The L And I Code File

Maintenance application allows the user to enter information connected with

Labor and Industry Codes. L and I codes are used by some states as a form of

employee contributed worker's compensation. The information entered in the

application will determine how the employee and employer L and I premiums are

calculated.

Since regulations vary from

state to state, the application allows the user to enter such information as:

- if premiums

are calculated on hours worked or wages earned

- maximum

limits on taxable hours/wages

- if

overtime/special pay is included in the premium calculation

The user may also enter G/L

accounts to record employee and employer liabilities and expenses.

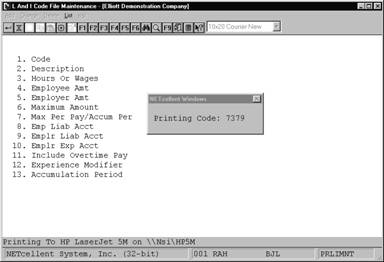

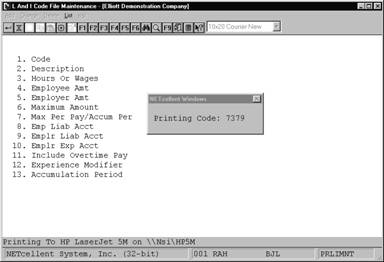

The application provides a list

function, which will print out all Labor and Industry codes on file, along with

all pertinent information about them.

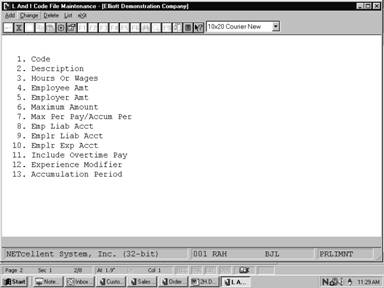

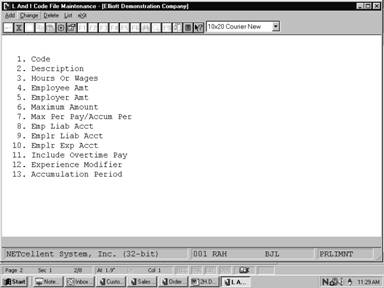

Select L And I Code File

from the pull down PR Maintenance window. The following screen will

then be displayed:

L And I Code File Maintenance Entry Screen

The following options are available:

* Select the

desired mode from the L And I Code File menu bar.

* Enter the

data requested on the screen.

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X for

EXIT when positioned at the menu bar.

Entry Field Descriptions

|

Name

|

Type

and Description

|

|

1. Code

|

6 alphanumeric characters.

Enter the code, which will represent this Labor, and

Industry payroll deduction code. If an employee is flagged for payroll

distributions and has multiple employee tax codes on file, the Time

Transaction Processing application will prompt the user to enter an L and

I code.

In change and delete modes, press the F7 key to

search for existing L and I codes.

During Time Transaction

Processing, the default L and I code from the employee's home state will be

used as the default.

|

|

2. Description

|

30 alphanumeric characters.

Enter a description for this

L and I code. This could be the state for which the code applies or a

description of the type of work done for this code.

|

|

3. Hours Or Wages

|

1 alphabetic character.

This field determines whether an employee's L and I

premium is based on hours worked or wages earned.

Valid values are:

H = Hours

Worked

W = Gross

Wages

The value entered in the

field will effect how field #11 appears.

|

|

4. Employee Amt

|

8 numeric digits with 5

decimal places and an optional minus sign (999.99999‑).

Enter the rate at which the employee's L and I premium

will be calculated. If field #3 contains an H, this will be the

amount per hour. If field #3 contains a W, this will be a percent of

all taxable wages earned as determined by field #11.

Default is zero.

|

|

5. Employer Amt

|

8 numeric digits with 5

decimal places and an optional minus sign (999.99999).

Enter the rate at which the employer's L and I premium

will be calculated. If field #3 contains an H, this will be the

amount per hour. If field #3 contains a W, this will be a percent of

all taxable wages earned as determined by field #11.

Default is zero.

|

|

6. Maximum Amount

|

7 numeric digits with 2

decimal places (99999.99).

Some states only require that the L and I premium be

paid on an individual employee's wages or hours up to a maximum. If this is

the case, enter the maximum hours or wages here. This field is not

applicable for distributed employees.

Note: The

period covered by this maximum amount is determined by the value entered in

the following field.

|

|

7. Max Per Pay/Accum Per

|

1 alphabetic character.

Enter P to have the

maximum amount entered in the previous field be per pay period. Enter A

to have the maximum amount be per the accumulation period entered in field

#13.

|

|

8. Emp Liab Acct

|

An account number in the

standard account number format.

This is the liability account where all amounts

withheld for employee L and I premiums are posted automatically during the

posting of payroll checks or manual payroll transactions.

Press the F7 key to

search for accounts by number or press the F8 key to search for

accounts by description.

|

|

9. Emplr Liab Acct

|

An account number in the

standard account number format.

This is the liability account where all amounts

withheld for employer L and I premiums are posted automatically during the

posting of payroll checks or manual payroll transactions.

Press the F7 key to

search for accounts by number or press the F8 key to search by

description.

|

|

10. Emplr Exp Acct

|

An account number in the

standard account number format.

This is the expense account that counterbalances the

liabilities account entered in the previous field.

Press the F7 key to

search for accounts by number or press the F8 key to search by

description.

|

|

11. Include Overtime Pay

|

1 alphabetic character.

This field controls whether or not overtime and special

hours or pay are used in calculating the premiums for this L and I code. If

L and I premiums are being calculated on hours worked (see field #3), this

field will display as Include Overtime Hours.

Valid entries for this case are as follows:

R = Regular

Hours Only

A = All

Hours

If L and I premiums are being calculated on gross wages

(see field #3), this field will display as Include Overtime Pay.

Valid entries for this case are as follows:

B = All

Pay Using The Base Rate

R = Regular

Pay Only

A = All

Pay

|

|

12. Experience Modifier

|

5 numeric digits with 2

decimal places (999.99).

This is a state-assigned

number and represents a percentage by which to multiply the calculated

premium. The modifier is based on past experience of claims by employees.

It defaults to 100% on initial entry.

|

|

13. Accumulation Period

|

1 alphabetic character.

This field controls the length of the period for which

L and I wages or hours will be accumulated.

Enter Q to accumulate L and I totals on a

quarterly basis. Enter A to accumulate L and I on an annual basis.

If premiums are being

calculated on hours worked, L and I may also be accumulated by pay period.

If field #3 contains an H, a P may be entered here to

accumulate by pay period.

|

Screens

L And I Code File

Maintenance

L A B O R A N D I N D U S T R Y C O D E S L I S T

Code

Description Hr‑Or‑Wages Emp‑Amount

Emp‑Liab‑Account Exp‑Mod

Include‑Ovt Emplr‑Amount Emplr‑Liab‑Account

Accum‑Per

Max‑Yr/Pay Max‑Amount Emplr‑Exp‑Account

4101

Printing/Lithography/Engraving H .29530 02180‑00000‑00000

Employee Liability Account 100.00

A .08855 02185‑00000‑00000

Employer Liability Account Q

05518‑00000‑00000 Employer Exempt Account

5474

Painting Waged To 16.99/Hr W .00000 02180‑10000‑00000

*** Account Not On File *** 102.00

B 15.31000 02185‑10000‑00000 *** Account Not On File

*** A

05518‑10000‑00000 *** Account Not On File

***

5482

Painting Wages Paid From 17.00 W .00000 02180‑10000‑00000

*** Account Not On File *** 102.00

R 13.09000 02185‑10000‑00000 *** Account Not On File

*** A

05518‑10000‑00000 *** Account Not On File ***

7379

New Jersey SUI/Disability W .62500 02180‑00000‑00000

Employee Liability Account 100.00

A .50000 02185‑00000‑00000 Employer Liability

Account Q

Y 14,400.00 05518‑00000‑00000 Employer Exempt Account

4

Codes On File