|

The Employee File Maintenance

application is used to maintain the basic data connected with all your

employees. There are essentially three types of data stored in the Employee

File, corresponding to the four entry screens in this application:

‑ data

identifying and defining the employee, such as employee number, name, address,

birth date, pay rates, federal, state and city tax calculation information,

etc.

‑ data on

the employee's regular deductions.

‑ the

accumulated period‑to‑date, quarter‑to‑date and year‑to‑date

hours and dollar amounts for the employee.

Wage Account

The General Ledger

account number entered for the employee's wage account is the default account

for all wage distributions that the user does not distribute manually (on the

distribution screen of Time Transaction Processing or Manual

Transaction Processing). This wage account will be used specifically in

the following cases:

‑ If the Payroll

Setup indicates that wages are never distributed;

‑ If the

individual employee is flagged for no distribution (field 52 on the first

screen in entry field descriptions of this section).

‑ As the default

account for all types of pay (except vacation, holiday and sick pay), on the

distribution screen of the Time Transaction Processing and Manual

Transaction Processing applications, when the user presses the return key;

- As the

default account for vacation, holiday, and sick pay if the respective accounts

have been entered as all 9's in Payroll Setup.

‑ Whenever

an expense account is specified (in Payroll Setup, the State/City Tax

Code File or the Deduction/Earning Code File), which is only the first portion

(main account number) of the account number, the second and third portions

(profit center, and department number) are taken from the second and third

portions of the wage account respectively. (Note that if the G/L

account number format is such that the profit center and/or department numbers

are not used, as specified in the Company file, then the current remark

does not apply.)

State and City Withholding Tax Data

This Payroll package uses

a generally utilized scheme for calculating state and city withholding taxes.

Most of the data defining these tax calculations is kept on the State/City Tax

Code File. However, there are several pieces of information concerning these

calculations that are stored directly in the Employee and the Employee Tax Code

Files. The data in these three files, State/City Tax Code File, the Employee

File and the Employee Tax Code File, are used by the Calculate Payroll

application to determine the employee's withholding tax.

Worker's Compensation

The calculation method and

parameters for worker's compensation are defined on a state‑by‑state

basis in the State/City Tax Code File. All of the worker's compensation data

specific to each employee is included in the Employee File and the Employee Tax

Code File. During the posting of payroll checks, and the posting of manual

payroll transactions, the data in these three files, State/City Tax Code File,

the Employee File and the Employee Tax Code File, is used to calculate each

employee's eligible wages or hours, which is accumulated into the Worker's

Compensation Accumulation field in the Employee record. The worker's

compensation premium due is also calculated at this time, for each employee,

and is posted to the Payroll Distribution File (if the Worker's Compensation

Expense Account in the State/City Tax Code File is not zero).

For states, which demand both an

employee and employer worker's compensation liability, refer to the sections of

this manual detailing the capabilities of the labor and industry code method of

withholding and reporting.

NOTE: If additional state tax codes

are used then the worker's compensation accumulation for these codes are in the

Employee Tax Code File. Manual payroll transaction processing does not use the

tax codes in the Employee Tax Code File.

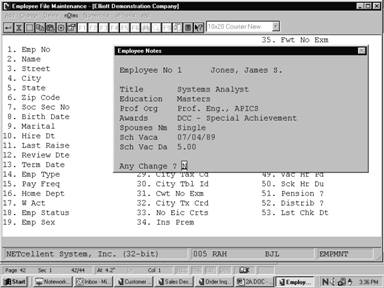

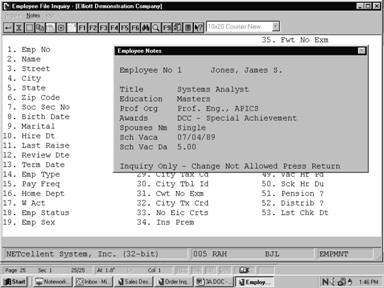

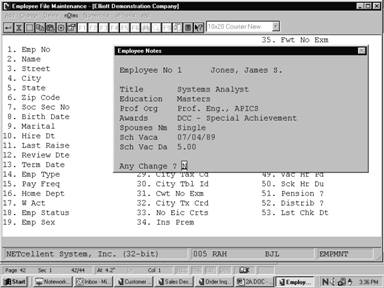

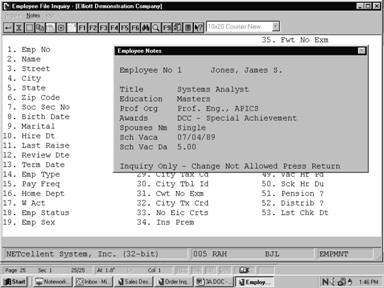

Employee Notes

By selecting Notes from

the Employee File Maintenance menu bar, you can define any additional

requirements for each employee record on file. The benefit of this feature is

apparent when you need special information that isn't present in any other file

maintenance application. The Notes function displays a window that

enables entry of the employee's number. You can enter up to 5 lines 30

characters each of additional comments plus one date and 1 amount field. This

option must be entered in the PR Setup in the Util_setup pull

down window before you can access this application.

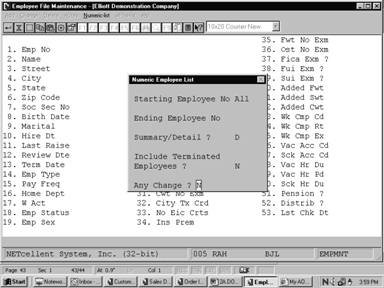

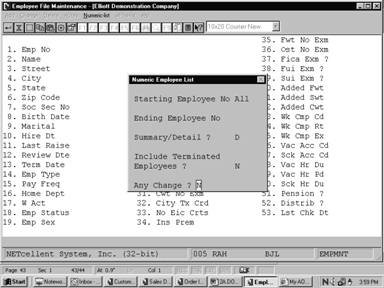

Numeric List

You may print a listing of the

employee-by-employee number order with the employee comment lines.

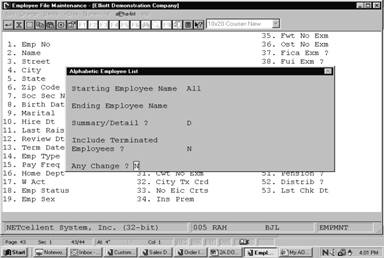

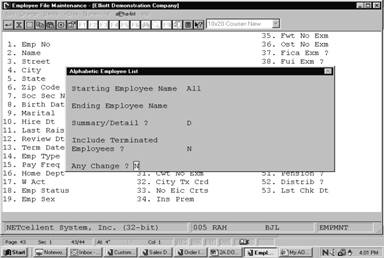

Alpha List

You may print a listing of the

employee file by employee name order.

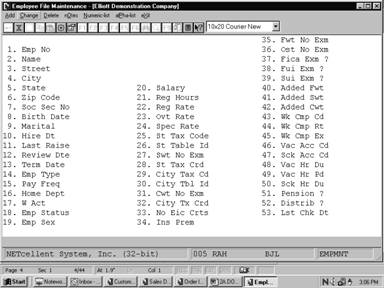

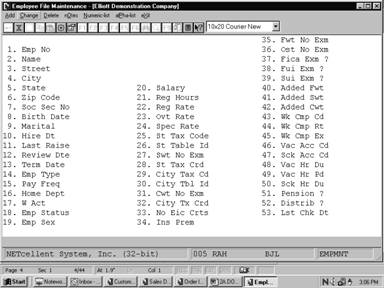

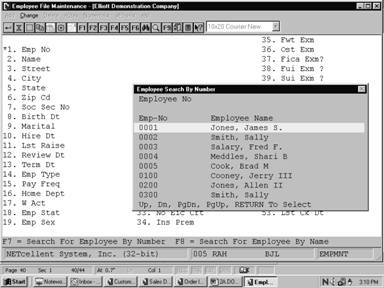

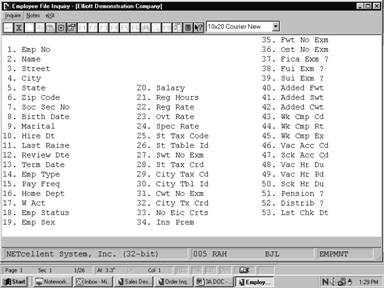

Select Employee File from

the pull down PR Maintenance window. The following screen will

then be displayed:

Employee File Maintenance Entry Screen

The following options are

available:

* Select the

desired mode from the Employee File menu bar

* Enter the

data requested on the screen

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X for

EXIT when positioned at the menu bar.

Entry Field Descriptions

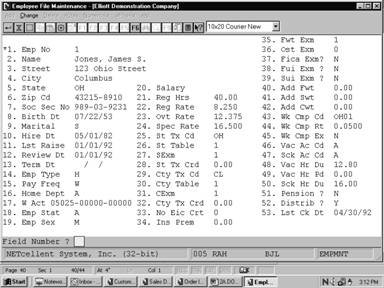

First Screen

|

Name

|

Type

and Description

|

|

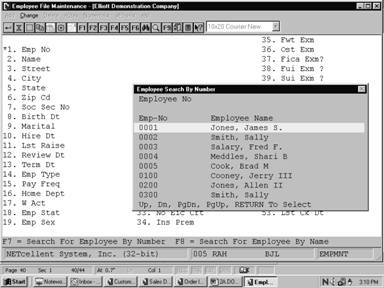

1. Emp No

|

4 numeric digits (9999).

The employee number may not be zero. This is the key

used throughout the package when referencing a specific employee.

In change or delete mode

only, press the F7 key for employee search by number or press the F8

key for employee search by name.

|

|

2. Name

|

28 alphanumeric characters.

The employee name may be

entered in the format First, Middle, Last or Last, First, Middle. If the

latter format is used, the check printing program and the W‑2 forms

program will print the name in the format First, Middle, Last anyway,

provided that there is a comma after the last name and before the first. But

if the former format is used, the Alphabetical Employee printout will print

in alphabetical order by the first name, not last. For this reason the

latter format is recommended.

|

|

3. Street

|

28 alphanumeric characters.

|

|

4. City

|

20 alphanumeric characters.

|

|

5. State

|

2 alphanumeric characters.

This should be the usual

postal code for the employee's state. It is recommended that this also be

used for the State Tax code in field 23 below.

|

|

6. Zip Cd

|

10 alphanumeric characters.

|

|

7. Soc Sec No

|

9 numeric digits (999‑99‑9999).

Enter the social security number as digits only. The

system will insert the hyphens in the appropriate places.

The social security number

may not be all zeros. If the employee currently has no social security

number, enter a dummy number, such as all 9's, and change this as soon as the

employee receives a valid number.

|

|

8. Birth Dt

|

A date in the standard date format.

|

|

9. Marital

|

1 alphabetic character.

Valid values are:

S = Single

M = Married

H = Head‑of‑Household

This field determines which

Federal Tax Table to use in calculating Federal Withholding Tax during the Calculate

Payroll application. See Calculate Payroll application for

details.

|

|

10. Hire Dt

|

A date in the standard date

format.

This is the date that the

employee was originally hired.

|

|

11. Lst Raise

|

A date in the standard date

format.

This is the date of the

employee's last raise.

|

|

12. Review Dt

|

A date in the standard date

format.

This is the date of the

employee's last review.

|

|

13. Term Dt

|

A date in the standard date

format.

The package will consider

the employee terminated if and only if this date is non‑zero.

|

|

14. Emp Type

|

1 alphabetic character.

Valid values are:

H = Hourly

S = Salaried

N = Non‑Employee

An hourly employee is always

paid at an hourly rate. The regular pay for a salaried employee is taken to

be his salary.

|

|

Emp Type (continued)

|

If the employee is marked as a non‑employee, the

package will not allow a regular payroll transaction to be entered for him or

her. Remuneration for a non‑employee may only be entered through the Manual

Transaction Processing application. The package will not print a check

for this individual and no taxes will be calculated for him or her. The Non‑Employee

Compensation Report may be printed on request showing all remuneration paid

year‑to‑date for all non‑employees.

|

|

15. Pay Freq

|

1 alphabetic character.

The Payroll package will handle the following

pay frequencies:

D = Daily

(also called Miscellaneous by the IRS)

W = Weekly

B = Bi‑weekly

S = Semi‑monthly

M = Monthly

Q = Quarterly

During the Time

Transaction Processing application you will be asked for which employee

pay frequencies you wish to enter transactions. You may request any

combination of the allowed frequencies at this time.

|

|

16. Home Dept

|

4 alphanumeric characters.

The employee's home

department number must be entered. It cannot be blank. It is used as a key

in various payroll reports to give a breakdown of wages and deductions, etc.

by department. Changes to the department number are not allowed if time

transactions are on file for the employee.

|

|

17. W Acct

|

An account number in the

standard account number format.

The employee's wage account number must have previously

been entered via the PR Account File Maintenance application. It

cannot be all zeros. It is used as a default account number by the Time

Transaction Processing application and the Manual Transaction

Processing application when distributing pay for an employee. The second

and third portions or subaccount number of this wage account will be used for

the subaccount number whenever an expense account number is specified from

any of the control files.

Pressing the F7 key

will allow you to search for the account by number or pressing the F8

key will allow you to search for the account by description.

|

|

18. Emp Stat

|

1 alphabetic character.

Valid entries are:

A = Active

I = Inactive

H = Hold

During time entry, the system will check the status of

the employee. If this field is I or H, a message will be

displayed on the screen and the question "Pay this employee? Y or

N will be asked.

The system also only allows

"A" status employees to have a time record automatically

created during the Generate Standard Payroll application.

|

|

19. Emp Sex

|

1 alphabetic character.

This is a reference field only.

M = Male

F = Female

|

|

20. Salary

|

8 numeric digits with 2

decimal places (999,999.99).

If the employee is not type S

(salaried), this field will be bypassed. Otherwise, the employee's regular

hourly rate is calculated and using this, the overtime-hourly rate and

special hourly rate are calculated. The salary amount should be the salary

for the employee's pay frequency.

|

|

21. Reg Hrs

|

5 numeric digits with 2

decimal places (999.99).

This is the number of hours

in this employee's regular pay period. It defaults to the number of hours in

the period as specified on Payroll Setup, but may be overridden by a

manual entry (if the employee is part‑time, for example).

|

|

22. Reg Rate

|

6 numeric digits with 3

decimal places (999.999).

This will need to be the

hourly rate for the employee. If the employee is salaried, the regular

hourly rate will default to the employee's salary divided by the number of

regular hours for the employee.

|

|

23. Ovt Rate

|

6 numeric digits with 3

decimal places (999.999).

The employee's overtime

hourly rate will default to the regular hourly rate times the overtime factor

as given in Payroll Setup.

|

|

24. Spec Rate

|

6 numeric digits with 3

decimal places (999.999).

The employee's special

hourly rate defaults to the regular hourly rate times the special pay factor

as given in Payroll Setup.

|

|

25. St Tax Cd

|

2 alphanumeric characters.

The State Tax code must have already been entered via

the State/City Tax Code File application.

Press The F7 key to

search for code.

|

|

26. St Table

|

1 alphabetic character.

This identifies the particular table for the State Tax

code in 25 above that is used for this employee. It must already have been

entered via the State/City Tax Code File application. Leave this

blank if you will not use a table to calculate SWT for the employee.

You will be prompted by the

system as to the available tax tables on file for this state tax code.

|

|

27. Swt Exm

|

2 numeric digits with no

decimal places (99), or 7 numeric digits with 2 decimal places (99,999.99).

The screen description changes, by pressing the F1

key, to SWT $ EXM, and back again by pressing the F1 key a second

time. You may enter either the number of exemptions for SWT for this

employee when the SWT NO EXM description is displayed, or the flat dollar

amount of the annual exemption, when the SWT $ EXM appears.

This allows flexibility in

calculating the state withholding tax for various states. See the Package

Overview section entitled State and City Tax Calculations for more

information.

|

|

Swt Exm (continued)

|

Values of 98 or 99 in this field have a

special significance, in connection with the Added Withholding Tax fields for

the employee. If the number of exemptions is entered as 98, no

withholding calculations will be done, but the added tax amounts will be

treated as percentages, and the amount of tax withheld will be equal to the

added tax amount (percent) times the employee's taxable gross pay. (This

applies to city and federal withholding also.) If the number of exemptions

entered is 99, then the SWT will be equal to the added SWT field.

(field 41, screen 1)

|

|

28. St Tx Crd

|

7 numeric digits with 2

decimal places (99,999.99).

There are two ways of

calculating any state tax credit allowed for an employee. One is to multiply

the state tax credit figure on the State Tax Code Table record by the

employee's SWT number of exemptions. If that is the way you wish to do it,

do not enter anything in this field. Otherwise, you may enter the exact

amount of this employee's (annual) state tax credit here.

|

|

29. City Tx Cd

|

2 alphanumeric characters.

The City Tax code must have already been entered via

the State/City Tax Code File application.

Press The F7 key to

search for code.

|

|

30. Cty Table

|

1 alphanumeric character.

This is the counterpart of field 29 above, for the

city. This Table ID must already have been entered via the State/City Tax

Code File application. Leave this blank if you will not use a table to

calculate city withholding tax for this employee.

You will be prompted by the

system as to the available tax tables on file for this state tax code.

|

|

31. Cwt Exm

|

2 numeric digits with no

decimal places (99), or 7 numeric digits with 2 decimal places (99,999.99).

This is the counterpart of

field 27 above, for the city. See the description for field 27.

|

|

32. Cty Tx Crd

|

6 numeric digits with 2

decimal places (9,999.99).

This is the counterpart of

field 28 above, for the city. See the description of field 28.

|

|

33. No Eic Crts

|

1 numeric digit (9).

The number of EIC certificates (W‑5 forms) may be

only 0, 1 or 2, depending upon whether the employee

alone has filed a W‑5 form, or both he and his spouse have filed them

(or none were filed). This number is used in the payroll calculation to

determine what, if any, earned income credit should be paid to the employee.

One certificate means that the employee is single or married and the spouse

has not filed a certificate. Two means the employee is married and both

spouses have filed a certificate.

This number is used in

conjunction with the EIC tables previously entered via Payroll Setup

application.

|

|

34. Ins Prem

|

6 numeric digits with 2

decimal places (9,999.99).

The premium for term

insurance in excess of $50,000 given to the employee by the employer. The

term insurance premium entered here prints in the appropriate box on the

year‑end W‑2 form, and will be included in the wages, tips, and

other compensation on that form.

|

|

35. Fwt Exm

|

2 numeric digits (99).

This is the number of

exemptions claimed by the employee on his W‑4 form. The values 98

and 99 have special significance as described for field 27 above.

|

|

36. Ost Exm

|

2 numeric digits (99).

This is the number of

exemptions claimed by the employee for other state tax. The Payroll

package as received from NETcellent System, Incorporated

performs no calculations using this field. If it is required by the

employee's OST state calculation method, coding modifications must be made.

|

|

37. Fica Exm?

|

Y or N.

Defaults to N.

If the employee is marked as

exempt from FICA, the payroll tax calculation will withhold no FICA for the

employee, nor will any employer FICA liability be calculated for this

employee.

|

|

38. Fui Exm ?

|

Y or N.

Defaults to N.

FUI and SUI liability are shown on the Quarterly

Payroll Report and the PR Distribution to G/L Report. The

percentage and cut‑off values for Federal are given in Payroll Setup,

while for State they are given on the State/City Tax Code record that

corresponds to the Employee's State Tax code.

If an employee is exempt

from either of these, the employer's FUI and SUI liability for this employee

will be zero.

|

|

39. Sui Exm ?

|

Y or N.

Defaults to N.

See the comments for field

38 above.

|

|

40. Add Fwt

|

6 numeric digits with 2

decimal places (9,999.99).

The added withholding tax amount will be added to the

calculated withholding tax amounts by the payroll calculation program, to

arrive at the final amount of tax to be withheld for the employee.

The added withholding tax

amount has a special significance if the corresponding number of exemptions

for that tax is either 98 or 99. See the comments for field 27 above.

|

|

41. Add Swt

|

6 numeric digits with 2

decimal places (9,999.99).

See the comments for field

40 above.

|

|

42. Add Cwt

|

5 numeric digits with 2

decimal places (999.99).

See the comments for field

40 above.

|

|

43. Wk Cmp Cd

|

5 alphanumeric characters.

This is the worker's

compensation code for this employee. The system will track the worker's

compensation expense for a group of employees if you associate the same code

for them.

|

|

44. Wk Cmp Rt

|

6 numeric digits with 4

decimal places (99.9999).

This is the rate at which

the worker's compensation premium is calculated for this employee. It will

be an amount per hour (for all hours worked) or a percent of wages (for all

taxable wages received), depending on the Worker's Compensation Calculation

Method recorded on the State Tax Code record for this employee's state.

|

|

45. Wk Cmp Ex

|

Y or N.

Defaults to N.

Ex

stands for executive. This field indicates whether or not this employee's

wages (or hours) are subject to the maximum amount field recorded on the

State Tax Code record for this employee's state. (See the Package

Overview section entitled Worker's Compensation for more information on

this.)

|

|

46. Vac Ac Cd

|

1 alphabetic character.

Valid values are: A, B, C, D,

E, F.

This is the Vacation Hours

Accrual code for the employee. It must correspond to one of the codes

recorded on Payroll Setup. If this field is left blank, no accruing

of vacation hours will be done for this employee, and any desired vacation

hours due must be entered manually.

|

|

47. Sck Ac Cd

|

1 alphabetic character.

Valid values are: A, B, C, D.

This is the Sick Hours

Accrual Code, which must correspond to one of the codes recorded in Payroll

Setup.

|

|

Sck Ac Cd (continued)

|

As for the Vacation Accrual code above, if this field

is left blank, no sick hours will be automatically accrued for this employee.

|

|

48. Vac Hr Du

|

5 numeric digits with 2

decimal places (999.99).

This is the number of

vacation hours currently due to this employee, not including any hours that

have already been taken.

|

|

49. Vac Hr Pd

|

5 numeric digits with 2

decimal places (999.99).

This is the number of

vacation hours that have already been taken by this employee for the current

calendar year only.

|

|

50. Sck Hr Du

|

5 numeric digits with 2

decimal places (999.99).

This is the number of sick

hours currently due to this employee, not including any sick hours already

taken.

|

|

51. Pension ?

|

Y or N.

Defaults to N.

Whether or not the employee

is part of a pension plan is indicated in the appropriate box on the year‑end

W‑2 form, according to the response to this question.

|

|

52. Distrib ?

|

Y, N

or S.

If you have indicated N (never distribute) as

the response to the Distribute Pay? question in the Payroll Setup

application, this field will automatically default to N. If, however,

your response to the Distribute Pay? question was A (always distribute) or S

(selectively distribute), you may enter either a Y, N or S) to

distribute with Shift code) in this field.

Y = Pay

distribution to G/L

N = No

pay distribution to G/L

S = Pay

distributed to G/L with shift differential

|

|

Distrib ? (continued)

|

For more information on

shift differential, refer to the Shift Code File Maintenance section

of this manual.

Note: In

the Generate Standard Payroll function, in the Time Transaction

Processing submenu, a standard payroll transaction will only be

generated for those employees that have an N response in this field

when the Payroll Setup Distribute flag is set to S (selectively

distribute). Payroll transactions for employees that use detailed

distribution to General Ledger must be entered individually.

|

|

53. Lst Ck Dt

|

This is the last date that a payroll check was issued

to this employee. This field will be updated automatically during the Post

Payroll Checks application.

|

|

54. Tip Cr ?

|

Y or N.

Defaults to N.

This indicates whether or not the employee is eligible

for tip credit.

Note: A

response to this question is only requested if the employer has been

indicated as a restaurant in Payroll Setup. If the employer is not a

restaurant, this field will not be displayed.

|

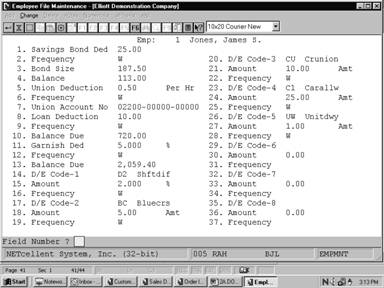

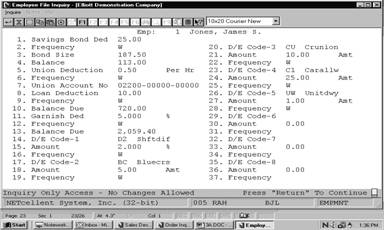

Second Screen

|

Name

|

Type

and Description

|

|

1. Savings Bond Ded

|

6 numeric digits with 2

decimal places (9,999.99).

This is the savings bond

deduction, if any, taken for this employee.

|

|

2. Frequency

|

1 alphabetic character.

Valid values are:

D = Daily

W = Weekly

B = Bi‑Weekly

M = Monthly

S = Semi‑Monthly

Q = Quarterly

|

|

Frequency (continued)

|

The frequency for taking of

the deductions, or adding in a permanent earning, must be one of the valid

pay frequencies. The default is the employee's regular pay frequency (field

15 on screen 1).

If the deduction/earning frequency is specified as more

frequent than the employee's pay frequency, the deduction/earning will still

only be taken when the employee is paid. So, effectively, the

deduction/earning frequency cannot really be more frequent than the

employee's pay frequency.

Note that if the amount for

a particular deduction is skipped (or entered as zero), then the other screen

items related to that deduction will be bypassed during entry.

|

|

3. Bond Size

|

6 numeric digits with 2

decimal places (9,999.99).

The savings bond size should

not be the face value of the bond, but its purchase price. If, during a

particular payroll run, the savings bond deduction when added to the savings

bond balance held becomes equal to or greater than the savings bond size, the

Savings Bond Register (which is printed automatically after payroll checks

are printed) will show a bond is due for this employee, and the savings bond

balance held will be reduced by the savings bond size when the payroll check

is posted.

|

|

4. Balance

|

6 numeric digits with 2

decimal places and an optional minus sign (9,999.99‑).

This is the balance already

accumulated by the employee for purchase of a savings bond.

|

|

5. Union Deduction

|

6 numeric digits with 3

decimal places (999.999) or 2 decimal places (9,999.99).

There are three types of union deductions allowed by

the Payroll package:

1. a dollar amount per hour of work reported (for

regular hours, overtime hours and special hours;

2. a percentage of gross wages (regular pay + overtime

pay + Special pay); or,

3. a fixed amount per pay

period.

|

|

Union Deduction (continued)

|

On entry, the program first

expects the per hour amount to be entered. To enter the percentage type

union deduction, press the F1 key once. To enter the fixed type,

press the F1 key again. If the F1 key is pressed a third time,

the program again expects the per hour amount to be entered, and so on.

The format for entry is 99.999

for the amount per hour and percentage types, but changes to 999.999

for the fixed amount type.

|

|

6. Frequency

|

1 alphabetic character.

See the comments for field 2

above.

|

|

7. Union Account No

|

An account number in the

standard account number format.

The Union Deduction General Ledger account must already

have been entered into the PR Account File through the G/L Account

File Maintenance application.

A Union Deductions Report is available on request via

the Employee Reports application, which summarizes union deductions by

union deduction G/L account number.

Pressing the F7 key

will allow you to search for the account by number or pressing the F8

key will allow you to search for the account by description.

|

|

8. Loan Deduction

|

6 numeric digits with 2

decimal places (9,999.99).

Enter the amount of the loan

deduction, or press RETURN to skip this field.

|

|

9. Frequency

|

1 alphabetic character.

See the comments for field 2

above.

|

|

10. Balance Due

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

The loan balance due and the

garnish balance due are automatically adjusted for any loan or garnish

deductions taken, by both the Print Payroll Checks application and the

Manual Transaction Processing application.

|

|

11. Garnish Ded

|

6 numeric digits with 2

decimal places (9,999.99) or 3 decimal places (999.999)

The garnish deduction to be taken can be a fixed amount

or a percent of gross pay or net pay. To have the deductions be a

percentage, press the F1 key when the cursor is positioned for entry

of the garnish deductions amount. You may press the F1 key again to

return to entry of a fixed amount for the garnish.

By answering Garnish By % Of

Net Pay? Payroll Setup file "Y", the percentage

deduction will be taken from net pay.

|

|

12. Frequency

|

1 alphabetic character.

See the comments for field 2

above.

|

|

13. Balance Due

|

7 numeric digits with 2 decimal

places and an optional minus sign (99,999.99‑).

See the comment for field 10

above.

|

Fields 14‑37

Eight additional deductions or

earnings (or combination of both) may be entered for each employee. The

Deduction/Earning code entered must correspond to a deduction or earning that

has already been entered into the Deduction/Earning Code file through

the Deduction/Earning Code file application.

These deductions and earnings

are considered as permanent in that they will automatically be taken or given

in each applicable pay period (according to the deduction/earning frequency)

either by a fixed amount entered as deduction/earning amount, or as a

percentage of regular wages for earnings or as a percentage of gross wages for

deductions. Any deduction or earning amount or percentage that varies from pay

period to pay period should be entered using the Temporary Deduction/Earnings

fields provided by the Time Transaction Processing application.

Enter the code, and if this code

exists on the Deduction/Earning Code file, its description will be

automatically displayed.

For a restaurant, a T

(tips) or M (meals) type earning may not be entered as one of these

permanent earnings. Both must be entered as Temporary earnings during the Time

Transaction Processing application.

|

Name

|

Type

and Description

|

|

14, 17, 20, 23, 26, 29, 32, 35 D/E Code 1 ‑ 8

|

2 alphabetic characters.

This is the deduction/earning code and must already

exist as a valid code on the Deduction/Earning Code file.

Pressing the F7 key

will allow you to do a search for the Deduction/Earning codes on file.

|

|

15, 18, 21, 24, 27, 30, 33, 36 Amount

|

6 numeric digits with 2

decimal places (9,999.99) or 3 decimal places (999.999).

This is the amount of the deduction/earning to be

taken, or the percentage deduction/earning to be taken.

Pressing the F1 key

will allow the entry of the percentage of gross pay.

|

|

16, 19, 22, 25, 28, 31, 34, 37 Frequency

|

1 alphabetic character.

See the comments for field 2

above.

|

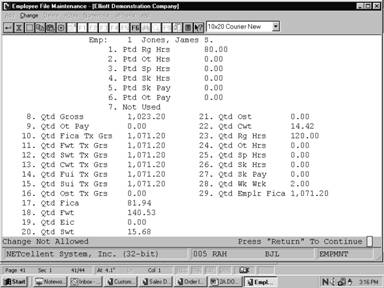

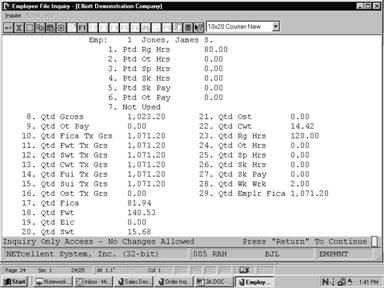

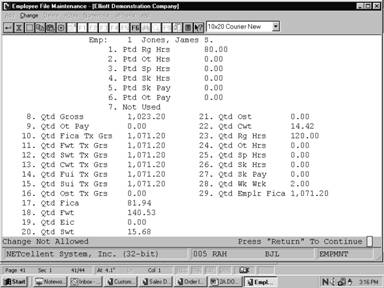

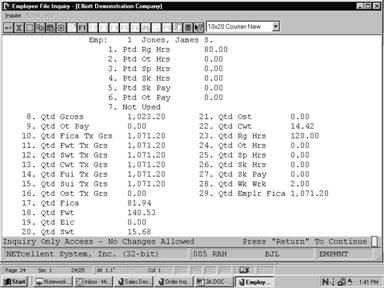

Third Screen

All Period‑to‑Date

(Ptd) and Quarter‑to‑Date (Qtd) fields appearing on the third entry

screen for the employee are automatically updated by the payroll check posting

program, and the manual payroll transactions posting program. These fields may

be cleared to zero at the end of a month or quarter, by running the Clear

Employee Totals application and selecting which fields you wish to clear

(Ptd, Qtd or Ytd).

Once these fields have been

initially entered, change mode of this application will not allow you to change

them (except by pressing the F6 key if the change protected fields flag

in Payroll Setup is Y). This is considered to be the sensitive

payroll data and the Payroll package provides a full audit trail of

changes to these fields during its normal operation, via various registers. If

a change is made in change mode of this application, there will be a record

written to the if the Employee Audit Trail flag is set to Y in Payroll

Setup.

If this flag is set to N

then there will be no audit trail of that change.

It is therefore recommended that

once the employee data is entered and verified to be correct, the F6 key

feature allowing changes to these fields should be disabled by changing the

change protected fields flag to N. Changes may then be entered via the Manual

Transaction Processing application.

Gross wages include all regular,

overtime, special, holiday, sick, vacation, temporary and permanent earnings,

both taxable and non‑taxable.

Note: Upon the initial set up of an

employee, the F10 key will default all of these values to zero.

|

Name

|

Type

and Description

|

|

1. Ptd Rg Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

regular hours worked for the period.

|

|

2. Ptd Ot Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

overtime hours worked for the period.

|

|

3. Ptd Sp Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

special hours worked for the period.

|

|

4. Ptd Sk Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of sick

hours taken for the period.

|

|

5. Ptd Sk Pay

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of sick

pay paid for the period.

|

|

6. Ptd Ot Pay

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑)

This is the total over time wages

paid for the period.

|

|

7. Ptd Excess Pay

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total excess pay paid by the employer to

meet federal minimum wage requirements for the period.

Note: A

response to this question is only requested if the employer has been

indicated as a restaurant in Payroll Setup. If the employer is not a

restaurant, this field is bypassed.

|

|

8. Qtd Gross

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total wages plus

earnings paid for the quarter so far.

|

|

9. Qtd Ot Pay

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total overtime

wages paid for the quarter.

|

|

10. Qtd Fica Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total taxable

FICA wages paid for the quarter.

|

|

11. Qtd Fwt Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for federal withholding taxes for the quarter.

|

|

12. Qtd Swt Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for state withholding taxes for the quarter.

|

|

13. Qtd Cwt Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for city withholding taxes for the quarter.

|

|

14. Qtd Fui Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for federal unemployment taxes for the quarter.

|

|

15. Qtd Sui Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for state unemployment taxes for the quarter.

|

|

16. Qtd Ost Tx Grs

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the taxable wages

for other state tax withholding taxes for the quarter.

|

|

17. Qtd Fica

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of FICA

withheld for the quarter to date.

|

|

18. Qtd Fwt

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the amount of

federal tax withheld for the quarter to date.

|

|

19. Qtd Eic

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of all

earned income credit payments made to the employee for the quarter to date.

|

|

20. Qtd Swt

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of

regular state tax withheld for the quarter to date.

|

|

21. Qtd Ost

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of other

state tax withheld for the quarter to date.

|

|

22. Qtd Cwt

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of city

tax withheld for the quarter to date.

|

|

23. Qtd Rg Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

regular hours worked for the quarter to date.

|

|

24. Qtd Ot Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

overtime hours worked for the quarter to date.

|

|

25. Qtd Sp Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

special hours worked for the quarter to date.

|

|

26. Qtd Sk Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of sick

hours taken for the quarter to date.

|

|

27. Qtd Sk Pay

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of sick

pay paid to the employee for the quarter to date.

|

|

28. Qtd Wk Wrk

|

4 numeric digits with 2

decimal places and an optional minus sign (99.99‑).

This is the number of weeks

worked for the quarter to date.

|

|

29. Qtd Emplr Fica

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the amount of the

employer taxable gross pay for FICA taxes for the quarter to date.

|

Fields 30‑33

The screen items for quarter‑to‑date

meals, tips and tip credit will only be displayed if the employer is a

restaurant (as indicated in Payroll Setup).

|

Name

|

Type

and Description

|

|

30. Qtd Meals

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the value of all

meals given to the employee for the quarter to date.

|

|

31. Qtd Tips

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the value of all

tips reported for the employee for the quarter to date.

|

|

32. Qtd Tp Cr

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of

all tip credit to the employee for the quarter to date.

|

|

33. Qtd Excess Pay

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total excess

pay paid by the employer to meet federal minimum wage requirements for the quarter

to date.

|

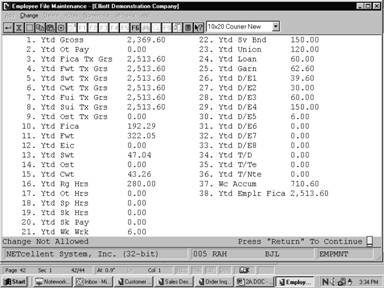

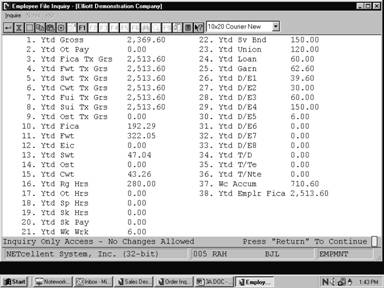

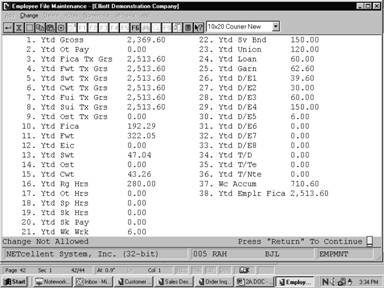

Fourth Screen

All Year‑To‑Date (Ytd) fields

appearing on the fourth entry screen for the employee are automatically

updated by the payroll check posting program and the manual payroll

transactions posting program. These fields may be cleared to zero at the end

of the year, by running the Clear Employee Totals application and

selecting which fields you wish to clear (Ptd, Qtd, or Ytd).

The only possible exception to this is the

Worker's Compensation Accumulation field. If the accumulation period

indicated on the State Tax Code record is A for anniversary year, this

field may only be cleared after the last Worker's Compensation Report before

the anniversary date is printed. This is done at the same time that the

Worker's Compensation Report is printed.

Note:

Upon the initial set up of an employee, the F10 key will default all of

these values to zero.

|

Name

|

Type

and Description

|

|

1. Ytd Gross

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the total wages

plus earnings paid for the year to date.

|

|

2. Ytd Ot Pay

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total overtime

wages paid for the year to date.

|

|

3. Ytd Fica Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the total taxable

FICA wages paid for the year to date.

|

|

4. Ytd Fwt Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for federal withholding taxes for the year to date.

|

|

5. Ytd Swt Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for state withholding taxes for the year to date.

|

|

6. Ytd Cwt Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for city withholding taxes for the year to date.

|

|

7. Ytd Fui Tx Grs

|

9 numeric digits with 2 decimal

places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for federal unemployment taxes for the year to date.

|

|

8. Ytd Sui Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for state unemployment taxes for the year to date.

|

|

9. Ytd Ost Tx Grs

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the taxable wages

for other state tax withholding taxes for the year to date.

|

|

10. Ytd Fica

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of FICA

withheld for the year to date.

|

|

11. Ytd Fwt

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the amount of

federal tax withheld for the year to date.

|

|

12. Ytd Eic

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of all

earned income credits paid to the employee for the year to date.

|

|

13. Ytd Swt

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the amount of

regular state tax withheld for the year to date.

|

|

14. Ytd Ost

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of other

state tax withheld for the year to date.

|

|

15. Ytd Cwt

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99).

This is the amount of city

tax withheld for the year to date.

|

|

16. Ytd Rg Hrs

|

6 numeric digits with 2

decimal places and an optional minus sign (9,999.99‑).

This is the number of

regular hours worked for the year to date.

|

|

17. Ytd Ot Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

overtime hours worked for the year to date.

|

|

18. Ytd Sp Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of

special hours worked for the year to date.

|

|

19. Ytd Sk Hrs

|

5 numeric digits with 2

decimal places and an optional minus sign (999.99‑).

This is the number of sick

hours taken for the year to date.

|

|

20. Ytd Sk Pay

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of sick

pay paid for the year to date.

|

|

21. Ytd Wk Wrk

|

4 numeric digits with 2

decimal places and an optional minus sign (99.99).

This is the number of weeks

worked for the year to date.

|

|

22. Ytd Sv Bnd

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

savings bond deduction taken for the year to date.

|

|

23. Ytd Union

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

union deduction taken for the year to date.

|

|

24. Ytd Loan

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

loan deduction taken for the year to date.

|

|

25. Ytd Garn

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

garnish deduction taken for the year to date.

|

|

26.‑ 33. Ytd D/E‑1 to Ytd D/E-8

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

Each of these fields is the total amount of the

corresponding permanent deduction or earning defined by fields 14‑37 on

the second screen. Note that the accumulation is done on a corresponding

basis. That is, deduction/earning 1 is accumulated into the Ytd D/E1 field,

etc. If one of these deductions or earnings is changed during the course of

the year, the new deduction or earning will accumulate into the same Year‑to‑Date

field as the old one.

Therefore, if you change

such a deduction or earning, you should record manually the accumulated

value for the old deduction and then manually set the Accumulation field to

zero.

|

Fields 34‑36

The temporary Year‑to‑Date

Deductions and Earnings fields include all temporary amounts entered during the

Time Transaction Processing and Manual Transaction Processing

applications.

If the employer is a restaurant,

meals and reported tips will not be included in these amounts. Even though

they may be entered as temporary earnings, they will be included only in the

Year‑to‑Date fields specifically designated for them.

|

Name

|

Type

and Description

|

|

34. Ytd T/D

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the accumulated

amount of all temporary deductions taken for the year to date.

|

|

35. Ytd T/Te

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

all temporary taxable earnings paid for the year to date.

|

|

36. Ytd T/Nte

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the total amount of

all temporary non‑taxable earnings paid for the year to date.

|

|

37. Wc Accum

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the accumulated eligible wages or hours for

calculating the worker's compensation premium due for the employee. The

length of time for accumulation is also defined in the State Tax Code record.

It represents hours or wages, depending on the

calculation method indicated for workers compensation on the State Tax Code

record for the employee's state.

See the Package Overview

section entitled Worker's Compensation for more details on this.

|

|

38. Ytd Emplr Fica

|

9 numeric digits with 2

decimal places and an optional minus sign (9,999,999.99‑).

This is the amount of the

employer taxable gross pay for FICA taxes for the year to date.

|

Fields 39‑42

The screen items for year‑to‑date

meals, tips and tip credit will only be displayed if the employer is a

restaurant (as indicated in Payroll Setup).

|

Name

|

Type

and Description

|

|

39. Ytd Meals

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the value of all

meals given to the employee for the year to date.

|

|

40. Ytd Tips

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the value of all

tips reported for the employee for the year to date.

|

|

41. Ytd Tp Cr

|

7 numeric digits with 2

decimal places and an optional minus sign (99,999.99‑).

This is the amount of all

tip credit credited to the employee

|

|

42. Ytd Excess Pay

|

8 numeric digits with 2

decimal places and an optional minus sign (999,999.99‑).

This is the total excess pay

paid by the employer to meet federal minimum wage requirements for the year

to date.

|

Employee Notes

|

Name

|

Type

and Description

|

|

Employee No

|

4 alphanumeric digits (9999)

Enter the employee number

that notes will be added to. Press the F7 key to search by employee

name or F8 to search by employee number.

|

|

Note 1-5

|

5 lines of 30 alphanumeric

characters.

You may enter up to 5 lines

of notes. Each can be up to 30 alphanumeric characters for every line that

was defined in PR Setup.

|

|

Date

|

A date in the standard date

format.

Enter the date relative to

this employee note entry that was defined in PR Setup.

|

|

Amount

|

9 numeric digits with 2

decimal places.

Enter an amount relative to

this employee note entry that was defined in PR Setup.

|

Numeric List

|

Name

|

Type

and Description

|

|

Starting Employee No

|

4 numeric characters.

Enter the starting employee number to specify a range

of employees to print on the report.

If you press RETURN

for the entry of the starting employee number the field will default to All

employees, and the entry of the ending employee number will be skipped.

|

|

Ending Employee No

|

4 numeric characters.

If you press RETURN

for the entry of the ending employee number the field will default to the

same value as entered for the starting employee number.

|

|

Summary/Detail?

|

S or D

Enter S for summary

or D or a detail listing.

|

|

Include Terminated

Employees?

|

Y or N.

Defaults to N.

If terminated employees are

selected to be printed, a total is kept and the termination date is included

on the list.

|

Alphabetical List

|

Name

|

Type

and Description

|

|

Starting Employee Name

|

28 alphanumeric characters.

The starting and ending employee name fields will take

into account upper and lower case letters in the name and will print names

containing lower case letters after ones with all upper case.

Press RETURN to

default to All employees.

|

|

Ending Employee Name

|

28 alphanumeric characters.

Press RETURN to default to the same as the

starting employee name.

See the comments for the

previous field.

|

|

Summary/Detail?

|

S or D.

Enter S for a summary or D to indicate a

detailed listing.

This field defaults to D.

|

|

Include Terminated Employee?

|

Y or N.

Defaults to N.

If terminated employees are

selected to be printed, a total is kept and the termination date is included

on the list.

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

PAGE

2 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 1 cont'd **

23.

Ovt Rate _ _ _ . _ _ _

24.

Spec Rate _ _ _ . _ _ _

25.

St Tx Cd _ _

26.

St Table _

27.

Swt Exm _ _

Swt Exm Amt _ _ , _ _ _ . _ _

28.

St Tx Crd _ _ , _ _ _ . _ _

29.

Cty Tx Crd _ _

30.

Cty Table _

31.

Cwt Exm _ _

Cwt Exm Amt _ _ , _ _ _ . _ _

32.

Cty Tx Crd _ , _ _ _ . _ _

33.

No Eic Crt _ 0, 1, or 2

34.

Ins Prem _ , _ _ _ . _ _

35.

Fwt Exm _ _

36.

Ost Exm _ _

37.

Fica Exm? _ Y = Yes, N = No

38.

Fui Exempt ? _ Y = Yes, N = No

39.

Sui Exempt? _ Y = Yes, N = No

40.

Add Fwt _ , _ _ _ . _ _

41.

Add Swt _ , _ _ _ . _ _

42.

Add Cwt _ _ _ . _ _

43.

Wk Cmp Cd _ _ _ _ _

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

PAGE

3 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 1 cont'd **

44.

Wk Cmp Rt _ _ . _ _ _ _

45.

Wk Cmp Ex

_ Y = Yes, N = No

46.

Vac Ac Cd _

47.

Sck Ac Code _

48.

Vac Hr Du _ _ _ . _ _

49.

Vac Hr Pd _ _ _ . _ _

50.

Sck Hr Du _ _ _ . _ _

51.

Pension? _ Y = Yes, N = No

52.

Distrib? _ Y = Yes, N = No

53.

Last Ck Dt _ _ / _ _ / _ _

54.

Tip Cr? _ Y = Yes, N = No

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

4 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 2 **

1.

Savings Bond Ded _ , _ _ _ . _ _

2.

Frequency _ D = Daily W = Weekly

B = Bi‑weekly M = Monthly

S = Semi‑monthly Q = Quarterly

3.

Bond Size _ , _ _ _ . _ _

4.

Balance _ , _ _ _ . _ _

5.

Union Deduction _ , _ _ _ . _ _

Union Ded % _ _ _ . _ _ _

6.

Frequency _

7.

Union Account No _ _ _ _ _ _ _ _ ‑ _ _ _ _ _ _ _ _ -

_ _ _ _ _ _ _ _

8.

Loan Deduction _ , _ _ _ . _ _

9.

Frequency _

10.

Balance Due _ _ , _ _ _ . _ _

11.

Garnish Ded _ , _ _ _ . _

Garnish Ded % _ _ _ . _ _ _

12.

Frequency _

13.

Balance Due _ _ , _ _ _ . _ _

14.

D/E Code‑1 _ _

15.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

16.

Frequency _

17.

D/E Code‑2 _ _

18.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

19.

Frequency _

|

|

EMPLOYEE FILE MAINTENANCE LOAD SHEET

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

5 of 9

**

SCREEN 2 cont'd **

20.

D/E Code‑3 _ _

21.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

22.

Frequency _

23.

D/E Code‑4 _ _

Percentage _ _ _ . _ _ _

25.

Frequency _

26.

D/E Code‑5 _ _

27.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

28.

Frequency _

29.

D/E Code‑6 _ _

30.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

31.

Frequency _

32.

D/E Code‑7 _ _

33.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

34.

Frequency _

35.

D/E Code‑8 _ _

36.

Amount _ , _ _ _ . _ _

Percentage _ _ _ . _ _ _

37.

Frequency _

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

6 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 3 **

1.

Ptd Rg Hrs _ _ _ . _ _

2.

Ptd Ot Hrs _ _ _ . _ _

3.

Ptd Sp Hrs _ _ _ . _ _

4.

Ptd Sk Hrs _ _ _ . _ _

5.

Ptd Sk Pay _ _ , _ _ _ . _ _

6.

Ptd Ot Pay _ _ , _ _ _ . _ _

7.

Ptd Excess Pay _ _ _ , _ _ _ . _ _

8.

Qtd Gross _ _ _ , _ _ _ . _ _

9.

Qtd Ot _ _ _ , _ _ _ . _ _

10.

Qtd Fica Tx Gross _ _ _ , _ _ _ . _ _

11.

Qtd Fwt Tx Grs _ _ _ , _ _ _ . _ _

12.

Qtd Swt Tx Grs _ _ _ , _ _ _ . _ _

13.

Qtd Cwt Tx Grs _ _ _ , _ _ _ . _ _

14.

Qtd Fui Tx Grs _ _ _ , _ _ _ . _ _

15.

Qtd Sui Tx Grs _ _ _ , _ _ _ . _ _

16.

Qtd Ost Tx Grs _ _ _ , _ _ _ . _ _

17.

Qtd Fica _ _ , _ _ _ . _ _

18.

Qtd Fwt _ _ _ , _ _ _ . _ _

19.

Qtd Eic _ _ , _ _ _ . _ _

20.

Qtd Swt _ _ , _ _ _ . _ _

21.

Qtd Ost _ _ , _ _ _ . _ _

22.

Qtd Cwt _ _ , _ _ _ . _ _

23.

Qtd Rg Hrs _ _ _ . _ _

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

7 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 3 cont'd **

24.

Qtd Ot Hrs _ _ _ . _ _

25.

Qtd Sp Hrs _ _ _ . _ _

26.

Qtd Sk Hrs _ _ _. _ _ _

27.

Qtd Sk Pay _ _ , _ _ _ . _ _

28.

Qtd Wk Worked _ _ . _ _

29.

Qtd Emplr Fica _ _ _ , _ _ _ . _ _

30.

Qtd Meals _ _ , _ _ _ . _ _

31.

Qtd Tips _ _ , _ _ _ . _ _

32.

Qtd Tp Cr _ _ , _ _ _ . _ _

33.

Qtd Excess Pay _ _ _ , _ _ _ . _ _

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

8 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 4 **

1.

Ytd Gross Wages _ , _ _ _ , _ _ _ . _ _

2.

Ytd Ot Pay _ _ _ , _ _ _ . _ _

3.

Ytd Fica Tx Gross _ , _ _ _ , _ _ _ . _ _

4. Ytd

Fwt Tx Gross _ , _ _ _ , _ _ _ . _ _

5.

Ytd Swt Tx Gross _ , _ _ _ , _ _ _ . _ _

6.

Ytd Cwt Tx Gross _ , _ _ _ , _ _ _ . _ _

7.

Ytd Fui Tx Gross _ , _ _ _ , _ _ _ . _ _

8.

Ytd Sui Tx Gross _ , _ _ _ , _ _ _ . _ _

9.

Ytd Ost Tx Gross _ , _ _ _ , _ _ _ . _ _

10.

Ytd Fica _ _ , _ _ _ . _ _

11.

Ytd Fwt _ _ _ , _ _ _ . _ _

12.

Ytd Eic _ _ , _ _ _ . _ _

13.

Ytd Swt _ _ _ , _ _ _ . _ _

14.

Ytd Ost _ _ , _ _ _ . _ _

15.

Ytd Cwt _ _ , _ _ _ . _ _

16.

Ytd Rg Hrs _ , _ _ _ . _ _

17.

Ytd Ot Hrs _ _ _ . _ _

18.

Ytd Sp Hrs _ _ _ . _ _

19.

Ytd Sk Hrs _ _ _ . _ _

20.

Ytd Sk Hrs _ _ , _ _ _ . _ _

21.

Ytd Wk Wrk _ _ . _ _

22.

Ytd Sv Bnd _ _ , _ _ _ . _ _

23.

Ytd Union _ _ , _ _ _ . _ _

|

|

Date

Filled Out __________ by ___________ ADD CHANGE DELETE

Page

9 of 9

EMPLOYEE FILE MAINTENANCE LOAD SHEET

**

SCREEN 4 cont'd **

24.

Ytd Loan _ _ , _ _ _ . _ _

25.

Ytd Garnish _ _ , _ _ _ . _ _

26.

Ytd D/E Code‑1 _ _ , _ _ _ . _ _

27.

Ytd D/E Code‑2 _ _ , _ _ _ . _ _

28.

Ytd D/E Code‑3 _ _ , _ _ _ . _ _

29.

Ytd D/E Code‑4 _ _ , _ _ _ . _ _

30.

Ytd D/E Code‑5 _ _ , _ _ _ . _ _

31.

Ytd D/E Code‑6 _ _ , _ _ _ . _ _

32.

Ytd D/E Code‑7 _ _ , _ _ _ . _ _

33.

Ytd D/E Code‑8 _ _ , _ _ _ . _ _

34.

Ytd T/D _ _ , _ _ _ . _ _

35.

Ytd T/Te _ _ , _ _ _ . _ _

36.

Ytd T/Nte _ _ , _ _ _ . _ _

37.

Wc Accum

_ _ _ , _ _ _ . _ _

38.

Ytd Emplr Fica _ , _ _ _ , _ _ _ . _ _

39.

Ytd Meals _ _ , _ _ _ . _ _

40.

Ytd Tips _ _ _ , _ _ _ . _ _

41.

Ytd Tp Cr _ _ , _ _ _ . _ _

42.

Ytd Excess Pay _ _ _ , _ _ _ . _ _

|

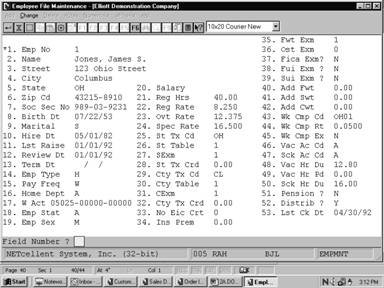

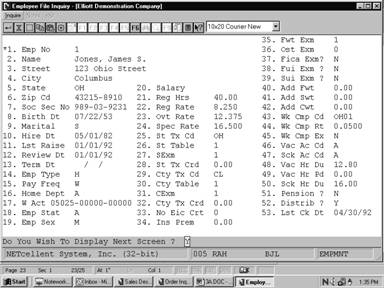

Employee File Maintenance

(Employee Search By Number)

Employee File Maintenance

(Screen #1)

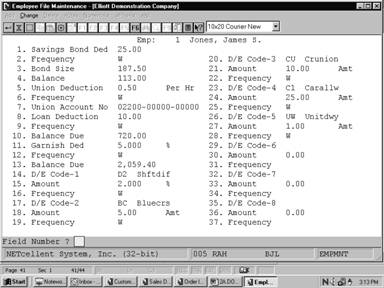

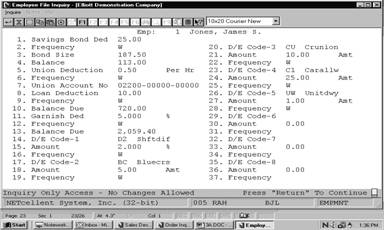

Employee File Maintenance

(Screen #2)

Employee File Maintenance

(Screen #3)

Employee File Maintenance

(Screen #4)

Employee Notes

Numeric Employee List

Alphabetic Employee List

E M P L O Y E E F I L E P R I N T ‑ O U T

For All

Employees

Marital

Status: S = Single M = Married H = Head Of Household Employee Status:

A = Active I = Inactive H = Hold

Employee

Types: H = Hourly S = Salary N = Non‑Employee Employee Sex: M

= Male F = Female

Pay/Deduct

Freq: D = Daily W = Weekly B = Bi‑Weekly S = Semi‑Monthly

M = Monthly Q = Quarterly

Terminated

Employees Not Included

Employee:

1 Jones, James S.

123 Ohio Street

Columbus

OH 43215‑8910 Sex: M Status: A

Soc

Sec No 989‑03‑9231 Savings Bond Ded 25.00 Ptd

Rg Hrs 80.00 Ytd Gross 2,369.60

Birth

Date 07/22/53 Frequency W Ptd Ot

Hrs .00 Ytd Emp Fica 2,513.60

Marital S Bond Size 187.50 Ptd Sp

Hrs .00 Ytd Ot Pay .00

Balance 113.00 Ptd Sk Hrs .00 Ytd Tx

Cwt 2,513.60

Hire

Date 05/01/82 Ptd Sk

Pay .00 Ytd Tx Swt 2,513.60

Last

Check 04/30/92 Union Deduction .500 /Hr Ptd Ot Pay .00

Ytd Tx Fica 2,513.60

Last

Raise 01/01/92 Frequency

W Ytd Tx Fwt 2,513.60

Review Dte 01/01/92 Union Account No 02200‑00000‑00000

Qtd Gross 1,023.20 Ytd Tx Ost .00

Term

Date Qtd Emp Fica

1,071.20 Ytd Tx Fui 2,513.60

Emp

Type H Loan Deduction 10.00 Qtd Ot

Pay .00 Ytd Tx Sui 2,513.60

Pay

Freq W Frequency W Qtd Tx Cwt

1,071.20 Ytd Fica 192.29

Home

Dept A Balance Due 720.00 Qtd Tx Swt

1,071.20 Ytd Fwt 322.05

Wage

Acct 05025‑00000‑00000 Qtd Tx

Fica 1,071.20 Ytd Eic .00

Salary Garnish Ded 5.000 % Qtd Tx

Fwt 1,071.20 Ytd Swt 47.04

Frequency W Qtd Tx Ost .00 Ytd

Ost .00

REPORTS

A L P H A B E T I C A L E M P L O Y E E L I S T

Ranges:

All Employees

Terminated Employees Not Included

Emp

Name Street City

St Zip Soc‑Sec‑No Emp Pay

No

Type Freq

400

Bill SaintClaire 5601 All Saints Lane Charlotte

NC 28226 282‑26‑7045 H B

5

Cook, Brad M 778 Sandrige Ave. Los Angeles CA

43329‑9921 008‑39‑3931 H W

100

Cooney, Jerry III 143 Appleton Ave. Westmont

OH 43333 332‑12‑2345 H W

200

Jones, Allen II W. Peach Ave. Norfolk

VA 23456 333‑02‑0101 H W

1

Jones, James S. 123 Ohio Street Columbus

OH 43215‑8910 989‑03‑9231 H W

4

Meddles, Shari B 221 Rolling Hills Drive Los Angeles

CA 43329‑9910 673‑09‑2882 H W

3

Salary, Fred F. 98 Buckeye Street Columbus

OH 43215‑9912 555‑44‑5252 S W

2

Smith, Sally 123 Third Street Columbus

OH 43214‑9211 323‑46‑7373 H W

300

Smith, Sally 100 E. Benchmark Pl. Morrow

OH 45445 435‑54‑3435 H W

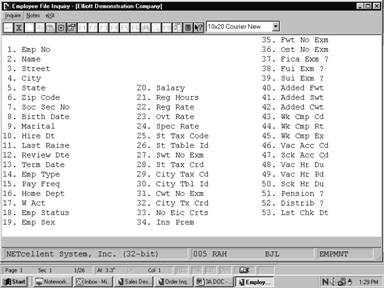

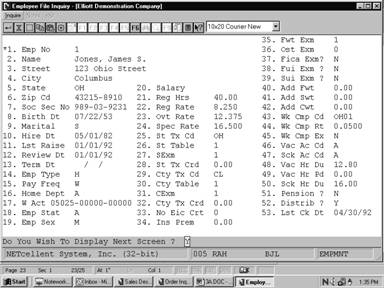

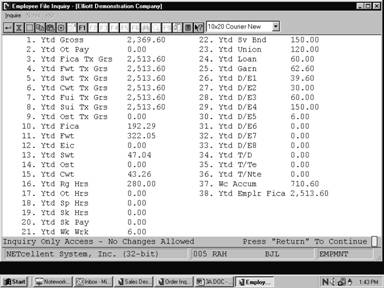

The Employee File Inquiry

application enables you to examine the information, and notes that were

previously entered into the Employee File. This is an inquiry only

function.

Select Employee File from

the pull down PR Inquiry window. The following screen will then

be displayed:

Employee File Inquiry Entry Screen

The following option is available:

* View,

without the ability to change, basic employee information such as address, Social

Security number, tax codes, PTD and YTD figures and notes.

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X

for EXIT when positioned at the menu bar.

Entry Field Descriptions

First Screen

This application provides an Inquiry

function only. It you want to add, change or delete any of these fields, use Employee

File Maintenance in the Maintenance pull down window.

|

Name

|

Type

and Description

|

|

1. Emp No

|

4 numeric digits (9999).

The employee number may not

be zero. This is the key used throughout the package when referencing a

specific employee.

|

|

2. Name

|

28 alphanumeric characters.

The employee name is

displayed in the format First, Middle, Last or Last, First, Middle.

|

|

3. Street

|

28 alphanumeric characters.

|

|

4. City

|

20 alphanumeric characters.

|

|

5. State

|

2 alphanumeric characters.

This displays the usual

postal code for the employee's state.

|

|

6. Zip Code

|

10 alphanumeric characters.

|

|

7. Soc Sec No

|

9 numeric digits (999‑99‑9999).

Displays the employee's

Social Security Number.

|

|

8. Birth Date

|

A date in the standard date

format.

Displays the employee's date

of birth.

|

|

9. Marital

|

1 alphabetic character.

Valid values are:

S = Single

M = Married

H = Head‑of‑Household

This field determines which

Federal Tax Table is used in calculating Federal Withholding Tax during the Calculate

Payroll application. See Calculate Payroll application for

details.

|

|

10. Hire Dt

|

A date in the standard date format.

|

|

11. Last Raise

|

A date in the standard date

format.

This is the date of the

employee's last raise.

|

|

12. Review Dte

|

A date in the standard date format.

|

|

13. Term Date

|

A date in the standard date

format.

The package will consider

the employee terminated if and only if this date is non‑zero.

|

|

14. Emp Type

|

1 alphabetic character.

Valid values are:

H = Hourly

S = Salaried

N = Non‑Employee

An hourly employee is always

paid at an hourly rate. The regular pay for a salaried employee is taken to

be his salary. If the employee is marked as a non‑employee, the

package will not allow a regular payroll transaction to be entered for him or

her.

|

|

15. Pay Freq

|

1 alphabetic character.

One of the following frequencies is displayed.

D = Daily

(also called Miscellaneous by the IRS)

W = Weekly

B = Bi‑weekly

S = Semi‑monthly

M = Monthly

Q = Quarterly

|

|

16. Home Dept

|

4 alphanumeric characters.

Displays the employee's home

department number. This information is used as a key in various payroll

reports to give a breakdown of wages and deductions, etc. by department.

Changes to the department number are not allowed if time transactions are on

file for the employee.

|

|

17. W Acct

|

An account number in the

standard account number format.

Displays the employee's wage

account number. This is entered via the P/R Account File application.

This is used as a default account number by the Time Transaction

Processing application and the Manual Transaction Processing application

when distributing pay for an employee. The second and third portions or

subaccount numbers of this wage account is used as the subaccount number

whenever an expense account number is specified from any of the control

files.

|

|

18. Emp Stat

|

1 alphabetic character.

Displays one of the following entries.

A = Active

I = Inactive

H = Hold

During time entry, the

system checks the status of the employee.

|

|

19. Emp Sex

|

1 alphabetic character.

This is a reference field only.

M = Male

F = Female

|

|

20. Salary

|

8 numeric digits with 2

decimal places (999,999.99).

If the employee is not type S

(salaried), this field will be empty. Otherwise, the employee's regular

hourly rate is calculated providing a basis for the overtime and special

hourly rate calculations. The salary amount should be the salary for the

employee's pay frequency.

|

|

21. Reg Hrs

|

5 numeric digits with 2

decimal places (999.99).

This is the number of hours

in this employee's regular pay period. It defaults to the number of hours in

the period as specified on Payroll Setup, but may be overridden by a

manual entry (if the employee is part‑time, for example).

|

|

22. Reg Rate

|

6 numeric digits with 3

decimal places (999.999).

This field displays the

hourly rate for the employee. If the employee is salaried, the regular

hourly rate will default to the employee's salary divided by the number of

regular hours for the employee.

|

|

23. Ovt Rate

|

6 numeric digits with 3

decimal places (999.999).

Displays the employee's

overtime-hourly rate. It references the regular hourly rate times the

overtime factor as given in Payroll Setup.

|

|

24. Spec Rate

|

6 numeric digits with 3

decimal places (999.999).

Displays the employee's

special hourly rate. It references the regular hourly rate times the special

pay factor as given in Payroll Setup.

|

|

25. St Tax Code

|

2 alphanumeric characters.

This field displays the

State Tax code entered via the State/City Tax Code File application.

|

|

26. St Table

|

1 alphabetic character.

This identifies the

particular table for the State Tax code in 25 above that is used for this

employee. It must already have been entered via the State/City Tax Code

File application.

|

|

27. Swt Exm

|

2 numeric digits with no

decimal places (99), or 7 numeric digits with 2 decimal places (99,999.99).

This field displays either the number of exemptions for

SWT for this employee when the SWT No Exm description is displayed, or the

flat dollar amount of the annual exemption, when the Swt $ EXM appears. This

allows flexibility in calculating the state withholding tax for various

states. See the Package Overview section entitled State and City

Tax Calculations for more information.

Values of 98 or 99

in this field have a special significance, in connection with the Added

Withholding Tax fields for the employee. If the number of exemptions is

entered as 98, no withholding calculations will be done, but the added

tax amounts will be treated as percentages, and the amount of tax withheld

will be equal to the added tax amount (percent) times the employee's taxable

gross pay. (This applies to city and federal withholding also.) If the

number of exemptions entered is 99, then the SWT will be equal to the

added SWT field. (field 41, screen 1)

|

|

28. St Tx Crd

|

7 numeric digits with 2

decimal places (99,999.99).

Displays the exact amount of

this employee's (annual) state tax credit here.

|

|

29. City Tx Cd

|

2 alphanumeric characters.

Displays the City Tax code

applicable for this employee.

|

|

30. City Table

|

1 alphanumeric character.

This is the counterpart of

field 29 above, for the city. It displays the City Table ID applicable for

this employee.

|

|

31. Cwt Exm

|

2 numeric digits with no

decimal places (99), or 7 numeric digits with 2 decimal places (99,999.99).

This is the counterpart of

field 27 above, for the city. See the description for field 27.

|

|

32. City Tx Crd

|

6 numeric digits with 2

decimal places (9,999.99).

This is the counterpart of

field 28 above, for the city. See the description of field 28.

|

|

33. No Eic Crts

|

1 numeric digit (9).

The number of EIC certificates (W‑5 forms) may be

only 0, 1 or 2, depending upon whether the employee

alone has filed a W‑5 form, or both he and his spouse have filed them

(or none were filed). This number is used in the payroll calculation to

determine what, if any, earned income credit should be paid to the employee.

One certificate means that the employee is single or married and the spouse

has not filed a certificate. Two means the employee is married and both

spouses have filed a certificate.

This number is used in

conjunction with the EIC tables previously entered via the Payroll Setup application.

|

|

34. Ins Prem

|

6 numeric digits with 2

decimal places (9,999.99).

The premium for term

insurance in excess of $50,000 given to the employee by the employer. The

term insurance premium displayed here prints in the appropriate box on the

year‑end W‑2 form, and will be included in the wages, tips, and

other compensation on that form.

|

|

35. Fwt No Exm

|

2 numeric digits (99).

This is the number of