The Deduction/Earning Code

File maintains the file, which contains the deduction, and earnings codes

you wish to use.

This file should contain all

possible employee pay deductions and earnings other than wages, savings bond

deductions, loan repayments, garnish payments, union payments, and withholding

taxes. Each deduction or earning must be assigned a unique two‑character

code and a corresponding General Ledger account number (except for meals

and allowances). Each code must have a maximum amount that will be taken or

added to the employee's wages. If there is no maximum deduction or earning

then enter 0 for this amount.

All of the tax calculations are

computed individually on each Deduction/Earning code. Each Deduction/Earning

code is established to be either exempt Y or N (if it's a

earning) or included Y or N (if it's a deduction) for the

calculation of various types of taxes. These Y or N controls

will determine the exact taxable base for each type (FWT, FICA, FUI, SUI, etc.)

of payroll tax. When a deduction code is entered, will be prompted with

"Is This a Before Tax Deduction". If you answer Y to this

question then you will need to fill in the correct Y or N answer

for each type of withholding tax. If the answer is N, then all of the

withholding tax computations should be flagged as N.

For example:

A before tax deduction code for

a pension plan may be included for the computation of FWT (to reduce the

taxable base of FWT) but not for FICA, FUI, and others. Likewise, after tax

deduction code for a United Way contribution would not be included (the tax

base would not be reduced) for any withholding tax computation. It is

advisable that you consult with your accountant or tax adviser to help in

determining how each of your Deduction/Earning codes should affect the tax

computation on each specific type of payroll tax.

Certain deductions are regularly

taken: weekly, monthly, etc. These deductions may be entered directly onto

the Employee File. The computer will take these deductions

automatically each specified pay period. Regular deductions often include

insurance, etc. Regular periodic deductions for union, savings bonds, employer

loans, and garnish payments do not need a deduction code since these are

handled separately in the Employee File. However, such deductions taken

randomly would require their own deduction code.

Other deductions or

earnings occur intermittently or differ in dollar amounts from period to

period. These irregular or temporary deductions/earnings are entered when the

employee's time is entered in the Time Transaction Processing application.

A temporary deduction/earning will be included in the employee's pay for that

pay period only. Common temporary deductions or earnings include such things

as uniform allowances, breakage fees, petty cash advances, supper allowances,

etc.

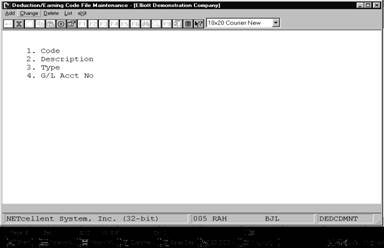

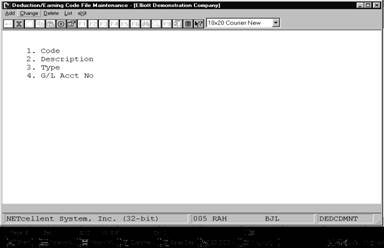

Select Deduction/Earning

Code File from the pull down PR Maintenance window. The

following screen will then be displayed:

Deduction/Earning Code File

Entry Screen

The following options

are available:

* Select

the desired mode from the Deduction/Earning Code File menu bar

* Enter

the data requested on the screen

To return to the menu bar, press the ESC or F10

key. To leave this application, press X for EXIT when positioned

at the menu bar.

Entry Field Descriptions

|

Name

|

Type

and Description

|

|

1. Code

|

2 alphanumeric characters.

Each type of deduction/earning used in the Payroll

package must be given a unique two‑character code. It is helpful to

separate deductions and earnings types by recognizable codes.

e.g. A1, A2 for allowances

D1, D2, D3 for deductions

E1, E2, E3 for earnings

M1, M2 for meals

T1, T2 for tips

In change and delete mode,

press the F7 key to search for code.

|

|

2. Description

|

7 alphanumeric characters.

This description appears on

the screen when the Deduction/Earning code is entered. It also appears on

the check stub.

|

|

3. Type

|

1 alphabetic character.

The Deduction/Earning Code File type may be one

of five values (one of three for non‑restaurants).

These values are:

A ‑ Taxable

earning added to the employee's taxable gross wages but not added to net pay.

D ‑ Deduction

from either the employees net pay or as a reduction of each tax withholding

basis.

|

|

Type (continued)

|

E ‑ Earnings

either added or not added to the employee's taxable gross wages.

R - Employee

reimbursement.

For restaurants:

M ‑ The

taxable value of meals given the employee.

T ‑ Tips

received by the employee reported to the employer or tips paid to the

employee by the employer.

Meals (M) and Tips (T) are given special

tax handling in accordance with federal regulations and are not added to or

subtracted from net pay.

However, tips may be added

to net pay if the Add Tips To Net Pay question is Y.

|

|

4. G/L Acct No

|

An account number in the

standard account number format.

This is the General Ledger account, which

corresponds to the liability/expense of the deduction/earning. The General

Ledger account may be entered only for earnings or deductions; not for

allowances or meals, as they do not affect the transfer of funds in payroll

other than to influence the magnitude of withholding liabilities.

In add mode, for allowances and meals, the General

Ledger account field will be skipped entirely.

Note: For tips this account

number will be used only if the Add Tips To Net Pay question is Y.

If the profit center and department account numbers of

an earning is all 9's, then upon posting of the earning to the Payroll

Distribution file, the main account from the number entered here will be

used, along with the profit center and department from the employee's wage

account. This can only be done for earnings E.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

If the Type (field #3) is

A, E, M, or T then the following fields apply:

|

Name

|

Type

and Description

|

|

5. Emp Exempt From Fica ?

|

Y or N.

Answer Y if this earning

is exempt from employee FICA contribution calculations. The default value is

N.

|

|

6. Emplr Exempt From Fica ?

|

Y or N.

Answer Y if the

employers FICA contribution is exempt from this earning. from the employer

FICA contribution calculation. The Default value is N.

|

|

7. Exempt From Fwt ?

|

Y or N.

Answer Y if the

employee FWT calculation is not to include this earning. The default value

is N.

|

|

8. Exempt From Fui ?

|

Y or N.

Answer Y if the

employer FUI tax calculation is not to include this earning. The default

value is N.

|

|

9. Exempt From Swt ?

|

Y or N.

Answer Y if the

employee State Withholding Tax is not to include this earning. The default

value is N.

|

|

10. Exempt From Cwt?

|

Y or N.

Answer Y if this

earning is not to be included in the employee City Withholding Tax. The

default value is N.

|

|

11. Exempt From Ost ?

|

Y or N.

Answer Y if this

earning is not to be included in any Other State Tax for the employee. The

default value is N.

|

|

12. Exempt From Sui ?

|

Y or N.

Answer Y if this

earning is exempt from the employer State Unemployment Insurance

calculation. The default value is N.

|

|

13. Exempt From Eic ?

|

Y or N.

Answer Y if the

earning is not to be included in the employee EIC calculation. The default

value is N.

|

|

14. Exempt From W.C. ?

|

Y or N.

Answer Y if the

earning is not to be included in the employer Workers Compensation

calculation. The default value is N.

|

If the Type (field #3) is

an A or E the following fields apply:

|

Name

|

Type

and Description

|

|

15. Maximum Amount

|

7 numeric digits with 2

decimal places (99,999.99).

Enter the maximum amount of

the earnings that should be paid to the employee. If their is no maximum then

this field should be left blank. The default value is 0.00.

|

|

16. Max Per Period or Year

|

Y or P.

If you select P the maximum amount is payment

per pay period.

If you select Y the maximum amount is per year.

The default value is Y.

|

If the Type (field #3) is

a T, then the following field applies.

|

Name

|

Type

and Description

|

|

15. Add Tips To Net Pay

|

Y or N.

Answer Y if the tips are to be added to the

employee's net pay. Also if the answer to this question is Y a G/L

distribution record will be created for the tip amount added to net pay.

The default value is N.

|

If the Type (field #3) is

a D then the following fields apply.

|

Name

|

Type

and Description

|

|

5. Include For Emp Fica?

|

Y or N.

Answer this Y if the

deduction should reduce the taxable base for the Employee calculation of

FICA. The default value is N.

|

|

6. Include For Emplr Fica?

|

Y or N.

Answer this Y if the

deduction should reduce the taxable base for the employer share of FICA. The

default value is N.

|

|

7. Include For Fwt ?

|

Y or N.

Answer this Y if the

deduction should reduce the employee federal tax withheld base for the

tax-withheld computation. The default value is N.

|

|

8. Include for Fui ?

|

Y or N.

Answer Y if the

deduction should reduce the taxable base for the federal unemployment

insurance.

|

|

9. Include For Swt ?

|

Y or N.

Answer Y if the

deduction should reduce the taxable base for the employee state tax

withheld.

|

|

10. Include For Cwt?

|

Y or N.

Answer this Y if the

deduction should reduce the employee City Withholding Tax base. The default

value is N.

|

|

11. Include For Ost?

|

Y or N.

Answer this Y if the

deduction should reduce any Other State Tax to the employee. The default

value is N.

|

|

12. Include For Sui ?

|

Y or N.

Answer this Y if the

State Unemployment Tax base is to be reduced by the deduction. The default

value is N.

|

|

13. Include For Eic ?

|

Y or N.

Answer this Y if the

employee EIC base is to be reduced by the deduction. The Default value is N.

|

|

14. Include For W.C. ?

|

Y or N.

Answer Y if the

employer Worker's Compensation Tax base should not include the deduction.

The default value is N.

|

|

15. Maximum Amount

|

7 numeric digits, with 2

decimal places (99,999.99).

Enter the maximum amount of

the earning or deduction an employee can take. If their is no maximum then

this field should be zero. The default value is zero.

|

|

16. Max Per Period or Year

|

Y or P.

If you select P the maximum amount is for

payment period, or if you select Y the maximum amount is for year.

The default value is Y.

|

|

Date filled

out________by__________ ADD CHANGE DELETE

DEDUCTION/EARNING

CODE FILE MAINTENANCE LOAD SHEET

1. Code

_ _

2. Description _

_ _ _ _ _ _

3. Type

_ D = Deduction E = Earning

A = Allowance M = Meals T = Tips

4. G/L Account # _ _ _ _

_ _ _ _ ‑ _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _

5. Include For Emp FICA _

6. Include For Emplor FICA _

7. Include For FWT _

8. Include For FUI _

9. Include For SWT _

10. Include For CWT _

11. Include For OST _

12. Include For SUI _

13. Include For EIC _

14. Include For W.C. _

15. Maximum Amount _

_ , _ _ _ . _ _

or

Add Tips To Net Pay _

16. Max Per Period or Year

_ (Y = Year, P = Per Period)

Date Entered________By_________

Date Verified__________by____________

|

Load Sheet

Deduction/Earning Code File

Maintenance

D E D U C T I O N A N D E A R N I N G C O D E S L I S T

Deduction/Earning

Types: D=Deduction A=Earning (NOt Added To Net) E=Earning (Added To Gross)

M=MealS T=Tips

Code

Description Type Account‑No Account Description

Maximum Amt Taxable Flags

99

insure D 00025‑02345‑00000

Include

For Emp Fica ? Y

Include For Emplr Fica ? Y

Include For

Fwt ? Y

Include For Fui ? Y

Include For Swt ? Y

Include For Cwt ? Y

Include For Ost ? Y

Include For Sui ? Y

Include For Eic ? Y

Include For W.C. ? Y

Max Per Period Or Year ? Y

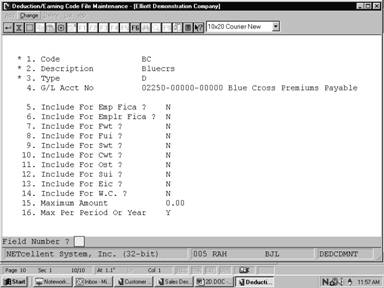

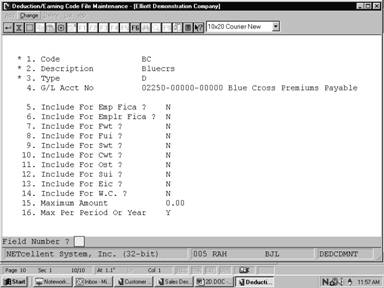

BC

Bluecrs D 02250‑00000‑00000 Blue Cross Premiums Payable

Include For Emp Fica ? N

Include For Emplr Fica ? N

Include For Fwt ? N

Include For Fui ? N

Include For Swt ? N

Include For Cwt ? N

Include For Ost ? N