|

|

Quarterly Payroll ReportApplication Overview

Quarterly Payroll Report application should be run immediately following the close of each quarter, and before any new transactions, either regular payroll or manual, have been entered for the next quarter. The program computes and prints Federal, State and City Withholding and Unemployment Insurance Liabilities for the preceding quarter. The information is needed for the 941 Forms.

The Quarterly Payroll Report can be printed for an individual state, or for ALL states on file.

If it is printed for ALL states, the report for each state begins at the top of a page. The federal information will print on the very last form.

FICA is calculated based on the cutoff limits provided in Payroll Setup for maximum FICA wages. The wages computed will be the quarter‑to‑date taxable wages paid to the employee, plus meals, plus any tip credit, minus any sick pay if this is exempt from FICA. If the FICA limit for the employer is exceeded for any employee then only the amount the employer should pay up to the maximum is shown.

For FUI tax liability the federal unemployment insurance maximum wage and percent is used. The liability is calculated similarly to FICA, except that sick pay is never exempted.

For SUI tax liability the State and City Tax Codes file is used for maximum wage and percent amounts. The calculation of the SUI liability is similar to that for FUI.

For OST the State and City Tax Codes file is used for the maximums for the employee liability; and the taxable wage is based on all amounts the employee received during the quarter, including tips and meals. Sick pay is never subtracted from the OST wages.

The city income tax withheld is the accumulation of all CWT for all employees within the state for which the report is printed. It is not broken down by particular city.

Non‑employees do not appear on the report. Run Instructions

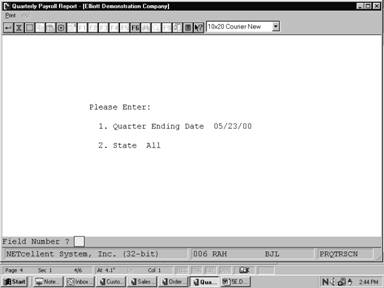

Select Quarterly Payroll Report from the pull down PR Reports window. The following screen will then be displayed:

Quarterly Payroll Report Entry Screen

The following options are available:

* Select the desired mode from the Quarterly Payroll Report menu bar * Enter the data requested on the screen

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar. Entry Field Descriptions

Print Quarterly Payroll Report

Q U A R T E R L Y P A Y R O L L R E P O R T

For The Quarter Ending 05/31/92

FEDERAL ID: 12345678901 STATE ID: 12345 Company: Elliott Demo Company Address: 3096 Temple Ave. Pomona, California 91766

Employer Employee Qtd‑Soc‑Sec Qtd‑Soc‑Sec Name Qtd‑Fwt Qtd‑Medicare Qtd‑Medicare Qtd‑Fui Qtd‑Sui Qtd‑Swt Qtd‑Ost Qtd‑Cwt Soc‑Sec‑No Wks‑Wrk Qtd‑Txb‑Fwt Qtd‑Txb‑Fica Qtd‑Txb‑Fica Qtd‑Txb‑Fui Qtd‑Txb‑Sui Qtd‑Txb‑Swt Qtd‑Txb‑Ost Qtd‑Txb‑Cwt Gross‑Pay

87.71 87.72 Brad M Cook 154.33 20.51 20.51 87.71 .00 24.18 .00 28.30 008‑39‑3931 6.00 1,414.75 1,414.75 1,414.75 1,414.75 1,414.75 1,414.75 .00 1,414.75 1,429.75

Sally Smith .00 .00 .00 .00 .00 .00 .00 .00 323‑46‑7373 5.00 .00 .00 .00 .00 .00 .00 .00 .00 1,345.00

123.55 123.57 Shari B Meddles 241.05 28.89 28.89 123.55 .00 37.13 .00 39.87 673‑09‑2882 6.00 1,992.75 1,992.75 1,992.75 1,992.75 1,992.75 1,992.75 .00 1,992.75 1,992.75

James S. Jones .00 .00 .00 .00 .00 .00 .00 .00 989‑03‑9231 4.00 .00 .00 .00 .00 .00 .00 .00 .00 1,709.80

Grand Totals 211.26 211.29 395.38 49.40 49.40 211.26 .00 61.31 .00 68.17 3,407.50 3,407.50 3,407.50 3,407.50 3,407.50 3,407.50 .00 3,407.50 6,477.30 4 Employees

|