|

Manual Transaction Processing

Manual Transaction Processing is used to add, change, delete,

and print an edit list of manual payroll transactions. It should be used to

enter any payroll transactions (handwritten checks, adjustments to previous

payroll checks or historical figures kept on the Employee's record, or

adjustments to General Ledger distributions or job distributions) that

take place outside of the normal payroll processing run (via the Time

Transaction Processing application). A minimum of validation is done on

the data entered here, since it is assumed in general that the manual

transaction has already taken place.

Non‑Employees

All compensation for employees

of employee type N (non‑employee) must be entered through this

application. Suitable earnings codes should be entered onto the Deduction/Earning

Code File to cover compensation for non‑employees, and this

compensation should be entered in one of the Other D/E fields on the Manual

Transaction Processing screen.

The Payroll package

prevents a non‑employee from being paid as a part of the normal payroll

run. Tax deductions and voluntary payroll deductions are not meaningful for a

non‑employee, and even though they will be stored on the non‑employee's

Employee record if entered in this application, they will generally not appear

on any tax or deductions reports within the package.

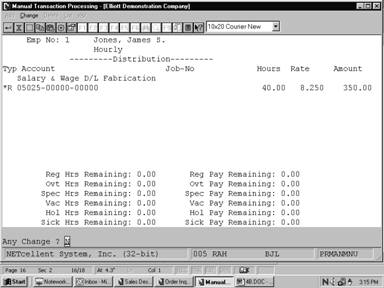

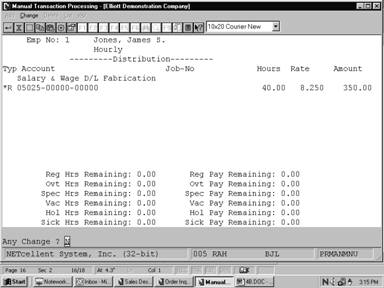

G/L Distribution

The second screen of this

application, the distributions screen, will appear if Payroll Setup

Distribute Pay To G/L? question is answered A, or if it is answered S

and the Employee's record contains a Y or S in the Distrib?

field (denoting detailed distribution to G/L).

If detailed distribution has not

been requested, the regular, overtime and special pay amounts entered here will

be automatically distributed to the employee's Wage account as entered on the

Employee record. Vacation, holiday and sick pay amounts will be distributed to

Default accounts made up of the Expense account in Payroll Setup, as the

main account, and the profit center account of the employee's Wage account.

If the employee has been marked

for detailed distribution to G/L, the operator will be required to

distribute all of the following amounts to selected G/L Distribution

accounts before being allowed to terminate the screen:

Regular Hours Regular

Pay

Overtime Hours Overtime

Pay

Special Hours Special

Pay

Vacation Hours Vacation

Pay

Holiday Hours Holiday

Pay

Sick Hours Sick

Pay

If the employee is salaried and

the regular hours are zero, the program assumes the employee was paid a salary,

and distributes it on the basis of the percentage of salary, to 100 percent.

The basic reason that the hours

must be distributed as well as the dollar amounts is the tracking of hours

worked on specified jobs. If job number usage is not selected when setting up

the Payroll package (while entering Payroll Setup), the operator

will still be required to distribute the hours before leaving the second

screen.

The hours and dollar amounts may

be distributed independently. That is, the dollar amount entered for a

particular distribution is not constrained to be equal to the hours times the

rate entered. This is to allow the Manual Transaction Processing

application sufficient flexibility to handle any kind of adjustments the user

may wish to make to the permanent Payroll files.

Even if no pay or hours have

been entered on the first screen, if the employee is marked for detailed

distribution to General Ledger, the program will proceed to the second

screen anyway. In this way, adjustments to General Ledger

distributions or distribution to jobs can be made without affecting the

employee's payroll figures.

If an employee is flagged for

shift differential distributions in the Employee File, the user will have the

option of entering a shift code during entry of distributions. This code will

calculate differences in pay rates between shifts. For more information on

shift codes, refer to the Shift Code File Maintenance section of this

manual.

If your state uses Labor and

Industry codes for calculating employee contributions to worker's compensation,

the user may enter an L and I code following each distribution. This code will

calculate the employee and employer L and I premiums for the distribution based

on information entered in the L And I Code File Maintenance

application. For more information, refer to that section of this manual.

To display or change

distributions entered, the user can press the F1 key when positioned for

entry of the distribution type. Pressing of the F1 key will cause the

first distribution to be found and displayed and the Any Change? question to be

asked. Answer Y to change or delete the distribution. To delete the

distribution press the RETURN key when the cursor is positioned for

entry of the hours or percent.

If you press the F1 key

for the type and answer N to Any Change? the distribution will roll down

on the screen. Pressing the F1 key again will then pull up the next

distribution on file. In this way you can display or change all the

distributions on file.

In change mode, you can also

change a distribution by entering its type, account number, and job. Then the

first distribution matching the type, account number, and job will have its

hour, rate and amount displayed and the Right Distribution? question will be

asked. If you answer Y, you can then change the distribution. If you

answer N the next distribution with that type, account number and job is

displayed. If there are no more distributions which match, the question No

More Distributions ‑ Do You Wish To Add? is asked. Then you can add a

new distribution.

Select Manual Transaction

Processing from the pull down PR Pro

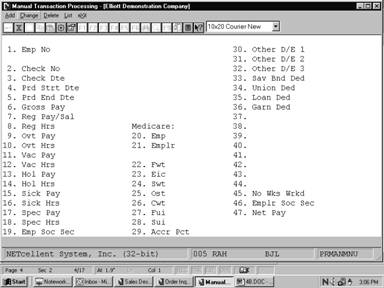

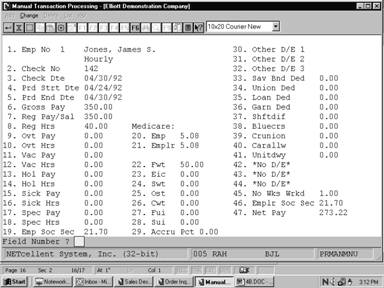

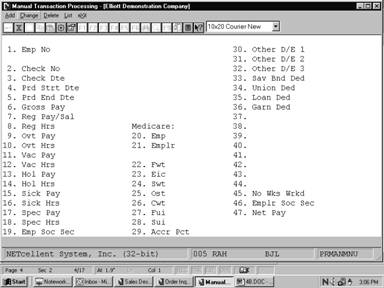

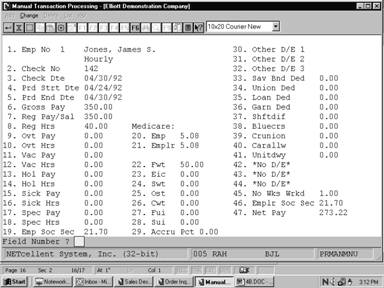

Manual Transaction Processing Entry Screen

The following options are

available:

* Select the

desired mode from the Manual Transaction Processing menu bar

* In the add and

change modes of operation, the second screen (Distribution screen) will only

appear if Payroll Setup Distribute Pay To G/L? question is answered A

or if it is answered S and the employee has been flagged for detailed General

Ledger distribution (by having a Y or S answer to the

Distrib? question on the Employee record).

* Enter the data

requested on the screen

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X for

EXIT when positioned at the menu bar.

Entry Field Descriptions

First Screen

|

Name

|

Type

|

Description

|

|

1. Emp No

|

4 numeric digits (9999).

|

The employee must exist on

the Employee File. After the employee number is entered, the employee

record is read and the employee name and employee type are automatically

displayed. If adding a transaction for an employee who is terminated (if a

termination date was entered in the Employee File) the Employee Terminated

‑ Add Anyway? question appears.

Press the F7 key for

employee search by number or press the F8 key for employee search by

name.

|

|

2. Check No

|

6 numeric digits (999999).

|

Not all manual transactions entered will be for

manually written checks. For adjustment type transactions with no net pay

involved, enter a control number here, such as 99999. There will be

no conflict within the package if the employee has an actual check with the

same number as this control number.

|

|

3. Check Dte

|

A date in the standard date format.

|

Defaults to the system date.

If there is no real check

associated with this transaction, enter the transaction date you wish to use

for posting to the General Ledger and then default the next date (4)

below to this date.

|

|

4. Prd Strt Dte

|

A date in the standard date format.

|

Defaults to the check date

above.

The pay period starting date

defaults to the check date. It is used for accounting purposes, and is a key

for the Payroll History Reports and for posting to the General Ledger

Distribution File.

|

|

5. Prd End Dte

|

A date in the standard date format.

|

Defaults to the check date

above.

The pay period ending date defaults to the check date.

It is used for accounting purposes, and is a key for the Payroll History

Reports and for posting to the General Ledger Distribution File.

|

|

6. Gross Pay

|

8 numeric digits, with 2 decimal places and optional

minus sign (999,999.99‑).

|

This is the total gross pay

associated with this manual transaction.

The program verifies that the gross pay is equal to the

sum of its component parts before allowing the user to exit from the Field

Number? question. The gross pay must be equal to the sum of:

Regular Pay or Salary +

Overtime Pay + Vacation Pay + Holiday Pay + Sick Pay + Special Pay + all Other

or Permanent Earnings (excluding meals and reported tips, for a restaurant).

|

|

7. Reg Pay/Sal

|

8 numeric digits, with 2 decimal places and optional

minus sign (999,999.99‑).

|

The Regular Pay or Salary field would include

supplemental wages for the employee.

|

|

8. Reg Hrs

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99‑).

|

|

|

9. Ovt Pay

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

|

|

10. Ovt Hrs

|

5 numeric digits, with 2 decimal places and optional minus

sign (999.99‑).

|

|

|

11. Vac Pay

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

|

|

12. Vac Hrs

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99‑).

|

The vacation hours entered here are not validated against

the vacation hours due kept on the employee's record.

|

|

13. Hol Pay

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

|

|

14. Hol Hrs

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99-)

|

|

|

15. Sick Pay

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

|

|

16. Sick Hrs

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99‑).

|

|

|

17. Spec Pay

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

|

|

18. Spec Hrs

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99‑).

|

|

|

19. Emp Soc Sec

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is the employee's portion of Social Security for this

manual transactions.

|

|

Medicare: Fields 20 and 21

|

|

|

|

20. Emp

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99-).

|

This is the employee's portion of Medicare for this

manual transaction.

|

|

21. Emplr

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99-).

|

This is the employer's portion of Medicare for this

manual transaction.

|

|

22. Fwt

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

This is Federal Withholding Tax.

|

|

23. Eic

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is the Earned Income Credit associated with this

manual transaction.

|

|

24. Swt

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is state withholding tax.

|

|

25. Ost

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is other state tax.

|

|

26. Cwt

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is city withholding tax.

|

|

27. Fui

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99-).

|

|

|

28. Sui

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99-).

|

|

|

29. Accr Pct

|

5 numeric digits with 2

decimal places (999.99).

|

Enter the percent of the

employee's pay to be accrued for the current financial period. The remainder

will be accrued for the following period.

For example, if the pay period runs Monday through

Friday and the month ends on Tuesday, 40% would be accrued to the current

month and 60% would be accrued to next month.

Defaults to 100% if no

previous transactions have been entered, otherwise defaults to the previously

entered percent.

|

Fields 30, 31, 32

For the other

deduction/earnings, enter the Deduction/Earning code first, as a two‑character

alphanumeric field. The program will verify that this code is on the Deduction/

Earning Code File. You will then be allowed to enter the amount of the

deduction or earning.

|

Name

|

Type

|

Description

|

|

30. Other D/E 1

|

2 alphanumeric characters.

|

Pressing the F7 key will allow a search for the

Deduction/Earning Codes on file.

|

|

31. Other D/E 2

|

2 alphanumeric characters.

|

Pressing the F7 key will allow a search for the

Deduction/Earning Codes on file.

|

|

32. Other D/E 3

|

2 alphanumeric characters.

|

Pressing the F7 key will allow a search for the

Deduction/Earning Codes on file.

|

|

33. Sav Bnd Ded

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is the savings bond deduction.

|

|

34. Union Ded

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

The union deduction will only be allowed if the

employee has a valid union deduction account on his employee record.

|

|

35. Loan Ded

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This field enables you to specify a loan deduction.

|

|

36. Garn Ded

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This field enables you to specify a garnishment

deduction.

|

Fields 37‑44

As soon as the user enters the

employee number (screen item #1), the Employee's record will be read from the Employee

File and the descriptions of his permanent deductions and earnings will be

displayed automatically. The

program will only allow entry of an amount if the screen item shows a valid

deduction or earning. If there is no permanent deduction/earning

corresponding to the screen item, the program automatically displays *NO D/E*

for the deduction/earning description.

|

Name

|

Type

|

Description

|

|

37‑44. Permanent

Deduction

Amount

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

|

|

45. No Wks Wrkd

|

4 numeric digits, with 2 decimal places and optional

minus sign (99.99‑).

|

This is the number of weeks worked associated with this

manual transaction.

|

|

46. Emplr Soc Sec

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99‑).

|

This is the employer portion

of SOC SEC for this manual transaction.

If SOC SEC was entered in

field 8 above, this does not mean that the employer's portion of FICA will be

automatically calculated. You must enter this figure here if you wish it to

be posted to the proper files.

|

|

47. Net Pay

|

8 numeric digits, with 2 decimal places and optional

minus sign (999,999.99‑).

|

The program verifies that

the net pay is correct before allowing the user to exit from Any Change?

mode.

The net pay must be equal to:

Gross Pay ‑ Employee

Social Security-Employee Medicare ‑ FWT ‑ SWT ‑ OST ‑

CWT ‑ Sav Bond Deductions ‑ Union Deductions ‑ Loan

Deductions ‑ Garnish Deductions ‑ All Permanent and Other

Deductions + EIC

|

|

48. Tip Cr

|

6 numeric digits, with 2 decimal places and optional

minus sign (999,999.99-).

|

Tip credits should be entered only if the employer is a

restaurant and it is applicable for this transaction.

|

|

49. Excess Pay

|

6 numeric digits, with 2 decimal places and optional

minus sign (9,999.99-).

|

Excess pay will only be entered if the employee’s

hourly wage plus tips is below the federal minimum wage requirement.

|

Second Screen

|

Name

|

Type

|

Description

|

|

Typ

|

1 alphabetic character.

|

The choices for distribution

type are:

R = Regular

S = Salary

O = Overtime

X = Special

V = Vacation

H = Holiday

K = Sick

Pressing the RETURN

key defaults to the last distribution type entered. The valid distribution

types for this transaction will display at the bottom of the screen.

|

|

Account

|

An account number in the standard account number

format.

|

As soon as the General Ledger account number is

entered, the record corresponding to it is read from the G/L Account

file, and the account description is automatically displayed.

|

|

Account (continued)

|

|

The account number must

already exist on the G/L Account file.

The account number defaults to the Wage account number

on the employee record, if the F1 key is pressed.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

Job-No

|

6 alphanumeric characters.

|

The Job number screen header

will not appear if the employer does not use job numbers, as indicated in Payroll

Setup.

If the employer does use job numbers, then entry of the

job number to assign this distribution to will be requested. If you do not

wish to assign it to a job, press RETURN. If you enter a job number,

the program checks to see that the job exists on the Job Code File.

Press the F7 key to

search for jobs.

|

|

Shop-#

|

6 alphanumeric characters.

|

This field and the next one will only appear if PR

Setup is set to use job numbers and the Job Costing package is in

use. If the distribution is assigned a job number, the user has the option

to enter a shop order number to associate the distribution with a specific

shop order. This allows for more accurate tracking of payroll expenses. The

shop order number entered must be on file in Job Costing under the job

number entered in the previous field.

|

|

Op-#

|

4 numeric digits.

|

If a job number and a shop order number have been

entered, the user must enter an operation that is on file in Job Costing

under the previously entered job and shop order numbers. If these conditions

are not met, a message will display and the cursor will return to the Shop-#

field.

|

|

Hours

|

5 numeric digits, with 2 decimal places and optional

minus sign (999.99‑).

|

The hours or percent to distribute can be the total

hours entered on the first screen or varying amounts to different accounts.

|

|

Hours (continued)

|

|

A percentage is entered when

distributing salary starting at 100% and payment being made for the 100% to

one account or broken up to varying ones.

The default will always be

the number of hours or percent remaining for the type of distribution

selected. Since holiday hours are not entered on the first screen, this will

be a percent for holiday pay.

|

|

Shift Differential

|

3 alphanumeric characters.

|

This field will appear on a

pop-up window only if the employee is flagged for shift differential

distributions in the Employee File.

Enter a valid shift code to calculate a shift

differential for the employee. If no shift differential needs to be

calculated, leave the field blank.

Press the F7 key to

search for shift codes.

|

|

Rate

|

6 numeric digits, with 3 decimal places and optional

minus sign (999.999‑).

|

The hourly rate will default to the value on the

Employee record if the F1 key is pressed.

|

|

Rate (continued)

|

|

For a regular distribution

it will default to the regular rate, for an overtime distribution to the

overtime rate, and for a special distribution to the special rate.

For a holiday distribution,

no rate will be requested. For a vacation or sick distribution, the F1

key will default the rate to the employee's regular rate.

|

|

Amount

|

7 numeric digits, with 2 decimal places and optional

minus sign (99,999.99‑).

|

The amount distributed will default on pressing the F1

key to the hours distributed times the rate entered.

|

|

L And I Code

|

6 alphanumeric characters.

|

If the employee is flagged

as distributed in the Employee File, and the employee's home state has

an L and I code on file, you will be prompted to enter an L and I code.

Enter a valid Labor and Industry code to calculate

employee and employer premiums for this distribution. If no L and I premium

needs to be calculated, leave the field blank.

L and I codes are not supported for any

secondary states the employee has in the Employee Tax Code File.

Press the F7 key to

search for L and I codes.

|

Screens Screens

Manual Transaction

Processing

Manual Transaction

Processing (Distribution)

REPORTS

M A N U A L P A Y R O L L T R X E D I T L I S T

Employee

Types: H = Hourly S = Salaried N = Non‑Employee

Distribution

Types: R = Regular S = Salary O = Overtime X = Special V = Vacation H

= Holiday K = Sick

Checks

Posted By Check Date

Journal

Number:

Emp#

Name Type Check# Chk‑Date Ppd‑Date

Gross‑Pay Reg‑Pay/Sal Ovtm‑Pay Vac‑Pay Hol‑Pay

Hol‑Hrs

1

Jones, James S. H 142 04/30/89 04/30/89 350.00

350.00

Soc‑Sec

Sick‑Pay

Spec‑Pay Reg‑Hrs Ovt‑Hrs Vac‑Hrs

Sck‑Hrs Spc‑Hrs Medicare Fwt Eic Swt Ost

21.70

.00 40.00 .00 .00

5.08 50.00 .00 .00

Empr‑Soc‑Sec

Cwt Sav‑Bnd Union Loan Garnish Shftdif Bluecrs Crunion

Carallw Unitdwy Wks‑Wrk Net‑Pay Empr‑Medic

21.70

.00 273.22 5.08

Emp#

Name Type Check# Chk‑Date Ppd‑Date

Gross‑Pay Reg‑Pay/Sal Ovtm‑Pay Vac‑Pay Hol‑Pay

Hol‑Hrs

2

Smith, Sally H 143 04/30/89 04/30/89 350.00

350.00

Soc‑Sec

Sick‑Pay

Spec‑Pay Reg‑Hrs Ovt‑Hrs Vac‑Hrs

Sck‑Hrs Spc‑Hrs Medicare Fwt Eic Swt Ost

21.70

.00 40.00 .00 .00

5.08 50.00 .00 .00

Empr‑Soc‑Sec

Cwt Sav‑Bnd Union Loan Garnish Shftdif Bluecrs Crunion

Blueshl Supalow Wks‑Wrk Net‑Pay Empr‑Medic

21.70

1.00 273.22 5.08

Pension Carallw

The Post Manual Transactions

application automatically updates your employee's payroll record and General

Ledger files with the following conditions.

1. The manual transaction

amounts are posted to the Employee record.

Any vacation or sick

hours entered for the employee are subtracted from his vacation or sick hours

due, and vacation hours are added to this vacation hours paid amount. If the

Number of Weeks Worked field is non‑zero, then vacation and sick hours

are accrued on the basis of the number of regular hours or weeks worked

entered.

2. The Manual

transactions are posted to the Payroll History file.

3. If check reconciliation

has been included in the package, any manual payroll transaction for which the

net pay amount is greater than zero is posted to the Payroll Check

Reconciliation file.

4. All distributions

(including automatic distributions mentioned above) are posted to the Payroll

Distribution file.

5. If the use of job

numbers has been included in the package, all distributions made to job numbers

are posted to the Job History file.

NOTE: Employer FICA liability

and worker’s compensation are posted to the Employee file, if applicable, but a

Worker's Compensation Premiums due are not posted. These have to be entered

manually via the General Ledger package, or entered as amounts to a

liability and an expense account in two balancing distributions for the check. The

latter method would keep the Worker's Compensation Premium posting accountable

by check within payroll but requires you to do detailed distribution of pay for

the transaction.

If no employee wage accrual

account number has been entered in PR Setup or if it has been entered as

all zeros, the user has the option of posting as of the check date or the pay

period ending date. If an accrual account number has been entered in PR

Setup, posting will be done according to the accrual percentages entered in

the Manual Transaction Processing application.

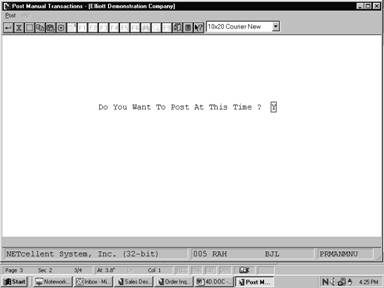

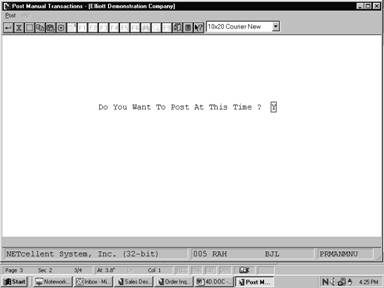

Select Post Manual

Transactions from the pull down PR Processing window. The

following screen will then be displayed:

Post Manual Transactions Entry Screen

The following options

are available:

* Enter

the data requested on the screen

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X for

EXIT when positioned at the menu bar.

Entry Field Descriptions

|

Name

|

Type

|

Description

|

|

Do You Want

To Post At This Time?

|

Y or N.

|

Enter Y

to post manual transactions or N decline.

|

|

Post Check

To G/L With Which Date?

|

1 alphabetic

character.

|

This field will only appear if no accrual account number has been

entered in PR Setup, or if it has been entered as all zeros.

Valid

entries are:

P = Pay

Period End Date

C = Check Date

|

Screens

Post Manual Transactions

|