|

|

Sales Tax Liability Report

Application Overview

Sales Tax Liability Reports are a function of the A/R Sales Tax Audit Trail feature. The purpose of this feature is to give a detailed tracking for sales tax so that complete auditing information can be available (especially for state auditing). This feature enables users to create Sales Tax Liability Reports for each tax code based on invoices or cash receipts. It also gives users the choice for printing a report for fully paid invoices only. If the user is tired of paying sales tax for which the invoice has not been paid off or paid in full, or if the user would like to be able to track down the exact sales tax amount based on fully-paid invoices, this feature will serve as a remarkable vehicle for business.

Run Instructions

To run these reports, the A/R Sales Tax Audit Trail feature must be enabled, see Utilities Set Setup – A/R Sales Tax Audit Trail .

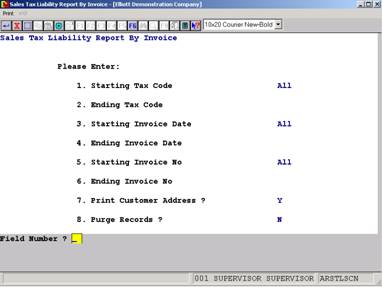

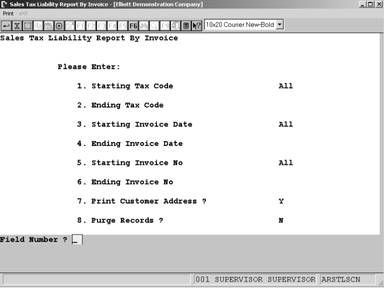

In order to get a glance of how much sales tax the user needs to pay to each state, county, and city, two reports are available to the user. One is Sales Tax Liability By Invoice, and the other is Sales Tax Liability By Cash Receipts. They both can be accessed by going through A/R à Reports à Sales Tax Liability Report. Figure 2D.2 and Figure 2D.3 display the print screens of each kind.

The report by invoice is asking the user to enter starting and ending Invoice Dates versus Cash Receipts Dates in the report by cash receipts. The report by cash receipt has an additional field - 8. “Print Full-Receipt Invoice Only?”. Figure 2D.3 displays the Sales Tax Liability Report by Cash Receipts. The “Receipt-Amt” and “Adj-Tax-Amt” columns will only display if the report is by Cash Receipts. As you can see, the report by Invoice does not contain these two columns (Figure 2D.4).

Figure 2D.2. Printing screen for Sales Tax Liability Report by Invoice.

Figure 2D.3 Printing screen for Sales Tax Liability Report by Cash Receipts.

Figure 2D.4 shows a sample of a Sales Tax Liability Report.

|