|

|

Employee ReportsApplication Overview

Employee Reports application allows access to the following functions:

Union Deductions Report Overtime and Sick Pay Report Non‑Employee Compensation Report Worker's Compensation Report Meals Report

The Meals Report is accessible only if Payroll Setup identifies the user as a restaurant.

Union Deductions Report

This report itemizes union deductions by employee for a selected union (or all unions), within a selected range of pay periods. The report prints employees in social security number order for the convenience of union administrators.

The report details hours worked, gross pay, the amount of the deduction and the method of calculation used to arrive at the deduction. The report may be utilized internally by payroll personnel and may also be submitted to the unions along with remittance of the amount deducted.

This report uses data in the Payroll History file. Data for certain periods will no longer be available once the Payroll History file has been purged for those periods.

This report uses data in the Employee file for the type of union deduction taken. If the type of deduction is changed after the data is put on the Payroll History file, then only the current deduction method (i.e., per hour, per pay period, or percentage) will be printed.

Employees deleted from the Employee file but not purged from the Payroll History file will not be printed. Overtime and Sick Pay Report

This report shows the overtime hours and sick hours and pay for each employee by department with month‑to‑date, quarter‑to‑date and year‑to‑date totals and averages.

This report will also show the total number of vacation hours due to an employee and the number of vacation hours that have been paid to the employee.

Non‑Employee Compensation Report

This report would customarily be run at the end of the year prior to the preparation of Non‑Employee Compensation Forms (Form 1099). It provides information requested on these forms such as recipient's name and address, identifying number (Social Security Number) and year‑to‑date gross pay.

Worker's Compensation Report

This is a report showing all wages or hours accumulated for all employees, for worker's compensation reporting purposes. Each state starts on a new page if all states are selected. The type of data shown here is somewhat dependent on the worker's compensation data recorded on the State Tax Code record for the particular state.

Employees are shown in order by social security number within the Worker's Compensation code. The premium due for each employee is shown, along with the subtotal for each Worker's Compensation code.

The period covered by this report depends on the accumulation period specified in the State Tax Code record. If the accumulation period is P for period (e.g. month), then every time the employee period‑to‑date totals are cleared, the accumulated worker's compensation hours or wages will also be cleared. In this case, the report should be printed every month, before the period‑to‑date totals are cleared. Accumulation periods of Q (quarter) and Y (calendar year) are handled similarly. If the accumulation period is A , for anniversary year, the situation is different. In this case, the Worker's Compensation Accumulation fields can only be cleared by this program.

The question, Clear Accum Amounts? will be asked if the current date is after the anniversary date and the program determines that the last time the fields were cleared was before the anniversary date (in the current calendar year). If the user answers Y, then the accumulation fields are cleared. See Print Payroll Checks application for some more data on this.

Meals Report

This report is designed to assist the user with posting meals expense to the general ledger. Since methods of posting meals expense vary significantly from one restaurant to another, this package requires that the user post the expense manually according to his own company's policy.

The Meals Report can be obtained for a single pay period or for several pay periods combined. The report may be generated for as great a range of periods as Payroll History data is available. With a listing of amounts by employee for the requested period, the appropriate journal entries can be made. Run Instructions

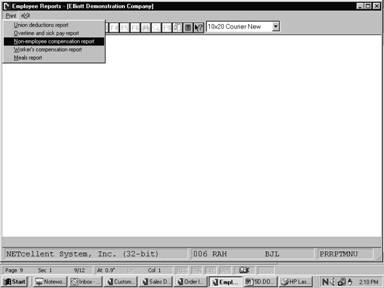

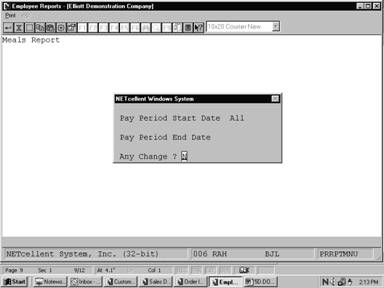

Select Employee Reports from the pull down PR Reports window. The following screen will then be displayed:

Employee Reports Entry Screen

The following options are available:

* Select the desired mode from the Employee Reports menu bar * Choose one of the following * Union Deduction Report, Overtime and Sick Pay Report, Non‑Employee Compensation Report, Worker's Compensation Report, Meals Report -(Available to those companies identified as restaurants in Payroll Setup.) * Enter the data requested on the screen

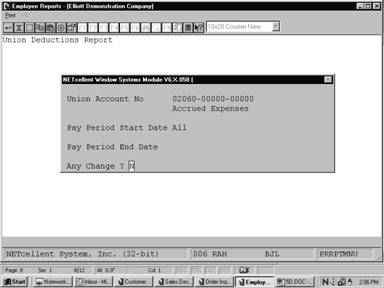

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar. Entry Field DescriptionsUnion Deduction Report

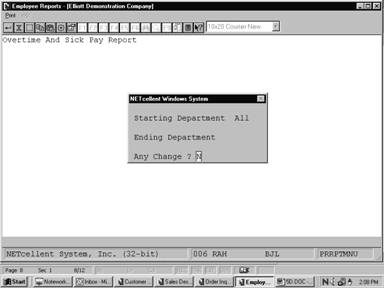

Overtime And Sick Pay Report

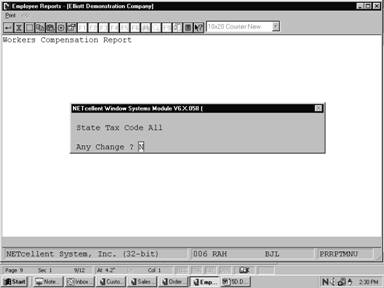

Worker's Compensation Report

NOTE: Payroll checks may not be printed for a new payroll period if there is any state for which these accumulated amounts have not been properly cleared.

Meals Report

Print Union Deductions Report

Print Overtime And Sick Pay Report

Non-employee Compensation Report

Worker’s Compensation Report

Print Meals Report

U N I O N D E D U C T I O N S R E P O R T

For Pay Periods All For Union Account No 02200‑00000‑00000 Union Dues Payable

Soc‑Sec‑No Name ‑‑‑‑‑‑‑‑‑‑‑‑‑Hours‑‑‑‑‑‑‑‑‑‑‑‑ Gross‑Pay Calc Union Regular Overtime Special Method Deduction

323‑46‑7373 Smith, Sally 140.00 .00 .00 1,130.00 Per Hour 300.00 989‑03‑9231 Jones, James S. 160.00 .00 .00 1,373.20 Per Hour 40.00

Union Totals: 300.00 .00 .00 2,503.20 340.00

O V E R T I M E A N D S I C K P A Y R E P O R T

For All Departments Employee Types: H = Hourly S = Salary N = Non‑Employee

Dept Empl Name Emp ‑‑‑‑Period‑To‑Date‑‑‑‑‑‑ ‑‑‑‑Quarter‑To‑Date‑‑‑‑‑ ‑‑‑‑‑‑Year‑To‑Date‑‑‑‑‑‑ No No Typ Ovrtim Sick Sick Ovrtim Sick Sick Ovrtim Sick Sick Vac Due Hrs Hrs Pay Hrs Hrs Pay Hrs Hrs Pay Vac Paid

100 100 Cooney, Jerry III H .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 200 Jones, Allen II H .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 300 Smith, Sally H .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 400 Bill SaintClaire H .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

4 Employees Department Totals: .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

Department Averages: .00 .00 .00 .00 .00 .00 .00 .00 .00 .00 .00

N O N ‑ E M P L O Y E E C O M P E N S A T I O N R E P O R T

Emp‑No Name Street‑Address Ytd‑Gross Soc‑Sec‑No City St Zip

500 Rich, Lisa A. 420 Lyonwood Dr. 1,152.12 291‑56‑2369 Caledonia OH 43072‑0485

1 Non‑Employees

W O R K E R ' S C O M P E N S A T I O N R E P O R T

State: CA California Calculation Method: Percent Of Salary Accumulation Period Quarterly Anniversary Date: 00/00/00 Experience Modifier: 100.00 Maximum Wages: .00 Last Clear Date: 00/00/00

Wk‑Cmp Soc‑Sec‑No Empl Name Rate Exec Eligible Premium Code No Exm? Wages Due

323‑46‑7373 2 Smith, Sally .0000 N .00 .00 989‑03‑9231 1 Jones, James S. .0000 N .00 .00

Totals This Code: .00 .00

CA01 008‑39‑3931 5 Cook, Brad M .0000 N 1,059.75 .00 CA01 673‑09‑2882 4 Meddles, Shari B .0100 N 1,452.75 .15

Totals This Code: 2,512.50 .15

Totals This State: 2,512.50 .15 Times Experience Modifier: X 100.00 ‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑ ‑‑‑‑‑‑‑‑‑

Premium Due: .15

M E A L S R E P O R T

For Pay Periods All

Emp‑No Name Amount

|