|

State/City Tax Code File Maintenance

State/City Tax Code File application allows the user to

enter all information connected with the State and City Tax codes so that state

withholding, city withholding, and other state tax costs can be calculated

automatically for each employee during the Calculate Payroll

application. The user also defines the General Ledger account numbers

used for automatically posting withheld tax amounts to the proper General

Ledger accounts, as well as all data concerning worker's compensation

premiums, on a state‑by‑state basis.

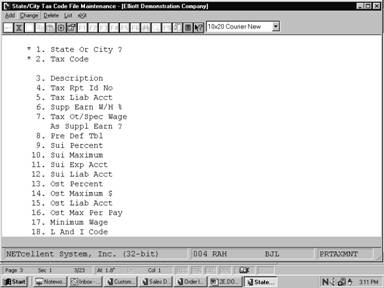

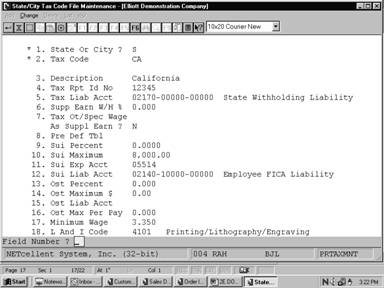

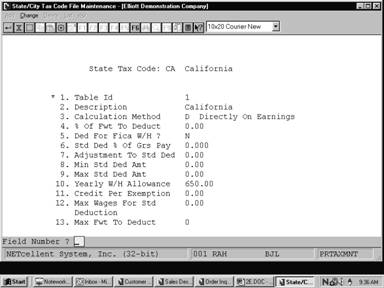

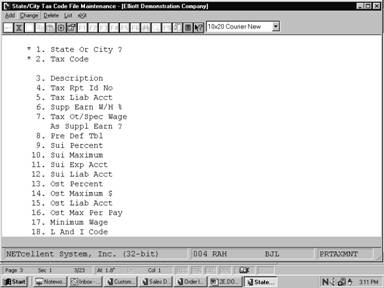

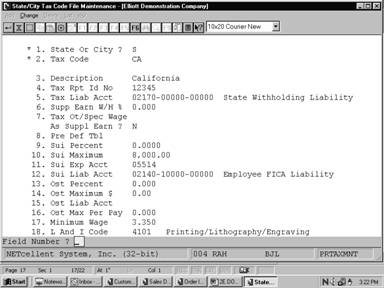

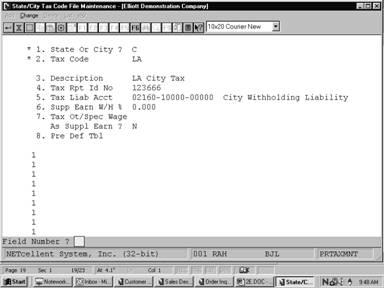

First Screen

The first screen appears

differently for a State Tax code than for a City Tax code. Only the first

seven fields appear if the entry is for a City Tax code. In this case, the tax

liability account is for CWT. For a state code, the tax liability account is

for SWT. Also, there are entries for State Unemployment Insurance (SUI) and

other state tax (OST). (NOTE: In California, as in some other states,

this state tax is SDI [State Disability Insurance]).

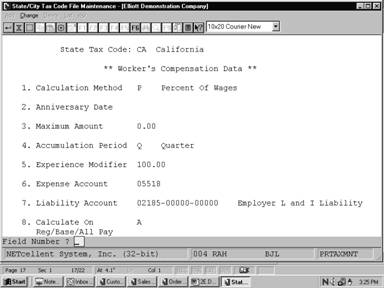

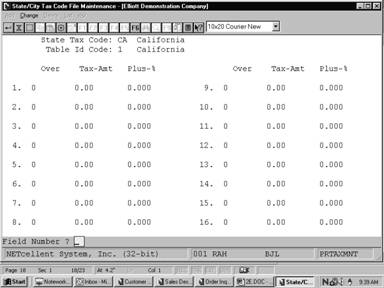

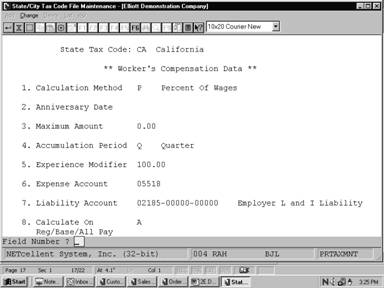

Second Screen

The second screen only appears

for a state code and defines the data necessary to calculate the worker's

compensation premium, as may be shown on the Worker's Compensation Report

(accessible from the Employee Reports application). Since worker's

compensation regulations vary from state to state, the scheme used here is a

fairly general one, which should handle most state's requirements. However, it

is conceivable that some minor programming modifications may be necessary to

handle particular states. See the section of the Package Overview

entitled Worker's Compensation for complete details of how worker's

compensation is handled.

The labor and industry code

section in this manual should also be considered as an alternative to the

general approach used in this section.

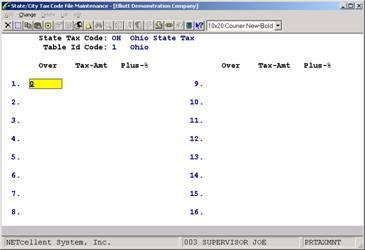

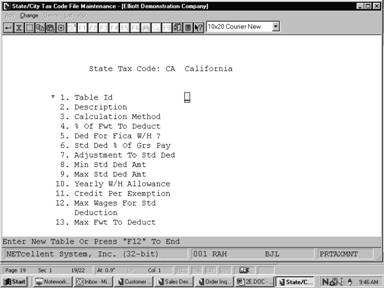

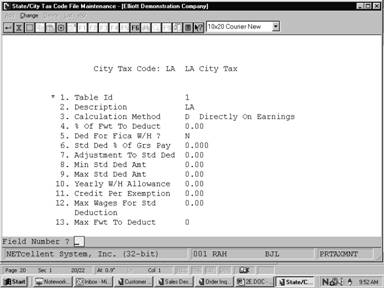

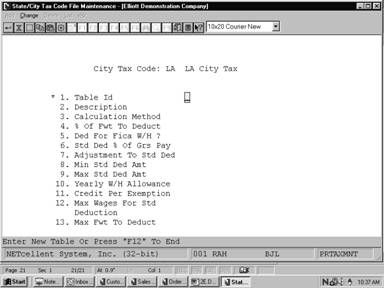

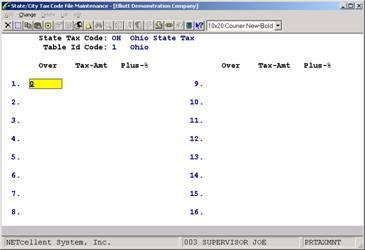

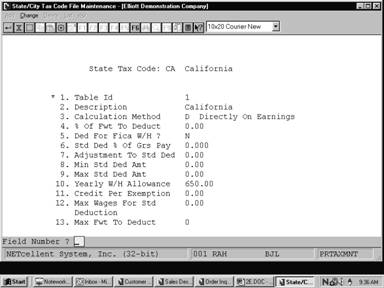

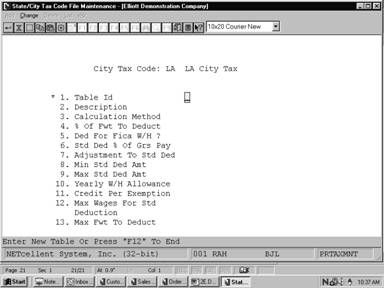

Third And Fourth Screens

These screens appear for both a

state code and city code. They are used to define a method and a table for

calculating state withholding tax or city withholding tax for a given State or

City Tax code.

Any particular State or City Tax

code may have up to 36 different tables associated with it (limited only by the

range of values that can be entered for the one‑character Table Id). In

practice, no state or city will have more than three such tables in order to

cover all possible situations.

Screen 3 defines the method of

calculation for the entered Table ID, as well as several parameters needed for

this calculation.

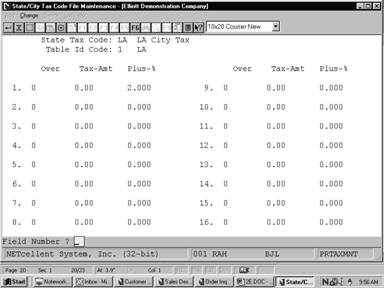

Screen 4 defines a single,

annual, table for this Table Id. The table has the same format as the Federal

Withholding Tables entered in Payroll Setup, except that it allows for

16 entries in the table instead of 8. It is an annual table, just as in the

federal case, and is obtained from the latest State Tax Circular or City Tax

Circular for that state or city.

The calculation methods

available through the scheme used here are very flexible and should adequately

handle all states and cities, with very few exceptions. For examples of how to

use these tables for various states, as well as more details on the calculation

method used see the Package Overview section entitled State and City

Tax Calculations.

Select State/City Tax Code

File from the pull down PR Maintenance window. The following

screen will then be displayed:

State/City Tax Code File Entry Screen

The following options are available:

- Select the desired mode from the State/City Tax Code

File menu bar

- Enter the data requested on the screen

- The worker's compensation screen is only displayed for a

State Tax code. Also, in add mode, when you are at the point of entering

the separate tax tables for the state or city, you will be allowed to

enter as many tables as you wish, until the ESC or F10 key

is pressed in response to the Table ID field.

- In change and delete modes, the tables will be displayed

one after another until all tables have been displayed or until you press

the ESC or F10 key for the Table ID.

- The delete mode works somewhat differently than the delete

mode on a standard file, since each table is contained in a separate

record. After you enter the first two fields on the first screen, the

entire first screen entries for that State or City code will be

displayed. If this is the code you want, you will be asked OK To Delete

This Code?. If you answer Y, then all data associated with this tax

code will be deleted, including all tax tables currently on file. If you

answer N, you will then be asked, Do You Wish To Delete A Table For

This Code? If you answer Y, then the tables for this code will be

displayed in order and you will be asked for each: OK To Delete This

Table? Answer this question Y or N as desired.

- When List option is selected, the program will

print a list of all codes that are on file, including all tables. There

is no selection screen for this function.

To return to the menu bar, press

the ESC or F10 key. To leave this application, press X for

EXIT when positioned at the menu bar.

Entry Field Descriptions

First Screen

|

Name

|

Type

and Description

|

|

1. State Or City?

|

1 alphabetic character.

Valid values are:

S = State

C = City

|

|

2. Tax Code

|

2 alphanumeric characters.

For a state, this should correspond to the usual postal

code for the state (though this is not required).

For a city, it should be some two‑character

abbreviation of the city name.

Press the F7 key to

search for tax code.

|

|

3. Description

|

30 alphanumeric characters.

This would be the full state

or city name.

|

|

4. Tax Rpt Id No

|

15 alphanumeric characters.

This is the number assigned

to the employer by the state or city for purposes of identification on

remittances and tax returns.

|

|

5. Tax Liab Acct

|

An account number in the

standard account number format.

This account is the state (SWT) or city (CWT) taxes

payable account to which posting of the amount withheld occurs.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

6. Supp Earn W/H %

|

5 numeric digits with 3

decimal places (99.999).

Some states and cities allow

an alternative method of calculating withholding tax on supplemental earnings

(such as bonuses, commissions, etc.), which is a flat percentage of the

supplemental earnings amount. If this is the case, enter the percent here.

If zero is entered, then all supplemental earnings will be taxed in the same

way as regular wages.

|

|

7. Tax Ot/Spec Wage As

Suppl Earn?

|

Y or N.

If your state requires that

Ot and special pay, without regular pay, be taxed by the supplemental pay

percentage, answer Yes to this question. If answered Yes and

there is no regular pay, the supplemental, overtime, and special pay will be

added together and the flat percentage rate will be taken.

|

NOTE: Fields 8 through 17 are

requested for state codes only.

|

Name

|

Type

and Description

|

|

8. Sui Percent

|

5 numeric digits with 3

decimal places (99.999).

This is the State

Unemployment Insurance (SUI) percent of taxable wages that the employer is

required to pay. It is not withheld from the employee's salary.

|

|

9. Sui Maximum $

|

8 numeric digits with 2

decimal places (999,999.99).

This is the maximum amount

of places of an employee's wages to which the percent in 7 above applies.

|

|

10. Sui Exp Acct

|

An account number in the

standard account number format.

This should be the main account number for the SUI

expense account. When payroll checks are posted, the SUI amount for each

employee is calculated and this amount is posted as a debit to an expense

account and as a credit to a liability account. The expense account number

is obtained by using this SUI main account number and using the subaccount

number from the for the SUI expense and using the subaccount number of the

employee's wage account, which has been defined in the Employee File.

If you do not wish this automatic posting to occur,

then leave this field blank.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

11. Sui Liab Acct

|

An account number in the

standard account number format.

This is the liability account that counterbalances the

expense account of the previous field. If no entry was made for field 9

above, then this field will be skipped.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

12. Ost Percent

|

5 numeric digits with 3

decimal places (99.999).

Enter the current percent of

taxable gross pay that is required to be withheld from the employee for other

state tax, if any. (An example of this would be State Disability Insurance.)

|

|

13. Ost Maximum $

|

8 numeric digits with 2

decimal places (999,999.99).

This is the maximum amount

of an employee's taxable wages to which the percent in 11 above applies.

|

|

14. Ost Liab Acct

|

An account number in the

standard account number format.

This is the liability

account to which all amounts withheld for OST are posted automatically, during

the posting of payroll checks or manual payroll transactions.

|

|

14. Ost Liab Acct (continued)

|

Pressing the F7 key will allow you to search for

an account by number or pressing the F8 key will allow you to search

for an account by description.

|

|

15. Ost Max Per Pay

|

6 numeric digits with 3

decimal places (999.999).

This is the maximum that can

be deducted from the employee's pay in a given period. If your state does

not have a maximum limit, leave the field blank.

|

|

16. Minimum Wage

|

5 numeric digits with 3

decimal places (99.999).

This field is used for

information purposes only and applies only to states. It is not necessarily

the same as the federal minimum wage that is stored in Payroll Setup.

|

|

17. L and I Code

|

6 alphanumeric characters.

Enter the Labor and Industry

code to be used during calculation of this state tax. If your state does not

use L and I codes, leave the field blank.

|

Second Screen

This screen is only displayed

for state codes and applies solely to worker's compensation for the state.

|

Name

|

Type

and Description

|

|

1. Calculation Method

|

1 alphabetic character.

Valid values are:

H = Hourly

Rates

P = Percent

of Wages

This is the method by which

the worker's compensation premium is calculated on an employee‑by‑employee

basis. Each employee record contains a rate field for worker's

compensation. If the current field is H, this rate represents a

certain number of dollars per hour (or part) worked. If the current field is

P, this rate represents a percentage of the employee's taxable

earnings.

|

|

2. Anniversary Date

|

A date in the standard date

format.

This is the anniversary, or

start date, of the Worker's Compensation Insurance policy for this state.

|

|

3. Maximum Amount

|

8 numeric digits with 2

decimal places (999,999.99).

Some states only require that the worker's compensation

premium be paid on an individual employee's wages or hours up to a maximum.

If this is the case, enter the maximum wages or hours here.

NOTE: Each employee must be specified

individually as being eligible or subject to this amount cut‑off. If

an employee is not so specified, then the premium will be calculated on all

wages or hours anyway.

You specify whether or not an employee is eligible for

this maximum cut‑off in field 43 on screen 1 of the Employee File application.

NOTE:

The period covered by this maximum amount is the same as the accumulation

period defined in the next field.

|

|

4. Accumulation Period

|

1 alphabetic character.

Valid values are:

P = Period

(as defined in this package‑usually a month)

Q = Quarter

Y = Calendar

Year

A = Anniversary

Year

The wages or hours subject

to worker's compensation will be accumulated for each employee in an

accumulator in the Employee File. The current field specifies when and

how this accumulator is to be cleared. If this field is P, Q

or Y, then the accumulator will be cleared whenever the Clear PTD

Totals, Clear QTD Totals, or Clear YTD Totals applications (respectively)

are run. If this field is A, then the user will be allowed to clear

the accumulator when the Worker's Compensation Report is printed, but only if

the current date is on or after the anniversary date, (which is defined in

field 2) and only if the date the accumulators were last cleared was before

the anniversary date in the current year.

|

|

4. Accumulation Period (continued)

|

The Worker's Compensation Report calculates the

premium based on the accumulated wages or hours in the Employee File

application.

|

|

5. Experience Modifier

|

5 numeric digits with 2

decimal places (999.99).

This is a state‑assigned

number and represents a percentage to multiply the calculated worker

compensation premium by, based on past experience of claims by employees, in

order to get the final value of the premium due. This defaults to 100% on

initial entry.

|

|

6. Expense Account

|

Up to 5 alphanumeric

characters.

This field has the same significance as the SUI Expense

Account. This should be the main account number for the Worker's

Compensation expense account.

If it is blank, no automatic posting of the worker's

compensation premium will be done during payroll check posting. Otherwise,

the calculated premium amounts will automatically be posted to the G/L

Distribution file.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

7. Liability Account

|

An account number in the

standard account number format.

This is the credit (liability) account corresponding to

the debit (expense) account in the previous field.

Pressing the F7 key

will allow you to search for an account by number or pressing the F8

key will allow you to search for an account by description.

|

|

8. Calculate On

Reg/Base/All Pay

|

1 alphabetic character.

This field determines if the tax code calculation will

be based on regular pay, all pay at the base rate, or all pay.

Valid entries are:

B = All

Pay Using Base Rate

R = Regular

Pay Only

A = All

Pay(Default)

|

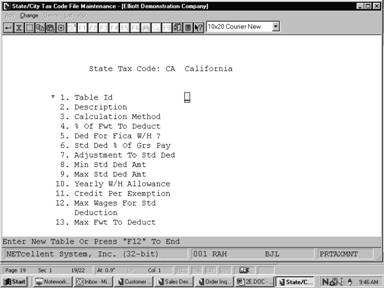

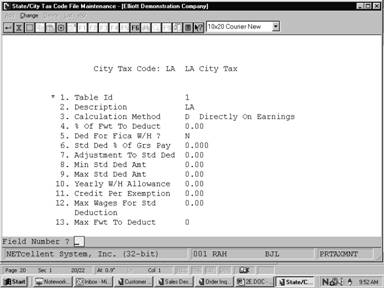

Third Screen

This is one of the two screens

required to fully define one tax calculation method (or table) for a city or

for a state. Withholding taxes are calculated on annual wages, so all amounts

entered here should be the annual amounts allowed.

|

Name

|

Type

and Description

|

|

1. Table Id

|

1 alphanumeric character.

This defines the particular

table within the state or city. The appropriate Table ID is entered into

each employee's record so that the Calculate Payroll application knows

which table it must use for each employee.

|

|

2. Description

|

30 alphanumeric characters.

This is simply a description of the table or method,

such as: Ohio‑Head‑Of‑

Household.

|

|

3. Calculation Method

|

1 alphabetic character.

Valid values are:

D = Directly

on Earnings

P = Percentage

of FWT

S = Percentage

of SWT (applies only to city codes)

O = Other

(applies to Oklahoma state only

Directly on earnings means that the employee's taxable

gross pay is used in conjunction with the state or city tables and percents

to calculate the state withholding tax amount. The Percentage of Federal

Withholding means the state or city withholding tax amount is a percentage of

the federal withholding tax amount, and likewise for Percentage of State

Withholding.

If you have selected O (other) for calculation

method (see State Tax Code: Ok Oklahoma State Tax Table) to load screen 3

and 4 information and ignore the following instructions for screens 3 and 4.

When you enter the state or

city withholding table on the next screen, the percents will be taken on

either taxable earnings or on federal withholding tax or on state withholding

tax, depending on your response here.

|

|

4. % of Fwt to Deduct

|

5 numeric digits with 2

decimal places (999.99).

If the state or city allows

you to adjust an employee's gross pay by a percent of the employee's federal

withholding tax, enter the percent here. It may be 100.00%.

|

|

5. Ded for Fica W/H ?

|

Y or N.

If the state or city allows

you to adjust an employee's gross pay by the amount of FICA withheld, answer Y.

Otherwise, answer N.

|

|

6. Std Ded % Grs Pay

|

6 numeric digits with 3

decimal places (999.999).

If the state or city allows

a standard adjustment to taxable gross pay prior to the calculation of the

tax amount, and if this adjustment is computed as a percent of taxable gross

pay, enter this percentage here. Note that this field has three decimal

places.

|

|

7. Adjustment to Std Ded

|

6 numeric digits with 2

decimal places (9,999.99).

After the percent in field 6

above is applied to the gross pay, this is the annual amount (if any) to

subtract from this calculated amount to get the final standard (annual)

deduction.

|

|

8. Min Std Ded Amt

|

6 numeric digits with 2

decimal places (9,999.99).

If you entered a standard adjustment percent in field

6, and if the state or city furthermore specifies a minimum adjustment

amount, enter that amount here. This must be the annualized amount in cases

where there is a choice of amounts, depending on the length of the pay

period.

If, during the calculation

of the employee's taxable gross pay, the program determines that the

adjustment to gross pay resulting from the standard percent is less than this

minimum amount, then this minimum standard deduction amount will be used

instead.

|

|

9. Max Std Ded Amt

|

6 numeric digits with 2 decimal

places (9,999.99).

Same as for field 8 above,

except this is the maximum adjustment amount the state or city will allow.

Again, it must be the annual value.

|

|

9. Max Std

Ded Amt (continued)

|

NOTE: If your state or city uses a fixed adjustment amount, then enter

this amount for both the minimum and the maximum.

|

|

10. Yearly

W/H Allowance

|

6 numeric digits with 2 decimal places (9,999.99).

This is the value of a single withholding exemption. If the employee

record has a dollar amount for the Exemptions for SWT or CWT (rather than a

number), it is this dollar amount that is used for the allowance, as is, and

the number in the current field of this state or city table is ignored.

|

|

11. Credit

Per Exemption

|

5 numeric digits with 2 decimal places (999.99).

After the annual SWT or CWT has been calculated using the above field,

and the table in the next screen, this field is multiplied by the number of

exemptions for SWT or CWT as specified on the employee record, and the result

is subtracted from the annual tax to arrive at the final annual withholding

tax value. If a dollar amount rather than a number was entered for the SWT

or CWT exemptions on the employee record, or a non‑zero tax credit

amount was entered there, then this field is ignored.

|

|

12. Max Wages For Std

Deduction

|

4 numeric digits (9,999).

*This applies to Oklahoma state only.

|

|

13. Max Fwt

To Deduct

|

7 numeric digits with 2 decimal places (99,999.99).

If your state permits deduction of Federal Taxes from annual wages,

the amount entered here will be the maximum amount of Federal Tax to be

deducted from your employees annual wages prior to state withholding tax

calculations. For example, if a given employee has annual wages of

$15,000.00 and the Federal Withholding Tax is $1500.00, then his annual base

pay would be $13,500.00.. (ie 15,000.00-1500=13,500.00).

|

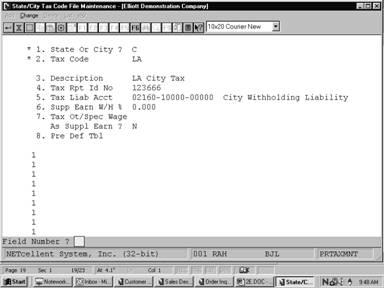

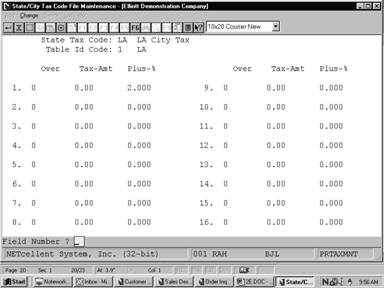

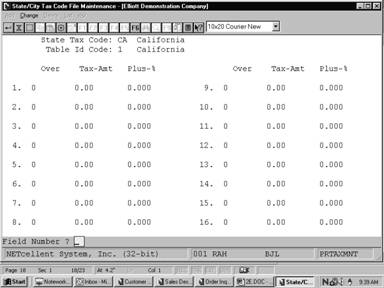

Fourth Screen

This is the actual

table used to calculate the withholding tax, after the employee's annual

taxable wages have been calculated. It is in the same format as the tables

used to calculate federal withholding tax on the Payroll Setup, but has

16 lines instead of 7 lines. The significance of each value entered is the same

as that for the corresponding values on the federal tables.

The first field of the first line should always be

zero. If the table uses less than 16 lines, enter zero for all values on all

unused lines.

|

Date

filled out __________ by ___________ ADD CHANGE DELETE

Page

1 of 4

STATE/CITY TAX CODES FILE MAINTENANCE LOAD SHEET

1.

State or City _ S = State C = City

2.

Tax Code _ _

3.

Description

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4.

Tax ID Number _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

5.

Tax Liability Acct _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ - _

_ _ _ _ _ _ _

6.

Supplemental Earn

W/H % _ _ . _ _ _

7.

Tax Ot/Spec Wage

As Suppl Earn ? _

8.

SUI Percent _ _ . _ _ _

9.

SUI Max Dollars _ _ _ , _ _ _ . _ _

10.

SUI Expense Acct _ _ _ _ _ _ _ _

11.

SUI Liability Acct _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ - _

_ _ _ _ _ _ _

12.

Other State Tax % _ _ . _ _ _

13.

Other State Tax

Max Dollars _ _ _ , _ _ _ . _ _

14.

Other State Tax

Liability Acct _ _ _ _ _ _ _ _ - _ _ _ _ _ _ _ _ - _ _ _ _ _ _

_ _

15.

OST Maximum Per Pay _ _ _._ _ _

16.

Minimum Wage _ _ . _ _ _

17.

L and I Code _ _ _ _ _ _

|

|

Date

filled out __________ by ___________ ADD CHANGE DELETE

Page

4 of 4

STATE/CITY TAX CODES FILE MAINTENANCE LOAD SHEET

TABLE SCREEN II

OVER TAX AMOUNT PERCENT OF EXCESS

1.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

2.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

3.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

4.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

5.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

6.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

7.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

8.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

9.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

10.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

11.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

12.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

13.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

14.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

15.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

16.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

Date

entered _______ by _______ Date verified ________ by ________

|

|

Date

filled out __________ by ___________ ADD CHANGE DELETE

Page

3 of 4

STATE/CITY TAX CODES FILE MAINTENANCE LOAD SHEET

TABLE SCREEN I

1.

Table ID _

2.

Description

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3.

Calculation Method _ D = Directly on Earnings

P = Percent of FWT S = Percent of SWT

4.

% of FWT to Deduct _ _ _ . _ _

5.

Deduction for FICA

W/H? _ Y or N

6.

Standard Deduction

%

of Gross Pay _ _ _ . _ _ _

7.

Adjustment to

Standard Deduction _ _ _ _ . _ _

8.

Minimum Standard

Deduction Amount _ _ _ _ . _ _

9.

Maximum Standard

Deduction Amount _ _ _ _ . _ _

10.

Yearly W/H

Allowance _ _ _ _ . _ _

11.

Credit Per

Exemption _ _ _ . _ _

12.

Maximum Wages for

STD Deduction _ _ _ _

13.

Maximum FWT to

Deduction _ _ , _ _ _ . _ _

|

|

Date

filled out __________ by ___________ ADD CHANGE DELETE

Page

4 of 4

STATE/CITY TAX CODES FILE MAINTENANCE LOAD SHEET

TABLE SCREEN II

OVER TAX AMOUNT PERCENT OF EXCESS

1.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

2.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

3.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

4.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

5.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

6.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

7.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

8.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

9.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

10.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

11.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

12.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

13.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

14.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

15.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

16.

_ _ _ , _ _ _ _ _ , _ _ _ . _ _ _ _ . _ _ _

Date

entered _______ by _______ Date verified ________ by ________

|

Load Sheet

Screens Screens

State/City

Tax Code File (State- Screen #1)

State/City

Tax Code File (State- Screen #2)

State/City Tax Code File (State-State Screen #3)

State/City Tax Code File (State-State Screen #4)

State/City Tax Code File (State-Screen # 5)

State/City Tax Code File (City-Screen # 1)

State/City Tax Code File (City-Screen # 3)

Screens

State/City Tax Code File (City-Screen # 4)Screens

State/City Tax Code File

(City-Screen #5)ScreensScreens

S T A T E / C I T Y T A X C O D E S F I L E P R I N T ‑ O U T

**

City Tax Codes **

City

Tax Code: CL Columbus

Tax

Rpt Id No 123444

Tax

Liab Acct 02160‑00000‑00000 City Withholding Liability

Supp

Earn W/H % .00 Tax Ot/Spec As Supp? N

City Tax Code: CL

Table Id: 1 Description Columbus

OVER TAX‑AMT PLUS‑%

Calculation Basis D Directly On Earnings

% Of Fwt To Deduct .00 0

.00 2.000

Ded For Fica W/H? N 0

.00 .000

Std Ded % Of Grs Pay .000 0

.00 .000

Adjustment To Std Ded .00 0

.00 .000

Min Std Ded Amt .00 0 .00

.000

Max Std Ded Amt .00 0

.00 .000

Yearly W/H Allowance .00 0

.00 .000

Credit Per Exemption

.00 0 .00 .000

Max Wages For Std .00 0

.00 .000

Deduction 0

.00 .000

Max Fwt To Deduct 0 0

.00 .000

0 .00 .000

0 .00 .000

0 .00 .000

|