|

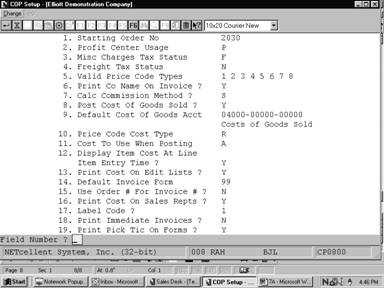

Utilities Setup

COP Setup allows you to customize the package to some

degree. You will run this application once while you are converting from your

former Order Processing system. You will rarely need to refer to it

thereafter.

You will be allowed to specify such things as the

starting order number, profit center usage, and the taxable status of freight

and miscellaneous charges. You will also determine whether you wish to print

your company name on invoices, and if statements and invoices will print on

laser forms.

The responses you provide here will affect processing in

a large number of programs, so consider them carefully. Additionally, review

the features and options available in Global Setup.

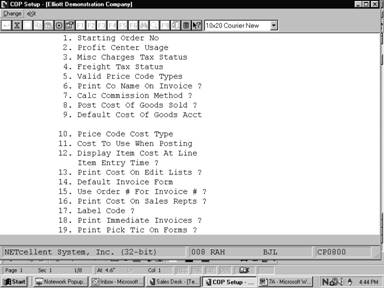

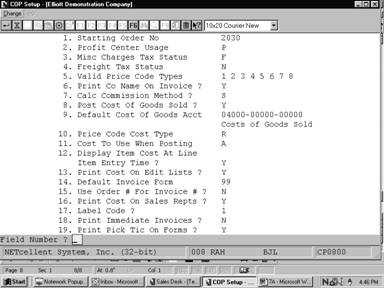

Select COP Setup from the pull down Util_setup window.

The following screen will then be displayed:

COP Setup Entry Screen

The following options are available:

* Select the desired mode from

the COP Setup menu bar

* Enter the data requested on

the screen

* If this is the first time

that you have run COP Setup, then the program will ask you to enter the data

for each of the fields on the screen. If this program has been run previously,

the data entered at that time will be displayed and may be changed.

To return to the menu bar, press the ESC or F10 key. To

leave this application, press X for EXIT when positioned at the menu bar.

Entry Field Descriptions

|

Name

|

Type

and Description

|

|

1. Starting Order No

|

6 numeric digits (999999).

Enter the first order number

which will be assigned during entry of orders. This field will be automatically

incremented every time an order is entered.

|

|

2. Profit Center Usage

|

1 alphanumeric character

O = Order Profit Centers

P = Product Category Profit Centers

If O is entered, the profit center, and department (if

applicable), which is the second and third part of account number, will be

entered for the order as a whole. This is done if you wish to track revenue

by sales locations rather than by product category.

If P is entered, the profit

center may be different for each line item on the order as it will be

associated with the product category of each item.

|

|

3. Misc Charges Tax Status

|

1 alphanumeric character.

N = Not

Taxable

F = Fully

Taxable

P = Partially Taxable

|

|

Misc Charges Tax Status (continued)

|

Enter an N if miscellaneous

charges are not taxable in your state. Enter an F if they are taxable. If P

is entered, a portion of the miscellaneous charges will be taxed, depending

on the ratio of taxable sale amount to non‑taxable sale amount, e.g.,

if the invoice shows a sale amount of $100.00, $20.00 of which is non‑taxable,

then 80% of the miscellaneous charges would be taxed.

Default is N.

|

|

4. Freight Tax Status

|

1 alphanumeric character.

N = Not Taxable

F = Fully Taxable

P = Partially Taxable

Enter an N if freight charges are not taxable in your

state.

Enter an F if they are taxable. If P is entered, a

portion of the freight charges will be taxed, depending on the ratio of

taxable sale amount to non‑taxable sale amount. For example, if the

invoice shows a sale amount of $100.00, $20.00 of which is non‑taxable,

then 80% of the freight charges would be taxed.

Default is N.

|

|

5. Valid Price Code Types

|

8 one‑digit numeric

entries. 9 not allowed (9).

The entries made here determine which price code types

are used and the order which the package will check them when figuring an

item's price. See Pricing Code File Maintenance for more data on price

codes.

If you are using more than one price code type, you

will need to make a decision about the order in which the codes are checked

when prices are being ascertained in Order Entry. If you are using

negotiated prices (Type 1) you will want this to appear first to avoid the

possibility of the customer being charged a different price from that which

was agreed upon.

Price code types not

specified here will not be recognized anywhere in the package.

|

|

6. Print Co Name on Invoice ?

|

Y or N.

This flag simply determines whether the company name is

printed on the invoice by the computer. If Y is entered, the company name

will be printed. You would answer N if your company name is preprinted on

the invoice form.

Default is Y.

|

|

7. Calc Commission Method

|

1 alphanumeric character.

Enter the commission method that will be used when

calculating commission for each order/invoice.

S = Total Sale Amount

M = (Total Sale Amt ‑ Total Cost Amt)

I = Item Pct/Amt

If you select S, the commission amount will be

calculated based upon the total sale amount for the order.

If you select M, the commission amount will be

calculated based upon the total gross margin (Total Sale Amount ‑ Total

Cost Amount) for the order.

If you select I, the commission amount will be

calculated based upon each item on the order. The commission method for each

item is determined by the item commission method in Item File Maintenance.

For more information on item commission method, refer to Item File

Maintenance in Inventory Management.

Default is S.

|

|

8. Post Cost Of Goods Sold ?

|

Y or N.

Enter whether you wish to have an I/M distribution for

Cost of Goods Sold created when posting invoices.

Default is Y.

|

|

9. Default Cost of Goods Sold Acct

|

An account number in the

standard account number format.

Enter the default Cost of Goods Sold account that will

be used if a valid product category/location record does not exist for the

item.

Pressing the F7 key will

allow you to search for the account by number or pressing the F8 key will

allow you to search for the account by description.

|

|

10. Price Code Cost Type

|

1 alphanumeric character.

Enter the item cost to be used when using markup percent

in Pricing Code File Maintenance.

A = Average Cost

R = Last Cost

S = Standard Cost

If the costing method in I/M

Setup is LIFO or FIFO, the LIFO/FIFO cost will not be used for markup.

Instead, the item cost selected here will be used.

|

|

11. Cost to Use When Posting

|

1 alphanumeric character.

A = Actual

Cost

L = Line

Item Cost

Enter the cost you wish to use when posting invoices.

If you select L, the posting program will use the cost

that was entered on the line item during Order Entry.

If you selection A, the posting program will use the

actual cost of the item at the time of posting. The actual cost used will

depend on the costing method in I/M Setup.

This field will not apply when the costing method is

LIFO or FIFO The item cost when using either of these methods is calculated

from the layers in the LIFO/FIFO file during posting.

Default is L.

|

|

12. Display Item Cost at Line Item

Entry Time ?

|

Y or N.

If you answer N, Item Cost

will not be displayed on the Order Entry screen during Order Entry.

|

|

13. Print Cost on Edit Lists ?

|

Y or N.

If you answer N, Item Cost

will not be printed on the Order Edit and the Billing Edit Lists.

|

|

14. Default Invoice Form

|

2 numeric characters.

Enter the default form

number you want to use when printing invoices. Default is 1.

|

|

15. Use Order # For

Invoice # ?

|

1 alphanumeric character.

If you answered Y to this

question, all orders will be posted to Accounts Receivable using order

numbers. No backorders will be allowed for orders. You must select all line

items and post to Accounts Receivable if the flag is set to Y. The default

is N.

|

|

16. Print Cost On Sales Repts ?

|

1 alphanumeric character.

This flag simply determines

if the cost will be printed on Sales Reports. The default is N.

|

|

17. Label Code ?

|

1 numeric character.

This simply determines what

label code will be used when printing labels. The label code is defined in

Label Code Setup application.

|

|

18. Print Immediate Invoices ?

|

Y or N.

If you answer Y during Order Entry of I type, (Invoice)

or C type (Credit Memo) you will be asked if you want to print invoices

immediately. If N, order entry will ask for another transaction.

If the answer is Y to the question, you will

immediately go into invoice printing. See Print Invoices in the Processing

section.

Default is N.

|

|

19. Print Pic Tic On Forms ?

|

1 alphanumeric characters.

This flag determines if the

picking tickets will be printed on pre-printed forms. Default is N.

|

|

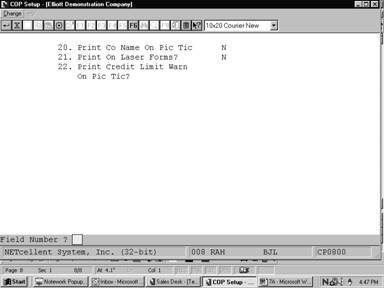

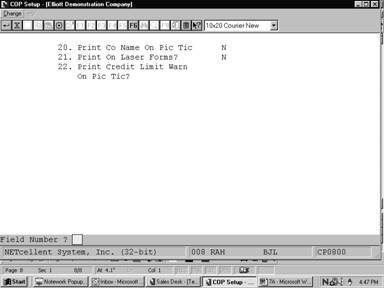

20. Print Co Name On Pic Tic

|

Y or N.

This field is only applicable if you are printing the

picking tickets on pre-printed forms. If you answer Y to the question, the

company name and address from Company Setup will print in the upper left hand

corner of the picking ticket. If you answer N, the company name and address

will not be printed.

Default is N.

|

|

21. Print On Laser Forms?

|

1 alphabetic character.

Valid entries are:

I =

Invoices Only

P =

Picking Tickets Only

B =

Both Invoices and Picking Tickets

N =

No Laser Forms

Enter I to print invoices on laser forms.

Enter P to print picking tickets on laser forms.

|

COP Setup

COP Setup

|