaction is the record of a payment made by the customer on their account. If the customer sent you $300 toward the $500 he owes you, the record of the $300 payment would become a payment transaction.

C = Credit Memo. A Credit Memo is a transaction recording some sort of credit you are giving the customer, usually because some of the goods sold were found to be unsatisfactory upon receipt. Perhaps some of the goods were damaged or found not to be exactly what was ordered. In this case, you would give the customer credit against the amount of the original invoice by entering a Credit Memo.

D = Debit Memo. A Debit Memo is a transaction recording some sort of an additional charge that is to be added to the customer's account. For example, let us say that the price of the sale was negotiated with the customer based on a certain shipping method, which later on turned out not to be fast enough, and a faster (and more expensive) method of shipping was used. You could charge the customer for this additional expense by entering a Debit Memo, which will add to the amount the customer owes you for the sale.

F = Finance Charge. A Finance Charge is an amount the customer owes you because he has open items on his account, which are too long overdue.

B = Balance Forward. This type of transaction is not one that you will deal with very often, especially after you have entered the initial contents of the A/R Open Item File. The purpose of this type of transaction is to allow you to enter a single amount that the customer owes as of a certain date, without having to enter all the detail that comprises that amount. For example, when you are first loading the A/R Open Item File, you may not want to enter every outstanding open item for every customer. Instead, you could enter just one Balance Forward transaction for the total amount of what the customer owes you at that time.

Note: This should only be used for Balance Forward Customers.

Apply‑To Numbers

If a customer uses Open Item accounting, he will usually designate which open items he is paying when he sends a payment for his account.

In other words, he applies cash to particular open items. The way Elliott keeps track of this is by storing in the payment transaction the invoice number of the sale transaction that is being paid.

The invoice number that is being stored in the payment transaction is called its apply‑to number. Then, Elliott can determine that a payment was made on a certain invoice by looking at the Apply‑To Number field of the payment.

Also, Credit Memos and Debit Memos usually apply to an invoice. Be sure that you enter the correct apply‑to number when you enter Credit Memos and Debit Memos.

For Invoices and Balance Forward transactions, the program will automatically set the apply‑to number equal to the document number. You will be allowed to change this assigned apply‑to number, but there is no reason to do so.

One important thing to keep in mind is that if the customer uses Balance Forward accounting, then he does not apply cash payments to particular invoices. For this reason, the concept of apply‑to numbers is not pertinent to a Balance Forward customer. Elliott will automatically set the apply‑to number for all transactions for a Balance Forward customer to zero. You will be allowed to change this apply‑to number if you wish, but there is no reason to do so.

Run Instructions

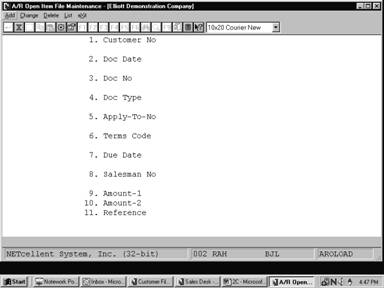

Select Open Item File from the pull down A/R Maintenance window. The following screen will then be displayed:

A/R Open Item File Maintenance Entry Screen

The following options are available:

* Add initial open items * Change initial open items * Delete initial open items * Print an open item edit listing

To return to the menu bar, press the ALT or F10 key. To leave this application, press ESC or X for EXIT when positioned at the menu bar.

Entry Field Descriptions

Date filled out __________ by __________ ADD CHANGE DELETE

A/R OPEN ITEM FILE LOAD SHEET

1. Customer No _ _ _ _ _ _

2. Doc Date _ _ / _ _ / _ _

3. Document No _ _ _ _ _ _

4. Doc Type _ I = Invoice F = Finance Charge C = Credit Memo P = Payment D = Debit Memo B = Balance Forward

5. Apply-to No _ _ _ _ _ _

6. Terms Code _ _

7. Due Date _ _ / _ _ / _ _

8. Salesman No _ _ _

9. Amount 1 $_ , _ _ _ , _ _ _ . _ _

10. Amount 2 $_ _ _ , _ _ _ . _ _

11. Reference _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Date entered __________ by _______ Date verified __________ by _______

A/R Open Item File List For Customer 100

Run Date: Sep 25, 2001 - 1:21am Elliott Demonstration Company Page 1

A / R O P E N I T E M F I L E E D I T L I S T

Document Types: I = Invoice P = Payment C = Cr Memo D = Dr Memo F = Fin Chg B = Bal Fwd

Note: Amount-1 Is Sale Amount On Doc Types I, C, D & B - Cash Receipt Amount On Doc Type P - Finance Charge On Type F. Amount-2 Is Other Charges On Doc Types I, C & D - Discount Allowed On Doc Type P - Not Defined For Type F & B.

Doc-No Doc Doc Apply Due Amount-1 Amount-2 Document Reference Slmn Terms Date Typ To-No Date Total

Customer: 000100 Williams John Q. Company

1002 02/06/89 D 887 03/08/89 77.26 4.64 81.90 DEBIT MEMO 400 2/10 N/30 1000 02/14/89 I 1000 03/16/89 902.75 93.17 995.92 INVOICE 400 2/10 N/30 1001 03/21/89 I 1001 04/20/89 1,122.78 97.37 1,220.15 INVOICE 400 2/10 N/30 1005 05/11/89 I 1005 06/10/89 1,524.78 255.86 1,780.64 Order # W3808 400 2/10 N/30 1004 05/26/89 I 1004 06/25/89 1,385.69 231.14 1,616.83 Order # W3983 400 2/10 N/30 1003 06/09/89 I 1003 07/09/89 1,823.77 109.43 1,933.20 Order # 3866 400 2/10 N/30 2000 06/11/89 I 2000 07/11/89 1,527.05 250.98 1,778.03 Order # W4517 400 2/10 N/30 2001 06/22/89 I 2001 07/22/89 1,256.87 192.07 1,448.94 Order # W5638 400 2/10 N/30 2002 06/23/89 I 2002 07/23/89 329.12 71.11 400.23 Order per Letter of 6/17/87 400 2/10 N/30 796003 06/30/89 F 786003 06/30/89 28.47 .00 28.47 FINANCE CHARGE 400 *N/A* 3001 07/11/89 C 2000 07/11/89 59.26CR 7.16CR 66.42CR CREDIT MEMO 400 *N/A* 6553 07/15/89 P 1000 07/15/89 995.92CR .00 995.92CR PAYMENT: CHECK NO 6553 *N/A* 6553 07/15/89 P 1001 07/15/89 1,220.15CR .00 1,220.15CR PAYMENT: CHECK NO 6553 400 *N/A* 6553 07/15/89 P 1003 07/15/89 1,933.20CR .00 1,933.20CR PAYMENT: CHECK NO 6553 400 *N/A* 6553 07/15/89 P 1004 07/15/89 1,616.83CR .00 1,616.83CR PAYMENT: CHECK NO 6553 400 *N/A* 6553 07/15/89 P 1005 07/15/89 733.90CR .00 733.90CR PAYMENT: CHECK NO 6553 400 *N/A* 3000 07/17/89 I 3000 08/16/89 2,130.85 412.15 2,543.00 Order # W7601 400 2/10 N/30 797013 07/31/89 F 787013 07/31/89 79.44 .00 79.44 FINANCE CHARGE 400 *N/A* 12093 08/15/89 P 1005 08/15/89 1,046.74CR .00 1,046.74CR PAYMENT: CHECK NO 12093 400 *N/A* 12093 08/15/89 P 2000 08/15/89 1,153.26CR .00 1,153.26CR PAYMENT: CHECK NO 12093 400 *N/A* 3016 09/09/89 I 3016 10/09/89 1,520.23 122.22 1,642.45 Po# HG87987 Our Ord# 1017 400 2/10 N/30 20011 10/20/89 I 20011 11/19/89 874.22 234.40 1,108.62 Order # W7723 400 2/10 N/30 3011 02/18/92 I 3011 03/20/92 1,606.00 96.36 1,702.36 Po# Our Ord# 1004 400 2/10 N/30 3012 03/13/92 I 3012 04/12/92 24.04 1.44 25.48 Po# Our Ord# 1013 400 2/10 N/30 3014 03/13/92 I 3014 04/12/92 15.95 .96 16.91 Po# Our Ord# 1015 400 2/10 N/30

Customer Totals: 7,470.01 2,166.14 9,636.15

Grand Totals: 7,470.01 2,166.14 9,636.15

|