|

|

Tax Code File MaintenanceApplication Overview

When you are setting up your Customer file, you will be asked to enter a Tax Code for each customer who is taxable. This tax code will designate what sales or other tax is to be charged when he purchases goods from you. For example, if you do business in California, there is a 6% sales tax on most items sold.

You should define here all of the taxing methods that you plan to use with any of your customers so that you will be able to associate a Tax code with each customer who is to be taxed.

When you are entering Sales transactions by way of Sales & CR/DR Memo Processing, or when you enter customer orders in Customer Order Processing, the amount of any sales tax to be charged will be calculated automatically using the tax percentage entered. You will, however, be able to override this calculated amount and enter the tax amount manually if you should desire to do so.

The amount of sales and miscellaneous charges associated with each tax code is stored in each tax code record. These fields may be cleared by the Clear A/R Accumulators application.

A tax code must be created for non‑taxable sales since a tax code is required for all sales transactions. Run Instructions

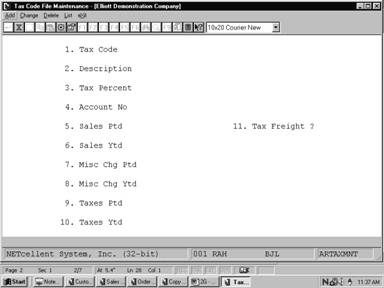

Select Tax Code File from the pull down A/R Maintenance window. The following screen will then be displayed:

Tax Code File Maintenance

The following options are available:

* Add new tax codes * Change existing tax codes * Delete existing tax codes * Print a Listing of tax codes, their descriptions and YTD, PTD figures

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar. Entry Field Descriptions

Item numbers 5 through 10 are updated each time sales transactions are processed. They can be set to zero by the Clear A/R Accumulators application. For this reason, the operator will ordinarily not be able to change the fields in the change mode.

However, if you do find it necessary to make corrections to data that was entered in error, there is a way to do it. In response to the Field Number question, press the F6 key. You will then be able to make changes to these fields if the change-protected fields in A/R Setup is Y.

Load Sheet

Date filled out __________ by __________ ADD CHANGE DELETE

TAX CODE FILE MAINTENANCE LOAD SHEET

1. Tax Code _ _ _

2. Description _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3. Tax Percent _ _ . _ _ _ _ %

4. G/L Account # _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _

5. Sales PTD _ _ _ , _ _ _ , _ _ _ . _ _

6. Sales YTD _ _ _ , _ _ _ , _ _ _ . _ _

7. Misc Chg PTD _ _ _ , _ _ _ , _ _ _ . _ _

8. Misc Chg YTD _ _ _ , _ _ _ , _ _ _ . _ _

9. Taxes PTD _ _ _ , _ _ _ , _ _ _ . _ _

10. Taxes YTD _ _ _ , _ _ _ , _ _ _ . _ _

********************************

1. Tax Code _ _ _

2. Description _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3. Tax Percent _ _ . _ _ _ _ %

4. G/L Account # _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _

5. Sales PTD _ _ _ , _ _ _ , _ _ _ . _ _

6. Sales YTD _ _ _ , _ _ _ , _ _ _ . _ _

7. Misc Chg PTD _ _ _ , _ _ _ , _ _ _ . _ _

8. Misc Chg YTD _ _ _ , _ _ _ , _ _ _ . _ _

9. Taxes PTD _ _ _ , _ _ _ , _ _ _ . _ _

10. Taxes YTD _ _ _ , _ _ _ , _ _ _ . _ _

Date entered __________ by _______ Date verified __________ by _______

|