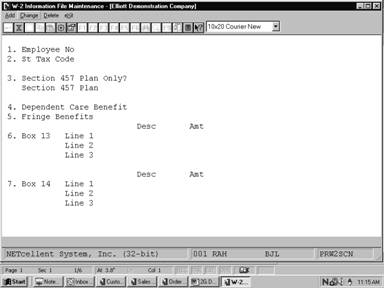

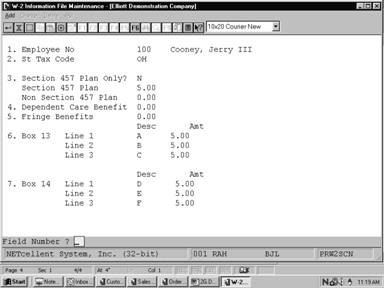

The W-2 Information File

Maintenance application should be run at the end of the year.

This application allows the user

to control what amounts are printed in Boxes 7, 14, 15, 16, 17 and 18 on the

W-2 Form for each employee. Box 7 is used if you have answered the restaurant

flag in PR Setup as Y.

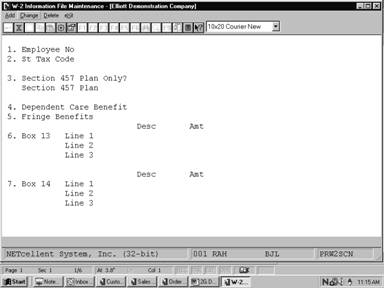

Select W-2 Information File

from the pull down PR Maintenance window. The following screen

will then be displayed:

W-2 Information File Maintenance Entry Screen

The following options are available:

* Select the

desired mode from the W-2 Information File menu bar

* Enter the data requested on the

screen To return to the menu bar, press the ESC or F10 key.

To leave this application,

press X for EXIT when positioned at the menu bar.

Entry Field Descriptions

|

Name

|

Type

and Description

|

|

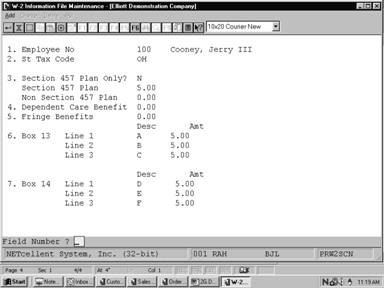

1. Employee No

|

4 numeric digits (9999).

The employee number cannot be zero.

The employee's name will be displayed to the right of

this field.

In add, change and delete

mode, press the F7 key for employee search by number or press the F8

key for employee search by name.

|

|

2. St Tax Code

|

2 alphanumeric characters.

This state tax code must be on the employee's record or

the employee's multi state tax record to be valid. This field cannot be left

blank.

Pressing the F1 key

will display the valid state tax codes one at a time.

|

|

3. Section 457 Plan Only ?

|

Y or N.

Answer whether or not the

distribution to your employee was solely from a section 457 plan or also from

a non-section 457 plan.

|

|

Section 457 Plan

|

8 numeric digits with 2

decimal places (999,999.99).

Enter the amount of the

distribution from a section 457 plan.

|

|

Non-Section 457 Plan

|

8 numeric digits with 2

decimal places (999,999.99).

Enter the amount of the

distribution from a non-section 457 Plan. This field will only appear if

field #3 is set to N.

|

|

4. Dependent Care Benefit

|

8 numeric digits with 2

decimal places (999,999.99).

Enter the total amount of

dependent care benefits under section 129 paid or incurred by you for your

employee including any amount in excess of the $5000 exclusion. This

information will print in Box 15 on the W-2 Form.

|

|

5. Fringe Benefits

|

7 numeric digits with 2

decimal places (99,999.99).

Enter the dollar amount of

fringe benefits received by the employee for the year. This field will

default to the total amount of "Allowance" type permanent

deduction/earning codes. This information will print in Box 16 on the W-2

Form.

|

|

6. Box 17

Line

1

Line

2

Line 3

|

1 alphanumeric character.

The valid descriptions are:

A - Uncollected

social security tax on tips

B - Uncollected

Medicare tax on tips

C - Cost

of group-term life insurance coverage over $50,000

D - Section 401(k) contributions

E - Section 403(b) contributions

F - Section

408(k)(6) contributions

G - Section

457 contributions

H - Section

501(c) contributions

J - Sick

pay not includible as income

K - Tax

on excess golden parachute payments

L - Nontaxable

part of employee business expense reimbursements rates

M - Uncollected social security tax on

cost of group-term life insurance

over $50,000 (former employers only)

N - Uncollected Medicare tax on cost

of group-term life insurance

coverage over $50,000 (former employers only)

The amounts for codes B and

D will be automatically calculated and displayed to the screen.

|

|

Desc

|

1 alphanumeric character.

3 description fields.

|

|

Amt

|

8 numeric digits with 2

decimal places (999,999.99).

3 amount fields.

|

|

7. Box 18

Line

1

Line

2

Line 3

|

5 alphanumeric characters.

Enter the description and

amount for each of the three lines. This box is for any other information

you wish to provide to your employee or any information that may be required

by an individual state, such as OST. Amounts for OST will be automatically

calculated and displayed to the screen.

|

|

Desc

|

5 alphanumeric character.

3 description fields.

|

|

Amt

|

7 numeric digits with 2

decimal places (99,999.99).

3 amount fields.

|

|

8. Allocated Tips

|

7 numeric digits with 2

decimal places (99,999.99).

Enter the dollar amount of the tips to be allocated to

this employee.

A response to this question will only be requested if

the employer has been indicated as a restaurant in Payroll Setup. If

the employer is not a restaurant, this field will not be displayed. This

information will print in Box 7 on the W-2 Form.

NOTE: A

maximum of three entries are supported for W-2 box 17 and 18. If your

organization requires more than three entries for these boxes you must issue

a type written W-2 form for the additional entries to the employee. Also, if

you are entering information for a secondary state, you will be allowed to

enter information for box 18 only.

|

Screens

W-2 Information File

Maintenance

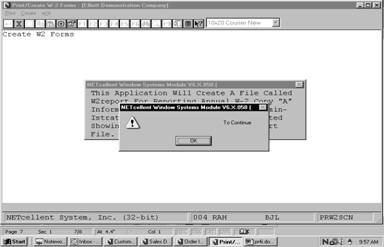

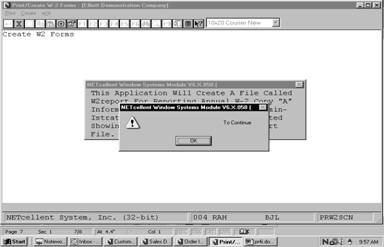

Print/Create W-2 Forms application should be run at

the end of the year. It provides all necessary income and withholding

information on standard W‑2 forms.

The program will also allow the

user to generate the (SSA) copy "A" information required by the

Social Security Administration on magnetic media. A file named W2REPORT will

be created which can be copied to a diskette and sent to the SSA. For more

information on magnetic media reporting please read the booklet provided by the

SSA titled "Diskette Reporting" Submitting Annual W‑2

Copy A Information to the Social Security Administration.

Even though the government does

not require that a subtotal form be printed if less than 41 forms are printed,

the program does print it.

If the printer runs out of forms

while printing, put some plain paper on the printer and let it finish the run.

Then go back and find the last subtotal form that was successfully printed and

reprint all W‑2 forms from that point on.

If you have used multiple state

or city tax codes for an employee, the information for the second state and/or

city will print on the first W-2 Form. Any additional state and/or city

information will be printed for each tax code following the federal forms. The

state or city W-2 Form contains only state or city tax information. The form

does not contain any federal tax information.

The federal W-2 Form will

contain the default employee state and city tax information.

A thorough understanding of the

capabilities and purpose of the W-2 Information File Maintenance section

of this manual is necessary prior to proceeding with Year-End W-2 Processing.

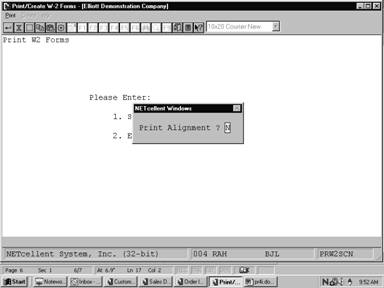

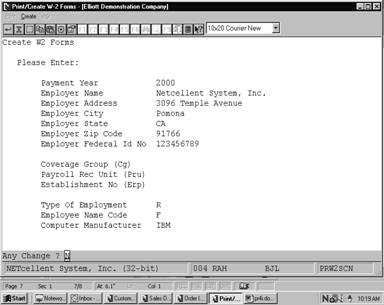

Select Print/Create

W-2 Forms from the pull down P/R Processing window. The

following screen will then be displayed:

Print/Create W-2 Forms Entry

Screen

The following options are available:

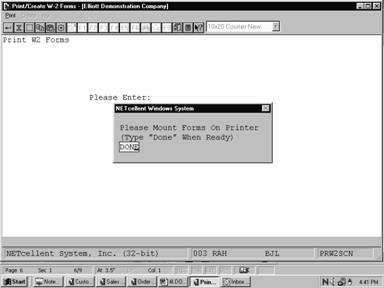

* Select

the desired mode from the Print/Create W-2 Forms menu bar

* Enter

the data requested on the screen

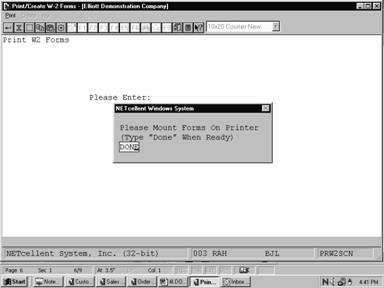

* If

you select Print W‑2 Forms, you will be requested to: Please Mount W‑2

Forms On Printer. Mount the forms on the printer. The forms we require come

two pairs to a page with a page having the same dimensions as standard computer

paper. The form must be mounted so that printing begins with the first pairs

of forms on the page. (A subtotal form will be printed every 42nd form. The

IRS requires that this form be at the bottom of the page. The program will

comply with this requirement if the forms are mounted properly.) Type: DONE

when this has been done.

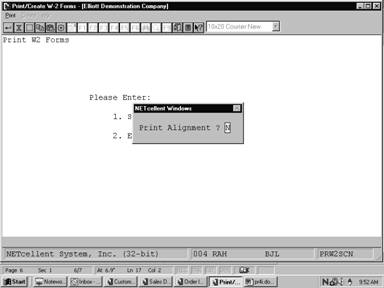

* Print

as many alignment forms as necessary for the forms to be properly aligned. One

full page of forms will print for each alignment; this is two pairs of W‑2

forms.

* If

you select Create SSA Copy "A” W‑2 File, you will need to

answer a number of questions that will be reported to the SSA.

* Enter

the starting and ending employee numbers.

* You

may exit the program by pressing the ESC or F10 key while

positioned for entry of the starting employee number. The program returns to

the Payroll menu.

To return to

the menu bar, press the ESC or F10 key. To leave this

application, press X for EXIT when positioned at the menu bar.

Entry Field Descriptions

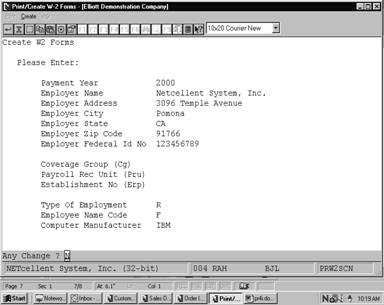

Create SSA Copy "A" W‑2

File

|

Name

|

Type

|

Description

|

|

Payment Year

|

4 alphanumeric characters.

|

This should be the year that the W‑2 information

is being reported to the SSA.

|

|

Employer Name

|

44 alphanumeric characters.

|

This should be the reporting companies name.

|

|

Employer Address

|

35 alphanumeric characters.

|

This should be the street address of the reporting

company.

|

|

Employer City

|

20 alphanumeric characters.

|

Enter the reporting companies city.

|

|

Employer State

|

2 alphabetic characters.

|

Enter the 2 letter postal state code for the state.

|

|

Employer Zip Code

|

5 alphabetic characters.

|

Enter the zip code for the reporting company.

|

|

Employer Federal Id Number

|

9 alphanumeric characters.

|

Enter the reporting company's federal ID number. You

will not need to enter the hyphens.

|

|

Employer 69 Number

|

9 alphanumeric characters.

|

Enter the numeric portion of the reporting company's 69

number only if the company is a section 218 state/local entity.

|

|

Coverage Group (Cg)

|

1 alphanumeric character.

|

Enter the CG number if the reporting company is a

state/local section 218 entity.

|

|

Payroll Rec Unit (Pru)

|

3 alphanumeric characters.

|

Enter the PRU number if the reporting entity is a

state/local section 218 reporting entity.

|

|

Establishment No (Erp)

|

4 alphanumeric characters.

|

Enter the ERP number of the reporting entity if the

company has submitted to the SSA a plan of locations, industrial activities,

etc..

|

|

Limitation of Liab Ind

|

1 alphabetic character.

|

The valid entry is L if the reporting entity is a

section 218 state/local entity.

|

|

Type of Employment

|

2 alphabetic characters.

|

Enter the type of entity

that is being reported to the SSA.

The valid entries are:

R = Regular

A = Agriculture

H = Household

M = Military

Q = Medicare Qualified

Government Employment

X =

Railroad

|

|

Employee Name Code

|

1 alphabetic character.

|

The valid entries are:

F = Employee First name first

S = Employee Surname first

Depending on how the names

appear of the W‑2 will determine how this field is set.

|

|

Computer Manufacture

|

8 alphanumeric characters.

|

Enter the name of the manufacture of the computer

system that the copy "A" information is generated on. i.e. IBM,

Compaq, ETC..

|

Print W‑2 Forms

|

Name

|

Type

|

Description

|

|

1. Starting Employee No.

|

4 numeric digits (9999)

|

Enter the staring employee number in the range you want

to print, or press RETURN to default to All employees.

|

|

2. Ending Employee No.

|

4 numeric digits (9999)

|

Enter the ending employee number in the range you want

to print. It you entered RETURN above, this field will be skipped.

|

Create Year-End W-2 Forms

Create Year-End W-2 Forms

Print/Create W-2 Forms

Emp# 1 Emp# 1

Elliott

Demo Company 12345678901 Elliott Demo

Company X

3096

Temple Ave. 3096 Temple

Ave

Pomona,

CA 91766 11111111111 989‑03‑9231

Pomona, CA 91766

X 322.05 2513.60

322.05 2513.60 12345678901 11111111111

192.29 2513.60

192.29 2513.60 989‑03‑9231

12345

James

S. Jones 150.00 James S.

Jones 150.00

123

Ohio Street

Columbus

OH 123 Ohio Street

43215‑8910 D 6.00 Columbus OH

D 6.00

43215‑8910

47.04 2513.60 OH 43.26 2513.60 CL 47.04

2513.60 OH 43.26 2513.60 CL

CA CO

CA CO

W ‑ 2 C O P Y " A " F I L E R E P O R T

Emp# Fica‑Wages Fica‑Tips Fwt‑Wages Fica E‑I‑C

Fwt Alloc‑Tip Insurance Pen Def Deferred Fringe

Dep Care Ben 457 Dist Not 457

Dist Comp Comp‑Amt

Benefit

1

2,513.60 .00 2,513.60 192.29 .00 322.05

.00 .00 N Y 6.00 150.00

.00 .00 .00

2 .00 .00 1,472.00 26.77 227.89 50.00

.00 .00 N Y 180.00 72.00

.00 .00 .00

3 3,661.60 .00 3,341.44 280.09 .00

710.60 .00 .00 N Y 360.16 .00

.00 .00 .00

4 1,620.00 .00 1,720.00 123.93 .00

195.42 .00 100.00 N N .00 .00

.00 .00 .00

5 1,065.00 .00 1,065.00 81.47 .00

112.14 .00 .00 N Y 15.00 .00

.00 .00 .00

Sub

Totals For 5 Employees:

8,860.20 .00 10,112.04 704.55 227.89 1,390.21

.00 100.00 561.16 222.00

.00 .00 .00

Grand

Totals For 5 Employees:

8,860.20 .00 10,112.04 704.55 227.89 1,390.21

.00 100.00 561.16 222.00

.00 .00 .00