|

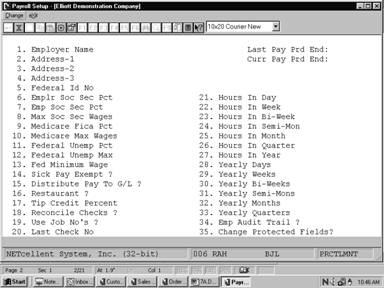

Utilities Setup

The Payroll Setup

application allows you to enter data, which remains relatively constant

throughout the Payroll package over an extended period of time. It also

allows you to customize your Payroll package to some degree. This is

the first Payroll application you should run after you have initialized

(or converted) the Payroll data files and have set up the Company File.

The responses you provide here will

affect processing in nearly all of the programs in the Payroll package,

so consider them carefully.

NOTE: As the various General

Ledger account numbers are being entered, there is no validation done

against the Account File. It is therefore very important that these account

numbers be entered accurately. The account numbers should also be entered via

the Account File Maintenance application so that their descriptions will

appear on distribution reports. If you desire to have profit center and departmental

accountability revert to the employee's profit center and department for all or

specific liabilities, the profit center and department portions of the

liability accounts entered here should be entered as all 9s.

Once the Payroll package

is in operation, if the answers to screen items 14, 16, 18, 19 on the first

screen are changed from Y to N, or N to Y, the

logic in the programs connected with these questions will automatically be

deactivated or activated. No data already in existence in the package will be

lost by changing the answers to these questions. However, if the Distribute

Pay To G/L ? has its answer changed from A to S or from N

to S, the distribution flag for each employee on file will have to be

changed individually for all those employees for which you now want to do

detailed General Ledger distribution.

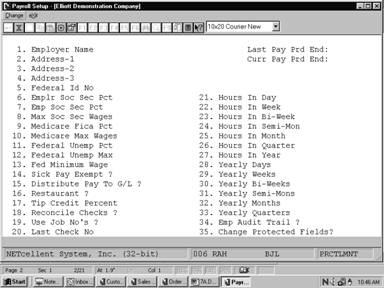

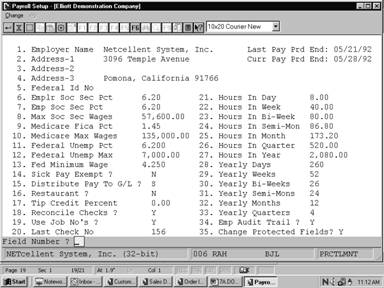

Select PR Setup from the pull down PR Util_setup

window. The following screen will then be displayed:

Payroll

Setup Entry Screen

The following options are available:

* Select

the desired mode from the PR Setup menu bar

* Enter the

data requested on the screen

To return to the menu bar, press the ESC or F10

key. To leave this application, press X for EXIT when positioned

at the menu bar.

Entry Field Descriptions

First Screen

|

Name

|

Type

and Description

|

|

1. Employer Name

|

25 alphanumeric characters.

This is the employer name

that will appear on the Year‑end W‑2 and Quarterly Report forms,

which are automatically printed by the Payroll program. The following

address (2‑4) is also used for the same purpose.

|

|

2. Address ‑ 1

|

25 alphanumeric characters.

|

|

3. Address ‑ 2

|

25 alphanumeric characters.

|

|

4. Address ‑ 3

|

25 alphanumeric characters.

|

|

5. Federal Id No

|

11 alphanumeric characters.

This is the employer's

federal identification number that will appear on the Year‑end W‑2

forms and Quarterly Payroll report.

|

|

6. Emplr Soc Sec Pct

|

4 digits, with 2 decimal

places (99.99).

The employer and employee

Social Security percents are subject to change by the federal government at

the beginning of each year. Their current values can be found in the IRS

Circular E ‑ Employer's Tax Guide.

|

|

7. Empl Soc Sec Pct

|

4 digits, with 2 decimal

places (99.99).

See the description for item

6 above.

|

|

8. Max Soc Sec Wages

|

7 digits, with 2 decimal

places (99,999.99).

The maximum Social Security wages is the cut‑off

maximum limit of an individual employee's taxable gross wages upon which the

Social Security deduction is calculated. This value can also be found in the

current IRS Circular E.

The maximum is the same for

both the employer's Social Security and the employee's Social Security.

However, if the employer is a restaurant, the employee's reported tips are

included as a part of the gross wages for the employee Social Security, but

not for the employer.

|

|

Max Soc Sec Wages (continued)

|

Meals are included in the taxable gross for both the

employer and the employee for Social Security computation. Tip credits are

included in the taxable gross for the employer for this calculation also.

|

|

9. Medicare Fica Pct

|

4 digits, with 2 decimal

places (99.99).

The Medicare percent is

subject to change by the federal government at the beginning of each year.

The current value can be found in the IRS Circular E-Employer's Tax Guide.

|

|

10. Medicare Max Wages

|

8 digits with 2 decimal

places (999999.99).

The maximum Medicare wages

is the cut-off maximum limit of an individual employee's taxable gross wages

upon which the Medicare deduction is calculated. This value can also be

found in the current IRS Circular E.

|

|

11. Federal Unemp Pct

|

5 digits, with 3 decimal

places (99.999).

The federal unemployment

(FUI) percent can also be found in IRS Circular E. It is used on the

Quarterly Tax Report to calculate the employer's FUI liability. However,

this may be reduced in some states that require State Unemployment Insurance

(SUI) payments.

|

|

12. Federal Unemp Max

|

7 digits, with 2 decimal

places (99,999.99).

The federal unemployment

(FUI) maximum wages are also found in IRS Circular E. It is the cut‑off

maximum limit of an individual employee's taxable gross wages upon which the

employer's FUI liability is calculated.

|

|

13. Fed Minimum Wage

|

5 digits, with 3 decimal

places (99.999).

This is the federal minimum wage per hour set by

federal law.

The federal minimum wage is used to calculate tip

credit for restaurants. The tip credit for an eligible employee would be

the hours worked below the federal minimum wage times the difference between

the wage paid and the federal minimum wage.

There is no check made

anywhere in the Payroll package to prevent paying an employee less

than the minimum wage. Paying the proper wage to employees is the user's

responsibility.

|

|

Fed Minimum Wage (continued)

|

However, if the restaurant question is answered Y

and the employee is eligible for tip credit, a message will appear on the

Payroll Register warning that the employee has not been paid the federal

minimum wage. A change can be made through Payroll Time Transaction

Processing, or the system will automatically post the required dollar

amount to an excess pay field for the employee.

|

|

14. Sick Pay Exempt?

|

Y or N.

Under special circumstances,

compensation the employer gives, as sick pay is exempt from FICA taxation.

If the answer to this question is Y, FICA will be calculated on

taxable gross wages minus sick pay, for both the employer's and employee's

share of FICA. All other tax calculations will include sick pay as part of

taxable gross wages.

|

|

15. Distribute Pay To G/L?

|

1 alphabetic character.

Valid responses are:

N = Never

Distribute

A = Always

Distribute

S = Selectively

Distribute

General Ledger distribution is always

automatically included as a part of the Payroll package, no matter

what the user responds to this question. It is the detailed distribution of

an employee's wages to selected General Ledger accounts that is

controlled by the response to this question. If the answer to this question

is N (never distribute), all employees' wages for regular hours or

salary, overtime hours, and special hours will be automatically distributed

to the employee's wage account as given in the employee record.

Vacation, holiday and sick

hours will be distributed according to the expense accounts indicated in this

Payroll Setup. If the answer to this question is A (always

distribute), then in both the Payroll Time Transaction Processing

application and Manual Trx Processing application, the operator will

be requested to distribute the employee's regular pay or salary, supplemental

pay, overtime pay, vacation pay, holiday pay, special pay and sick pay in

detail to selected General Ledger accounts.

|

|

Distribute Pay To G/L (continued)

|

If the answer to this question is S (selectively

distribute), the operator will be requested to enter a detailed General

Ledger distribution only for employees that have been flagged for

distribution on the employee record (see the Employee File Maintenance

application).

|

|

16. Restaurant?

|

Y or N.

If the employer is a restaurant, the Payroll

package will perform the basic accounting functions necessary to handle an

employee's reported tips and any meals provided by the employer, as well as

tip credits. Meals in this case are always considered a part of the

employee's taxable gross wages. Meals are not, however, automatically posted

to a General Ledger account. Any such posting must be done manually

in the General Ledger package. To aid the user in doing this, an

Employee Meals Report is available as part of the Print Employee Reports

application.

Tip credits are calculated

when an employee is flagged as eligible for tip credit in the employee

record. When a payroll transaction is entered for an employee, if the

employee's wages (hourly rate, plus reported tips) are less than what that

employee would get if he were getting the federal minimum wage for the hours

reported, the tip credit is calculated by subtracting the federal minimum

wage from regular, overtime or special rate, plus reported tips (if these

are below the federal minimum wage) and then multiplying this amount by the

number of worked hours hours worked at the substandard rate. Tip credit is

not computed for vacation pay, sick pay, or holiday pay.

|

|

17. Tip Credit Percent

|

5 digits, with 2 decimal

places.

The maximum allowable

percentage of the federal minimum wage that the employer may use as the tip

credit.

|

|

18. Reconcile Checks?

|

Y or N.

If check reconciliation is

selected, then all regular payroll checks and all manual checks (when the net

pay is more than zero) will be automatically kept on file for later

reconciliation using the Payroll Check Reconciliation application.

|

|

19. Use Job No’s?

|

Y or N.

The Payroll package allows for the detailed

accounting of wages paid to employees by job number. In order to distribute

an employee's wages to selected jobs, the employee must be flagged for

detailed distribution of his wages to General Ledger. For such an

employee (which may be all employees), when the operator is doing the

detailed distribution of a regular payroll transaction, or of a manual

payroll transaction, to General Ledger,

he will also be requested to enter a job number to

which this distribution applies. He may leave the Job Number field blank if

he does not wish a particular distribution to be applied against a job.

Tracking wage expense by job number in the Payroll

package is distinct from tracking job expenses in the Job Costing

package. Wage expense is fed into the Job Costing package via the Labor

Performance package.

The field may not be Y

if the entry for field 15 is N.

|

|

20. Last Check No

|

6 numeric digits, no decimal

places (999999).

The last check number used is automatically updated

during the Print Payroll Check application. Once check number 999999

is used, the next check number used will be 1.

Note that check numbers

entered in the Manual Transaction Processing application are not used

to update this field.

|

Fields 21 through 27

The number of hours in the

various time periods are used in payroll calculations in several different

programs. They should correspond exactly to the number of hours used by the

employer as the basis for paying his employees. Their default values are as

follows:

Default

Hours in Day 8.00

Hours in Week 5

x Hours in Day

Hours in Bi‑week 2

x Hours in Week

Hours in

Semi‑month 2.17 x Hours in Week

Hours in

Month 4.33 x Hours in Week

Hours in

Quarter 13 x Hours in Week

Hours in Year 52

x Hours in Week

|

Name

|

Type

and Description

|

|

21. Hours in Day

|

4 numeric digits, with 2

decimal places (99.99).

Default is 8.00.

|

|

22. Hours in Week

|

4 numeric digits, with 2

decimal places (99.99).

Default is 5 x Hours in Day.

|

|

23. Hours in Bi‑Week

|

5 numeric digits, with 2

decimal places (999.99).

Default is 2 x Hours in

Week.

|

|

24. Hours in Semi‑Mon

|

5 numeric digits, with 2

decimal places (999.99).

Default is 2.17 x Hours in

Week.

|

|

25. Hours in Month

|

5 numeric digits, with 2

decimal places (999.99).

Default is 4.33 x Hours in

Week.

|

|

26. Hours in Quarter

|

6 numeric digits, with 2

decimal places (9,999.99).

Default is 13 x Hours in

Week.

|

|

27. Hours in Year

|

6 numeric digits, with 2

decimal places (9,999.99).

Default is 52 x Hours in

Week.

|

Fields 28 through 33

The number of the various

possible pay periods in a working year are used in tax calculations in order to

annualize an employee's pay, so that the annual Federal Withholding Table can

be used to calculate withholding tax, no matter what the employee's pay period

is. The default values are as follows:

Default

Yearly Days 260

(per IRS Circular E)

Yearly Weeks 52

Yearly Bi‑weeks 26

Yearly Semi‑months 24

Yearly Months 12

Yearly

Quarters 4

|

Name

|

Type

and Description

|

|

28. Yearly Days

|

3 numeric digits (999).

Default is 260.

|

|

29. Yearly Weeks

|

2 numeric digits (99).

Default is 52.

|

|

30. Yearly Bi‑Weeks

|

2 numeric digits (99).

Default is 26.

|

|

31. Yearly Semi‑Mon

|

2 digits (99).

Default is 24.

|

|

32. Yearly Months

|

2 digits (99).

Default is 12.

|

|

33. Yearly Quarters

|

1 digit (9).

Default is 4.

|

|

34. Emp Audit Trail ?

|

Y or N.

Your answer here will

determine whether or not changes to the Employee file will be recorded

for later audit.

|

|

35. Change Protected Fields ?

|

Y or N.

Enter Y here if you

want the ability to change F6 protected fields in the Payroll

system. The default value is N.

|

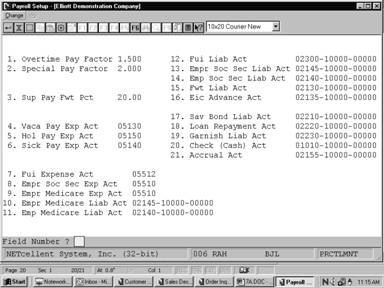

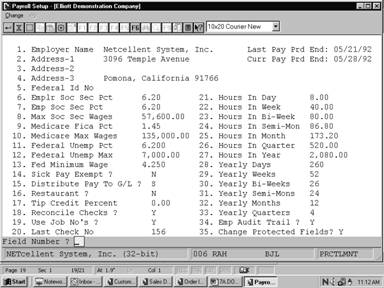

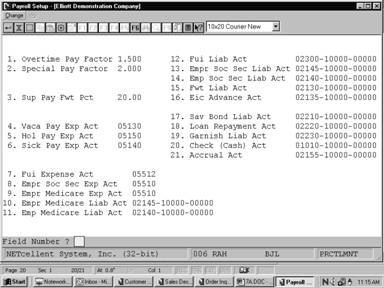

Second Screen

|

Name

|

Type and Description

|

|

1. Overtime

Pay Factor

|

4 numeric digits, with 3 decimal places (9.999).

This value is used when entering employee's rates of pay in the Employee

File Maintenance application. The overtime pay rate will default to the

regular pay rate times this overtime pay factor. This rate can be manually

overridden during Employee File Maintenance.

|

|

2. Special

Pay Factor

|

4 numeric digits, with 3 decimal places (9.999).

This field is used when entering the employee's rates of pay in the Employee

File Maintenance application. The special pay rate will default to the

regular pay rate times this special pay factor. This rate can be manually

overridden during Employee File Maintenance.

|

|

3. Sup Pay

Fwt Pc

|

4 numeric digits, with 2 decimal places (99.99).

During the Time Transaction Processing application,

supplemental wage payments may be entered (for such things as bonuses, commissions,

etc.). The normal federal withholding tax calculations need not be done on

such payments, if the time transactions contain only supplemental pay.

Instead, FWT can be calculated as a flat percentage of the supplemental

payment, given by this field. If this entry is zero, then supplemental

earnings will have FWT calculated in the usual way.

|

|

Sup Pay Fwt

Pct (continued)

|

Note: State taxing authorities also allow this flat percentage method of

calculating withholding on supplemental wage payments. This is provided for

in the state tax calculation routines (see the State/City Tax Codes

Maintenance application).

|

Fields 4 Through 6

After checks are

printed in the Print Payroll Check application, and when manual payroll

transactions are being posted, if the user does not manually distribute these

amounts, vacation pay, holiday pay and sick pay will be posted as a debit to

the expense account whose main account number is the value entered in these

fields, and whose profit center account number is the same as the profit

center account number of the wage account entered for the particular employee

in the employee record. If, however, any one of these expense accounts is entered

as all nines, then all pay of this type (vacation or holiday or sick) will be

distributed to G/L as a part of every employee's regular wages, to the

employee's wage account.

|

Name

|

Type

and Description

|

|

4. Vaca Pay Exp Act

|

Up to 8 alphanumeric

characters.

This is dependent on the

format of G/L account number specified in the Company file.

|

|

5. Hol Pay Exp Act

|

Up to 8 alphanumeric

characters.

See description in Item 4

above.

|

|

6. Sick Pay Exp Act

|

Up to 8 alphanumeric

characters.

See description in Item 4

above.

|

Fields 7 Through 16 And 20 Through 21

If the profit center portion of

these account numbers is entered as all nines, the profit center from the

employee's wage account will be used when posting distributions to the PR

Distribution File.

If the department portion of

these account numbers is entered as all nines, the department from the

employee's wage account will be used when posting distributions to the

Distribution File.

Fields 7, 8 and 9

The employer's share of FICA and

FUI payments are not deductions from the employee's pay. Therefore, to keep

the General Ledger in balance, two accounts are provided for each of

these: an expense account and a liability account. Only the main account

number is entered for the expense accounts. The profit center account number

and department account number is always the same as the profit center account

number of the employee's wage account.

Note: The Manual Transaction

Processing application posts the employer's share of FICA to the General

Ledger but does not automatically post the FUI amounts. These amounts are

posted in the normal check printing, but for checks entered in Manual

Transaction Processing, amounts will have to be calculated as distributions

or adjustments and entered manually into the General Ledger package.

If you wish no automatic posting

of FUI or employer FICA to be made to the General Ledger during the

Payroll check-printing run, but wish to do this manually over longer time

intervals, then leave these fields (or either one) blank. If you do this, then

you will not be requested to enter the corresponding liability account number

(fields 9 and 10).

|

Name

|

Type

and Description

|

|

7. Fui Expense Act

|

Up to 8 alphanumeric

characters.

This is dependent on the

format of G/L account number specified in the Company file.

|

|

8. Empr Soc Sec Exp Act

|

Up to 8 alphanumeric

characters.

See description in Item 7

above.

|

|

9. Empr Medicare Exp Act

|

Up to 8 alphanumeric

characters.

See description in Item 7

above.

|

|

10. Empr Medicare Liab Act

|

An account number in the

standard account number format.

This is the credit account

that counter balances the debit (expense) account in field 9. If field 9 is

blank, then this field will not be requested.

|

|

11. Emp Medicare Liab Act

|

An account number in the standard account number

format.

|

|

12. Fui Liab Act

|

An account number in the

standard account number format.

This is the credit account

that counter‑balances the debit (expense) account in field 7. If field

7 is blank, then this field will not be requested.

|

|

13. Emplr Soc Sec Liab Act

|

An account number in the

standard account number format.

This is the credit account

that counter‑balances the debit (expense) account in field 8 above. If

field 8 is blank, then this field will not be requested.

|

Fields 14, 15, 17, 18, 19

The employee's share of FICA,

federal withholding tax and any amounts for savings bond deduction, loan

repayment deduction and garnish deduction all come out of the employee's

wages. The liability accounts entered here provide the counter‑posting

accounts to the various employee wage accounts.

|

Name

|

Type

and Description

|

|

14. Emp Soc Sec Liab Act

|

An account number in the standard account number

format.

|

|

15. Fwt Liab Act

|

An account number in the standard account number

format.

|

|

16. Eic Advance Act

|

An account number in the

standard account number format.

Earned Income Credits (EIC)

are posted to this account as a debit and to the checking (cash) account as a

credit. EIC payments are a reduction in a liability instead of an expense so

multiple profit center accounts are not allowed.

|

|

17. Sav Bond Liab Act

|

An account number in the standard account number

format.

|

|

18. Loan Repayment Act

|

An account number in the standard account number

format.

|

|

19. Garnish Liab Act

|

An account number in the standard account number

format.

|

|

20. Check (Cash) Act

|

An account number in the standard account number

format.

|

|

21. Accrual Act

|

An account number in the

standard account number format.

This is the account used to

accrue the employer's liability for employee's wages. Distributions will be

created for this account when prorating an employee's pay over two accounting

periods. If no accrual account is entered or all zeros are entered, accrual

distributions will not be generated by the Post Payroll Checks

application.

|

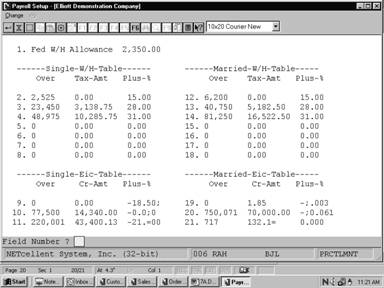

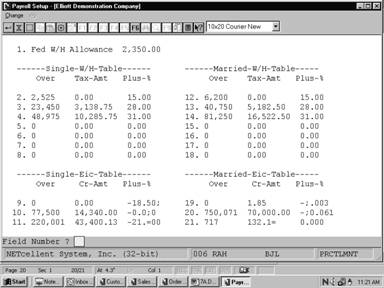

Third Screen

This screen contains all the

information needed to calculate Federal Withholding Tax and EIC payments during

the payroll calculation run, based on each employee's marital status, FWT

number of exemptions, and number of EIC certificates as recorded on the

Employee record.

The table entered here should be

the ANNUAL tables as found in IRS Circular E.

|

Name

|

Type

and Description

|

|

1. Fed W/H Allowance

|

6 numeric digits, with 2

decimal places (9,999.99).

This is the value of one

withholding allowance for the year.

|

Single W/H Table

|

Name

|

Type

and Description

|

|

Fields 2‑8

|

The values are taken from the IRS Circular E.

|

|

Over

|

6 numeric digits.

This is the over amount, and

defines the lower limit of each tax bracket.

|

|

Tax‑Amt

|

8 numeric digits, with 2 decimal

places (999,999.99).

This is the flat tax amount

for the particular tax bracket, before any percentage of the excess of wages

over the lower limit (the over amount) is taken.

|

|

Plus‑%

|

4 numeric digits, with 2

decimal places (99.99).

This is the percent to be

taken on the excess of wages over the lower limit (over) amount, which is

then added to the Tax‑Amt to give the total tax.

|

Single EIC Table

|

Name

|

Type

and Description

|

|

Fields 9‑11

|

The values are taken from

the IRS Circular E.

The values entered here have

the same significance as those described above for the Single W/H Table,

except that the second amount (CR‑Amt) is a credit rather than a tax

(Tax‑Amt). Also, note that the last entry for the Plus‑% is

negative (field 11).

|

Married W/H Table

|

Name

|

Type

and Description

|

|

Fields 12‑18

|

The values are taken from

the IRS Circular E.

The values entered here have

the same significance as those described above for the Single W/H Table.

|

Married EIC Table

|

Name

|

Type

and Description

|

|

Fields 19‑21

|

The values are taken from the IRS Circular E. The

values have the same significance as those described above for the Single

EIC Table.

|

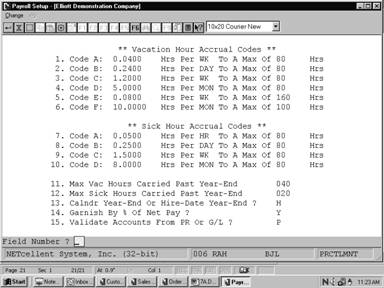

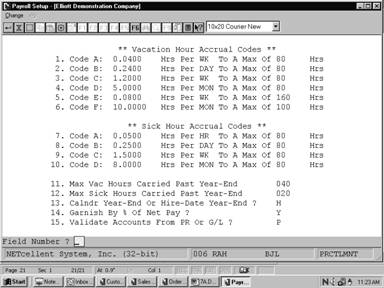

Fourth Screen

This screen is used to define

the ways that vacation and sick hours may be accrued for your employees. Each

employee is assigned a Vacation Accrual code and a Sick Pay Accrual code (on

the Employee record). If an employee has a blank value for either of these

codes, then no accrual will be done for that type of benefit (vacation or sick)

and any desired values for vacation hours due or sick hours due for such an

employee must be entered manually. Otherwise, whenever a payroll check or a

manual payroll transaction is posted for an employee, vacation and sick hours

are accrued to that employee based on these codes.

Vacation Hour and Sick Hour Accrual Codes

Fields 1‑10

|

Name

|

Type

and Description

|

|

Accrual Amount

|

6 numeric digits, with 4

decimal places (99.9999).

These are the number of

fractional hours to accrue (add to) the Vacation Hours Due or Sick Hours Due

field on the Employee record.

|

|

Accrual Period

|

3 alphabetic characters.

Valid values are:

HR = Per

Hour

DAY = Per

Day

WK = Per

Week

MON = Per

Month

This is the period of time

the employee must work in order to get the accrued hours described in the

previous field. For example, if the value here is DAY and the employee works

one week, which is 5 days, then he will accrue 5 times the hours specified in

the Accrual Amount field of vacation or sick hours due to him.

|

|

Maximum Accrual

|

4 numeric digits (9,999).

This is the maximum value

that the employee can have due at any particular time. If you do not set a

maximum on sick or vacation hours accrued for your employees, then enter 9999

for this field.

|

|

11. Max Vac Hours Carried Past Year‑End

|

3 numeric digits (999).

This is the maximum number

of vacation hours for any employee that can be carried forward from one year

to the next. When the employee totals are cleared at the end of the year, by

the Clear Employee Totals application, if an employee's vacation hours

due are greater than this amount, it will be set equal to this amount, if

field 13 below is C for calendar year.

|

|

Max Vac Hours Carried Past Year‑End

(continued)

|

Otherwise, if field 13 below is H for Hire‑Date

Anniversary, the program that posts payroll checks will detect when this

field needs to be used to set down the vacation hours due to the maximum

allowable.

|

|

12. Max Sick Hours Carried Past Year‑End

|

3 numeric digits (999).

This is the counterpart of

the previous field, for accrued sick hours. However, this maximum is always

applied at the end of the calendar year.

|

|

13. Calndr Year‑End or Hire‑Date

Year‑End?

|

1 alphabetic character.

Valid values are:

C = Calendar Year

H = Hire‑Date Year

This field determines when

the maximum in field 11 above will be applied. If this field is C,

the Clear Employee Totals application run at year‑end will set

the accrued vacation hours due to no greater than the maximum. If this field

is H, the Payroll Check Posting program will detect if this is

the first pay period after the anniversary of the employee's hire date, and

if so, it will apply the maximum amounts in field 11.

|

|

14. Garnish By % Of Net Pay

|

Y or N.

Defaults to N.

If garnishment percentage is

taken from net pay, the calculation using the percentage entered at Garnish

Ded (field 11 screen 2, Employee File Maintenance) will be performed

after all other deductions have been taken out during Payroll Calculation.

|

|

15. Validate Accounts From PR Or G/L?

|

1 alphabetic character.

Valid Values are:

P = PR

Account File

G = G/L

Account File

Defaults to P.

|

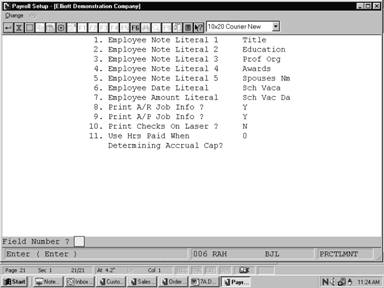

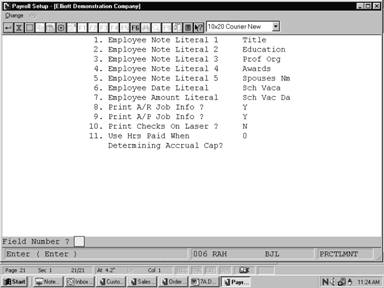

Employee Notes

|

Name

|

Type

and Description

|

|

1. Employee Note Literal 1

|

10 alphanumeric characters.

This field serves to label

the first description line of the Notes field information. You may

enter any expression that suits your needs.

|

|

2. Employee Note Literal 2

|

10 alphanumeric characters.

This field serves to label

the second description line of the Notes field information. You may

enter any expression that suits your needs.

|

|

3. Employee Note Literal 3

|

10 alphanumeric characters.

This field serves to label

the third description line of the Notes field information. You may

enter any expression that suits your needs.

|

|

4. Employee Note Literal 4

|

10 alphanumeric characters.

This field serves to label

the fourth description line of the Notes field information. You may

enter any expression that suits your needs.

|

|

5. Employee Note Literal 5

|

10 alphanumeric characters.

This field serves to label

the fifth description line of the Notes field information. You may

enter any expression that suits your needs.

|

|

6. Employee Date Literal

|

10 alphanumeric characters.

This field serves to label

the date line of the Notes field information. You may enter any

expression that suits your needs.

|

|

7. Employee Amount Literal

|

10 alphanumeric characters.

This field serves to label

the amount line of the Notes field information. You may enter any

expression that suits your needs.

|

|

8. Print A/R Job Info?

|

Y or N.

If you answer Y, Job

History file information generated from Accounts Receivable will be

printed on the Job Analysis Report and Job Distribution Report. If you answer

N, Job History file information generated from Accounts Receivable

will not be printed on the Job Analysis Report.

|

|

9. Print A/P Job Info?

|

Y or N.

If you answer Y, Job

History file information generated from Accounts Payable will be

printed on the Job Analysis and Job Distribution Reports. If you answer N,

Job History file information generated from Accounts Payable will not

be printed on the Job Analysis and Job Distribution Report.

|

|

10. Print Checks On Laser?

|

Y or N.

Enter Y to print PR

checks on laser forms. Enter N to print checks on standard

(continuous) forms.

|

Screens

Payroll Setup Screen 1

Payroll

Setup Screen 2

Screens

Payroll

Setup Screen 3

Screens

Payroll Setup Screen 4

Payroll Setup Screen 5

|