|

|

MaintenanceAccounting Period File MaintenanceApplication OverviewThe Accounting Period File application should be the second application used (after G/L Setup) if the user is installing the General Ledger package for the first time. It allows the user to enter the periods that define his fiscal year. Up to 13 periods may be entered, as well as the definition of the current period. The start date of the first period must be the exact start date of the current fiscal year, and the end date of the last period entered must be the exact end date of the current fiscal year. There must be no overlap of periods, and the periods must be entered consecutively: the start of a period must be the date immediately following the end date of the preceding period.

The period settings may be changed only if you have answered Y to the question Allow Changes To The Period File in the G/L Setup application. Otherwise you are not permitted to make any change to the current settings. WARNING: If you have less than 13 periods in your fiscal year, you must not enter anything in the screen fields for periods beyond the end of the fiscal year. If you do, several of the General Ledger applications will not work properly. The current period is referenced during transaction processing (both General Journal and Recurring Journal). The date is displayed on the entry screens and the presence of a transaction dated outside the current period will trigger a warning message on the General Journal Edit List and Register. Recurring Journal transactions are dated with the current period’s ending date when they are posted to the General Ledger Transaction file. The Recurring Journal Trx Processing application requires that the current period be a standard accounting period as defined in this file for posting to occur. The current period is also used as the default period when a range of dates is accepted in reports. The Accounting Period file defines what the periods are for period compression in the Compress General Ledger Trx File application. When the Year‑End procedure is run, all periods in this file are automatically advanced one year. You must not manually advance the accounting periods. At any time that you manually change the period file, other than resetting the current period, run recalculate account balances from the processing menu. The year of the last period is used to designate the fiscal year. This year is the reference year for the Comparative and Budget year. Run InstructionsSelect Accounting Period File from the pull down G/L Maintenance window. The following screen will then be displayed:

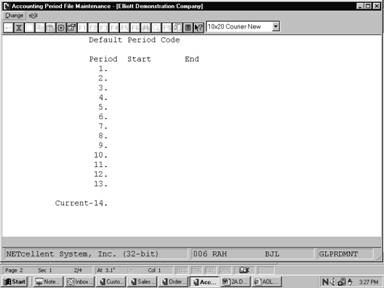

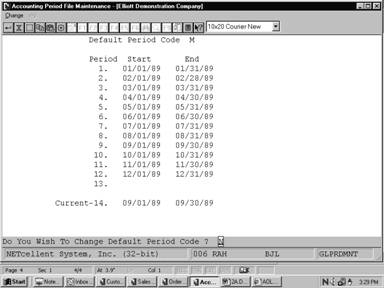

Accounting Period File Maintenance Entry Screen

The following options are available: Select the desired mode from the Accounting Period File menu bar Enter the data requested on the screen To exit press the ESC or F10 key when the cursor is positioned for entry of the first field on the screen

If the accounting periods have not been previously set up, the screen will display and allow entry of the periods. If the accounting periods have been previously set up, the existing periods will display and the question Do You Wish To Change Default Period Code ? will appear. Answer N if you wish to look at or change the existing periods. Answer Y if you wish to re‑enter all the accounting periods. Enter the Default Period Code.

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar. Entry Field Descriptions

Accounting Period File Maintenance

|