|

|

ProcessingTime Transaction ProcessingApplication Overview

Time Transaction Processing will utilize an employee's regular hours or salary; overtime, special hours, vacation, holiday and sick hours; supplemental income; temporary deductions and earnings; number of advanced vacation weeks; and number of weeks worked to generate a transaction that represents how much the employee will get paid on his check. Once entered, transactions may be displayed for inquiry, changed or deleted from the file. An edit list showing transactions in order by employee number within department may be printed. A worksheet listing employees due for payment, for selected pay frequencies, may be printed. The user may also generate time transactions automatically for employees whose pay is not normally distributed in detail to different wage accounts.

1. ADD provides for the entry of employee time transactions and, if needed, distributions.

2. CHANGE provides for the modification of time transactions and distributions.

3. DELETE provides for the deletion of time transactions and distributions.

4. NUM_LIST prints out a numerical list of the time transactions and distributions on file. The numerical listing is printed automatically by employee number within their respective home department number. Distributions will only be printed if Payroll Setup indicates A (always) or S (selectively) distribute wages.

5. ALPHA_LIST prints out an alphabetical list of the time transactions and distributions on file. The listing is printed automatically by employee name within their respective home department number. Distributions will only be printed if Payroll Setup indicates A (always) or S (selectively) distribute wages.

6. PRINT WORKSHEET prints out a worksheet of employees by employee number, employee name, or employee number within department number.

7. GENERATE creates time transactions for employees whose pay is not manually distributed to G/L accounts and their employee status is A for active.

8. LABELS will print labels for employee time cards which will include pay period ending date, employee name, employee number, the employee's department, and a place for the employee's signature.

Add, Change, and Delete

In change mode, answering Y to the Right Trx? question will allow change for the transaction. If the transaction has associated distributions and no changes have been made to the salary, regular hours, overtime hours, special hours, supplemental pay, vacation hours, sick hours, or holiday hours, then the question Do You Wish To Change Distributions? will be asked.

When distributing pay, the operator may enter multiple transactions for the same account and job. This relieves the operator of the responsibility for manually calculating in advance the totals for each combination of account and job.

All entries are made on the top distribution line. When complete, the entry rolls down to the second line. Exit from distribution entry is not allowed until all amounts have been fully distributed, or the entire entry of the Time Transaction is aborted and deleted!

The operator may review previous entries at any time by pressing the F1 key while positioned for entry of the distribution type. Doing this the first time (after at least one entry has been made) will locate and display the first distribution entered and allow the amount to be changed. Entering zero for the amount deletes the distribution. Pressing the F1 key again will display the next distribution on file and so forth. Users may find it helpful to differentiate wage accounts by profit center designation and make each payroll expense department a separate profit center. Thus, when employees work in other than their home departments, the wage accounts to which the employee's hours or salary are distributed would be for those departments. Only in this manner can departmental payroll expenses be accurately determined. The PR Distribution to G/L Report can be used to evaluate these expenses prior to the availability of financial statements for the period.

If an employee is flagged for shift differential distributions in the Employee File, the user will have the option of entering a shift code during entry of distributions. This code will calculate differences in pay rates between shifts. For more information on shift codes, refer to the Shift Code File Maintenance section of this manual.

If your state uses Labor and Industry codes for calculating employee contributions to worker's compensation, the user may enter an L and I code following each distribution. This code will calculate the employee and employer L and I premiums for the distribution based on information entered in the L And I Code File Maintenance application. For more information, refer to that section of this manual.

For restaurants, reported tips must be entered as temporary earnings. Tip credits are defined, for purposes of this Payroll package, as the allowable amounts permitted the employer as a credit against the reported tips. This credit is used to meet the federal minimum wage requirement. The allowable tip credit will be the lesser; of the maximum percentage of the federal minimum wage (this percentage is kept in Payroll Setup) times the hours worked, or reported tips.

If the employee does not meet the federal minimum wage requirement the calculate program will automatically generate the excess pay needed for the employee to meet federal minimum wage requirements. A warning message will appear on the payroll register which indicates the calculated excess pay.

Restaurants, in some states, may utilize a portion of the employee's reported tips to meet minimum wage. For that portion so utilized, the employer must contribute FICA and may have to contribute unemployment tax as well. The amount utilized must not exceed the state‑determined maximum allowable tip credit and must also not exceed the amount of tips that the employee reported.

Quarter‑to‑date and year‑to‑date tips, tip credits, and excess pay are stored in the employee file.

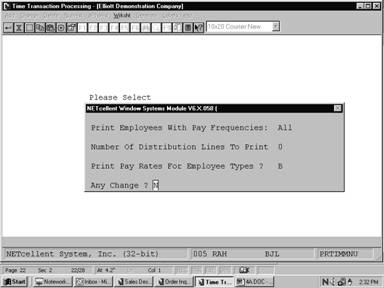

Print Attendance Entry Worksheet

The Payroll Attendance Entry Worksheet is designed to assist payroll personnel with the preparation of the payroll. It provides a list of employees for selected pay frequencies with room on the report for calculations and the entry of final amounts. Generate Standard Payroll

This program generates standard time transactions, which may be edited like any others. If wage account distribution has been selected as Always (in the Payroll Setup application) or if there are existing transactions on file then this program cannot be run.

NOTE: Commissions, bonuses, etc. may be paid to an employee by entering an amount in the Supplemental Earnings field on the Time Transaction Processing screen. If any other type of pay is included on the same Time Transaction record, then all pay for this time transaction will be taxed in the usual way. However, if the time transaction contains only supplemental earnings, then a separate tax rate (specified in Payroll Setup for Federal, and the State/City Tax Code File for states and cities) can be used for the supplemental earning. If the Tax OT/SPEC Wage As Suppl Earn? question is answered Y and there is only supplemental, overtime, or special pay or any combination of the three without regular pay, the separate tax rate for state will be used to calculate taxes.

No matter what the employee's regular pay frequency is, the number entered in the Number of Weeks Advance Vacation field always refers to a full week of vacation. To give advance vacation pay corresponding to a time period other than a week, you must calculate number of hours and enter it in the Vacation Hours field. This vacation pay will then not appear on a separate check (as does an advance vacation week).

Run Instructions

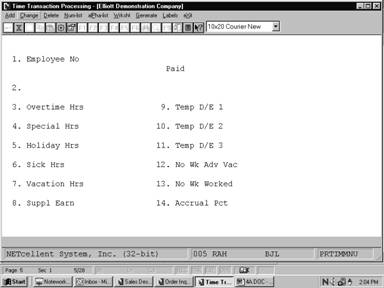

Select Time Transaction Processing from the pull down PR Processing window. The following screen will then be displayed:

Time Transaction Processing Entry Screen

The following options are available:

* Select the desired mode from the Time Transaction Processing menu bar

* Enter the data requested on the screen

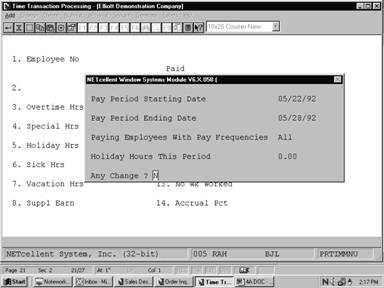

* In Time Transaction add mode you must first enter the pay period ending date, select which frequencies are applicable for this pay period and enter the number of holiday hours (if any) to take for this pay period. The pay period ending date will remain on file in the PR Setup until the checks have been printed and posted. You may end at this point by pressing the ESC or F10 key for the pay period ending date.

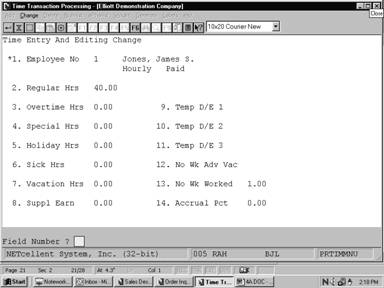

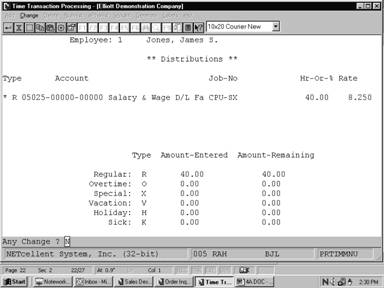

* The distribution of hours and salary will be processed on either of the following conditions: (a) in PR Setup, Distribute Pay To G/L is A (always distribute); (b) in PR Setup, Distribute Pay To G/L is S (selectively distribute), and in the employee's record Distribute is Y or S. Job number distribution will also be allowed if selected as an option in PR Setup. After entering the individual employee information on the screen, the distributions for the hours will be processed on a separate screen. When the total amount of hours or percentage of salary and supplemental pay remaining to distribute are equal to zero then press the ESC or F10 key when the cursor is positioned for entry of the distribution type.

* In Time Transaction add mode, pressing the F1 key when the cursor is positioned for entry of the employee number will bring up the next hourly or salaried (non‑terminated) employee on file within the range of frequencies entered.

* In Time Transaction change or delete mode, pressing the F1 key when the cursor is positioned for entry of the employee number will bring up the next transaction on file in sequential order. Only one transaction is allowed per employee. Changes are allowed to all fields except the employee number. * To Generate time transactions, enter the pay period starting and ending dates and select the pay frequencies applicable for this pay period. The pay period dates will remain on file in Payroll Setup until payroll checks have been printed and posted. Enter the number of holiday hours to be taken on every employee's time transaction.

* If Payroll Setup has selective (S) distribution selected, then the employees on file who have not been selected for distribution and are eligible will be processed. Otherwise, if no distribution has been selected in Payroll Setup, all eligible employees on file will be processed. An eligible employee is one who is either hourly or salary on the Employee File, not terminated, is an "A" status, and has a pay frequency matching one of the pay frequencies entered.

* NOTE: If there are no employees on file for the selected pay frequencies then an error message is displayed and re‑entry of the requested data is permitted.

After the requested data is entered, the question Are You Sure? is asked and a response is needed in order to continue processing.

To return to the menu bar, press the ESC or F10 key. To leave this application, press X for EXIT when positioned at the menu bar.

Entry Field Descriptions

Preliminary Screen of Add Mode

First Screen

Fields 9, 10 and 11

These are one‑time deductions and earnings. An employee's reported tips, and meals given the employee would customarily be entered here because the amount of tips or meals would vary from week to week. Any other deduction or earning that occurs non‑periodically or for varying amounts would qualify as a temporary deduction/earning.

The code entered must be defined in the Deduction/Earning Code file application. The code's description will display beside the code to allow operator verification of the entry. Pressing the ESC key while positioned for entry of the amount will clear the line and allow re‑entry of the code.

Distribution Screen

Worksheet

Generate

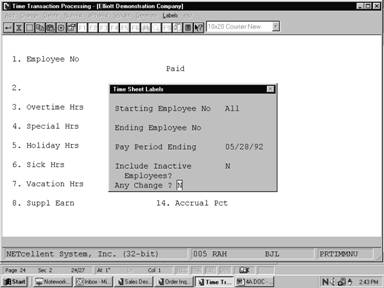

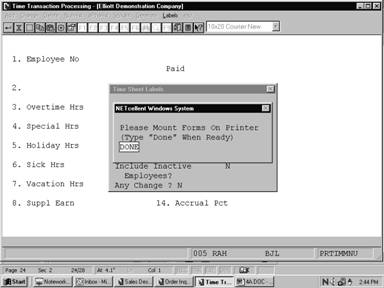

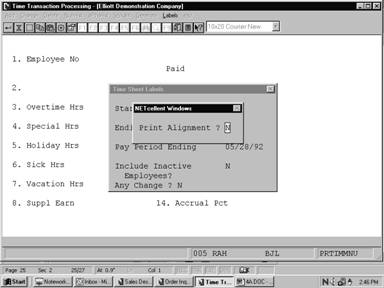

Labels

Time Transaction Processing

Time Transaction Processing

Time Transaction Processing (Distribution)

Time Transaction Processing (Worksheet)

Time Transaction Processing Worksheet

Time Sheet Labels (Screen # 1)

Time Sheet Labels (Screen # 2)

Time Sheet Labels

P A Y R O L L T I M E E D I T L I S T

For The Pay Period Ending 10/06/89

Employee Types: H = Hourly S = Salary Pay Frequencies: D = Daily W = Weekly B = Bi‑Weekly S = Semi‑Monthly M = Monthly Q = Quarterly Distribution Types: S = Salary % R = Regular Hours O = Overtime Hours X = Special Hours P = Supp Pay H = Holiday Hours V = Vacation Hours S = Sick Hours

‑‑‑‑‑‑‑‑‑Hours‑‑‑‑‑‑‑‑‑‑ Dept Emp Name Salary Regular Special Sick ‑‑‑‑Temp‑Ded/Earn‑‑‑‑ Vac Wks Adjust No No Soc‑Sec‑No Type Wage‑Acct Freq Supp‑Earn Ovrtime Holiday Vac Desc Type Amount Wks Wrk Sal?

A 1 Jones, James S. .00 40.00 .00 .00 1.00 989‑03‑9231 H 05025‑00000‑00000 W .00 .00 .00 .00

Distribution: Type Account‑No Hrs‑% Rate Job‑No R 05025‑00000‑00000 Salary & Wage D/L Fabrication 40.00 8.250 SCHOOL School Desks for District

3 Salary, Fred F. 800.40 .00 .00 .00 1.00 Y 555‑44‑5252 S 05025‑00000‑00000 W .00 .00 .00 .00

Distribution: Type Account‑No Hrs‑% Rate Job‑No S 05025‑00000‑00000 Salary & Wage D/L Fabrication 100.00 ARMY U.S. Army ‑ Custom Tables

2 Entries Department Totals: 40.00 .00 1 Hourly .00 1 Salary .00 .00 .00 ‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

B 2 Smith, Sally .00 30.00 .00 .00 1.00 323‑46‑7373 H 05030‑00000‑00000 W .00 .00 .00 .00

Distribution: Type Account‑No Hrs‑% Rate Job‑No R 05030‑00000‑00000 Salary & Wage D/L Machine Shop 30.00 6.500

P A Y R O L L T I M E E D I T L I S T

For The Pay Period Ending 10/06/89

Employee Types: H = Hourly S = Salary Pay Frequencies: D = Daily W = Weekly B = Bi‑Weekly S = Semi‑Monthly M = Monthly Q = Quarterly Distribution Types: S = Salary % R = Regular Hours O = Overtime Hours X = Special Hours P = Supp Pay H = Holiday Hours V = Vacation Hours S = Sick Hours

‑‑‑‑‑‑‑‑‑Hours‑‑‑‑‑‑‑‑‑‑ Dept Emp Name Salary Regular Special Sick ‑‑‑‑Temp‑Ded/Earn‑‑‑‑ Vac Wks Adjust No No Soc‑Sec‑No Type Wage‑Acct Freq Supp‑Earn Ovrtime Holiday Vac Desc Type Amount Wks Wrk Sal?

A 1 Jones, James S. .00 40.00 .00 .00 1.00 989‑03‑9231 H 05025‑00000‑00000 W .00 .00 .00 .00

Distribution: Type Account‑No Hrs‑% Rate Job‑No R 05025‑00000‑00000 Salary & Wage D/L Fabrication 40.00 8.250 SCHOOL School Desks for District

3 Salary, Fred F. 800.40 .00 .00 .00 1.00 Y 555‑44‑5252 S 05025‑00000‑00000 W .00 .00 .00 .00

Distribution: Type Account‑No Hrs‑% Rate Job‑No S 05025‑00000‑00000 Salary & Wage D/L Fabrication 100.00 ARMY U.S. Army ‑ Custom Tables

2 Entries Department Totals: 40.00 .00 1 Hourly .00 1 Salary .00 .00 .00 ‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑‑

B 5 Cook, Brad M .00 40.00 .00 .00 1.00 008‑39‑3931 H 05010‑00000‑00000 W .00 .00 .00 .00

P A Y R O L L A T T E N D A N C E E N T R Y W O R K S H E E T

Worksheet In Order By Employee No For The Pay Period Ending ........

Employee Types: H = Hourly S = Salary N = Non‑Employee Pay Frequencies: D = Daily W = Weekly B = Bi‑Weekly S = Semi‑Monthly M = Monthly Q = Quarterly

Dept Emp Name Sal? Reg Ovt Spcl Hol Sick Vac Supp Wks Wks Temporary No No Soc‑Sec‑No Type Pay‑Freq Adj? Hrs Hrs Hrs Hrs Hrs Hrs Earn Vac Wrk Ded/Earnings

A 1 Jones, James S. Y N ...... ...... ...... ...... ...... ...... ...... ... ...... ... ........ 989‑03‑9231 H W Y N ... ........ Pay Rates: Reg 8.250 Ot 12.375 Spec 16.500 ... ........

B 2 Smith, Sally Y N ...... ...... ...... ...... ...... ...... ...... ... ...... ... ........ 323‑46‑7373 H W Y N ... ........ Pay Rates: Reg 6.500 Ot 9.750 Spec 13.000 ... ........

A 3 Salary, Fred F. Y N ...... ...... ...... ...... ...... ...... ...... ... ...... ... ........ 555‑44‑5252 S W Y N ... ........ Pay Rates: Reg 20.010 Ot 30.015 Spec 40.020 ... ........

B 4 Meddles, Shari B Y N ...... ...... ...... ...... ...... ...... ...... ... ...... ... ........ 673‑09‑2882 H W Y N ... ........ Pay Rates: Reg 5.750 Ot 8.625 Spec 11.500 ... ........

B 5 Cook, Brad M Y N ...... ...... ...... ...... ...... ...... ...... ... ...... ... ........ 008‑39‑3931 H W Y N ... ........ Pay Rates: Reg 4.500 Ot 6.750 Spec 9.000 ... ........

Pay Period: 10/06/89 Employee#: 0001 Dept: A Name: Jones, James S. Signed: _________________________

Pay Period: 10/06/89 Employee#: 0002 Dept: B Name: Smith, Sally Signed: _________________________

Pay Period: 10/06/89 Employee#: 0003 Dept: A Name: Salary, Fred F. Signed: _________________________

Pay Period: 10/06/89 Employee#: 0004 Dept: B Name: Meddles, Shari B Signed: _________________________

Pay Period: 10/06/89 Employee#: 0005 Dept: B Name: Cook, Brad M Signed: _________________________

|