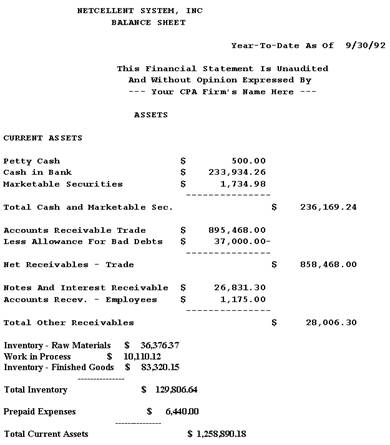

The Select And Print Financial Statements

application encompasses two major processes that enable your company to select

and print standard or customized financial statements.

These processes are statement specifications and financial

statements.

Statement Specifications

This process maintains Standard or Custom statement

specifications. It controls which financial statements are to be printed on the

next statement run and stores other information concerning the appearance and

content of these important documents. The decision of whether to select a

standard or custom specification is dependent on your specific objectives.

Before proceeding further you should consider whether they are better suited to

a standard or customized statement specification. You may also begin with

standard statements and progress to customized statements.

In general, standard specifications are appropriate when

your primary objective is to generate a standard column format that

incorporates standard definitions in the Statement Layout File. But if

the job requires greater flexibility, and powerful features such as printing up

to 13 columns of financial information, defining specialized financial

specifications, and numerical rounding then select the customized

specifications option. In this section the benefits of these two unique

procedures are discussed.

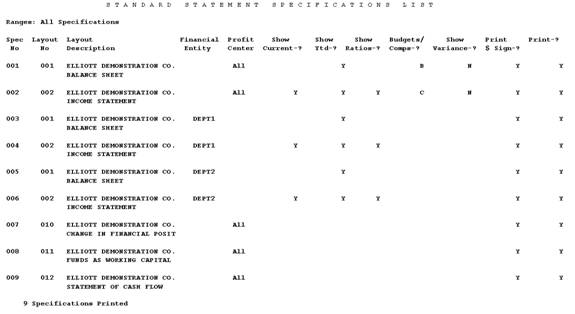

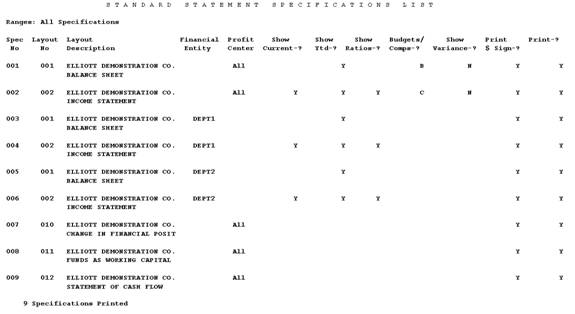

Standard Specifications

The Standard Specifications feature enables you to

select add, change, or delete records on file. It will additionally enable the

generalized clearing and selection of Standard Statement Specifications that

are to be printed on the next financial statement run as well as a listing of

these specifications.

The format and appearance of individual financial

statements is determined by the statement's layout entered in the Statement

Layout File. However, a statement defined by a particular layout must be

selected before it can be printed. In addition to selecting the layout other

information is required by the programs that print financial statements. This

application provides for the selection of layouts and the entry of that

additional information.

It is advisable to group statement specifications

numerically to facilitate access when selecting them to be printed. One

example of such logical grouping is to reserve specification numbers 1 through

100 for statements with the level of detail required for month‑end

administrative reporting. Numbers 101 through 200 might then be reserved for

quarterly reports and 201 through 300 for those statements which you wish to

make public. Another such logical organization would be to group the

specifications according to the types of statements to which they pertain. For

instance, specification numbers 1 through 50 might be reserved for Profit and

Loss Statements, numbers 51 through 100 for Balance Sheet Statements, etc.

Each user's priorities are somewhat different. Some may

choose to ignore profit center and financial entity capabilities while others

rely heavily upon frequent, in‑depth analysis of the activities at these

levels of the company. Some users may wish to get by with one or two versions

of the Balance Sheet and P&L while others may desire many versions from the

highly detailed to concise summaries. Whatever your priorities, this file can

be accessed and maintained most easily if it is structured according to some

convenient numbering system.

When selecting specifications for the next financial

statement run, unless you intend to print the same statements that were printed

on the last run, you will need to modify the selections. You will probably

find it most convenient to first clear all previous selections utilizing the Clear

function of this application. This will set the Print Next Run? field

for each specification to N.

Once all selections have been cleared it would be helpful to

get a listing of specifications on file so that you could review your options

and note, which specifications are to be selected.

When you know which specifications are to be selected you

must then change the Print Next Run? answer for each of them to Y.

If there are a small number of specifications to be selected it would be easy

to access each of them individually in order to select them. You can access

them in change mode by bringing them up one at a time using the F1 key

option and selecting the appropriate specifications to print.

If there are a great many specifications on file and they

are grouped numerically in logical order you will wish to utilize the Generalized

statement selection function. This will permit you to select a range of

specifications to be printed and specify which profit centers and/or financial

entities are to be allowed.

When running Generalized statement selection you

must enter the starting and ending specification numbers. Only specifications

within this range will be considered for selection. You will then have one or

more of these options for the selection criteria on which specifications will

be selected within the starting and ending number range. You may choose to

select specifications for which the profit center is All (consolidated

statements); you may choose to select those specifications for a specific

profit center or financial entity; and/or, you may choose to select

specifications for All individual profit centers and all financial

entities. Whichever options are chosen, only those specifications, which fall

within the range that was entered, and which match the profit center and/or

financial entity designations will be selected to print on the next financial

statement run.

If you do not maintain profit centers in this General

Ledger package you must choose the selection of specifications for

consolidated statements only, when running Generalized Statement Selection.

Once the specifications have been selected you may wish to get a printout

showing all selected specifications. To do this run List and request to

show selected specifications only.

Custom Specifications

The Custom Specifications feature also enables you

to select add, change, or delete records on file. It additionally permits the

generalized clearing and selection of Custom Statement Specifications that are

to be printed on the next financial statement run as well as a listing of the

specifications on file.

However, Custom Specifications provides a more

flexible alternative than the previous selection. To begin with, it doesn't

incorporate the same redundant variables that were present in Standard

Specifications. Instead the specification is entered directly from two

input screens. In the first you may assign a custom number, layout number,

financial entity, profit center, and specify whether to print the $ sign, zero

balances, bracket non-typical balances, or print during the next financial

statement run.

The second input screen contains 13 areas numbered from 1

to 13., that define the columns of your financial statement.

Period Format

Rounding Titles

Col. Type From

To Year/Rev Number Option

Line 1 Line 2

As illustrated above, each column consists of six

variables that interact to define a unique setting. They include Type, Period,

Year/Rev, Format Number, Rounding Option, and Title Header. Each of these

affect the information subsequently displayed in each column. The following

pages examine statement type options, and explore some practical applications

for defining a custom specification. They provide an example of how the

variables work together to help you achieve your desired objective.

Suppose that in the first column of the custom statement

you want to display the actual year to date amounts associated with current G/L

accounts.

Period

Format Rounding Titles

Col. Type From To Year/Rev

Number Option Line

1 Line 2

Col. Type From To Year/Rev

Number Option Line

1 Line 2

1. P 01

CP CY Y M

Current

The P Type option indicates Present

accounts.

The From To is set to delineate period 01

to the current period CP.

The Year/Rev is set to indicate the current year CY.

The resulting values will be formatted and rounded to the M

millions.

The present statement type variable P references

corresponding account amounts that reside in the Account Balance File.

To define this column enter P as the Type. Then specify the Period

to range From 01 To the current period CP, and the Year

automatically displays the current year CY.

You can optionally conserve horizontal form space by

decreasing the column width. This is accomplished by specifying an appropriate Rounding

and Format Number option. In this column the Format Number is

set to Y and the Rounding Option will round all resulting column

values to the millions.

Finally, the Titles variable labels two lines of

text that serves to identify the column. In the illustration above, Line 1

is labeled as "Current". These titles will print on financial

statements each time an LEG command is inserted in the statement layout

file.

In the second and third columns suppose that you want to

display the budget for the current period versus last years budget for the same

period.

Period Format

Rounding Titles

Col. Type From To

Year/Rev Number Option Line 1

Line 2

1. P

01 CP CY Y M

Current

2. B 01

CP CY-01 Y N Current

Budget

3. B

01 CP PY-01 Y N Prev Budget

Column #1 displays the Present accounts from period

1 to the current period.

Column #2 displays the Budget amounts from Period

01 to Current Period of the first revision, for current year.

Column #3 displays the Budget amounts from Period

01 to Current Period of the first revision for the previous year.

All resulting column amounts are formatted.

The rounding option is set to N .

When the budget Type option B is entered all

corresponding amounts associated with Budgets in the Budget File

are considered. This option enables you to specify the budget period, (CP

for current period), (CB for current budget with highest revision

number), or budget year (CY for current year) and budget revision

number.

In our example, column #2 displays the budget B From

Period 01 To the current period CP, for the current year CY,

and revision number 01. A revision number of CB could also be

used for current budget. The current budget (CB) is determined as the

last budget revision number created in Budget File Maintenance for the

account for the year. If an account had a revision number 1 and 2 on file for

the budget year then revision 2 would be the current budget selected. All

accounts do not have to have the same budget revision.

In Column # 4, suppose you want to display variance

between the present G/L account information displayed in column #1 and

the budget values displayed in column #2. By selecting the variance type V

and specifying a range From 1 To 2, as illustrated below this

information is displayed.

Period Format

Rounding Titles

Col. Type From To Year/Rev

Number Option Line 1 Line

2

4.

V 1 2 Y

N Variance

Column #4 displays the variance between the values entered

in Column #1 and Column #2.

All resulting column amounts are formatted.

The rounding option is set to N.

When using variances, the base value of the calculation

should always be entered in the "To" column.

In the next three columns you could then display

comparative amounts for the years 1990, 1989, and 1988. Remember that if your

fiscal year differs from the calendar year, calculate the previous year, PY,

by subtracting one from the year of the last period in the Accounting

Period File.

To display the comparative amounts it will be necessary to

delineate a comparative C Type, and then to specify the Period

to range From 01 To the current period, CP for each year you want

to compare.

In our example, Column #5, will display the Comparative

amounts from the previous year PY, Column #6, the Comparative

amounts for 1989, and Column #7, the Comparative amounts for 1988.

Period

Format Rounding Titles

Col. Type From To Year/Rev Number Option

Line 1 Line 2

5. C 01

CP PY Y N

1990 Comp

6.

C 01 CP 89 Y

N 1989 Comp

7.

C 01 CP 88 Y

N 1988 Comp

Column #5 displays the Comparative account amounts From

period 01 to the current period CP of the previous year PY.

Column #6 displays the Comparative account amounts

from period 01 of 1989 to the current period of 1989.

Column #7 displays the Comparative account amounts

from period 01 of 1988 to the current period of 1988.

All resulting column amounts are formatted.

The rounding option is set to N.

Finally, if your objective is to define a Profit &

Loss statement, the appropriate starting ratio SR and ending ratio

account ER ranges are specified in the Statement Layout File.

You can then define a column that displays the Ratio R for these

accounts.

Period

Format Rounding Titles

Col. Type From To Year/Rev Number Option

Line 1 Line 2

1. P CP

CP CY Y N

Current

2. R CP

CP N N

Ratio

Column #1 displays the Present account amounts From

the current period CP to the current period CP.

Column #2 displays the Ratio of account amounts

displayed in column #1,if the SR and ER was previously defined in

your Statement Layout File.

Formatting and Rounding are not permitted in the Ratio

column.

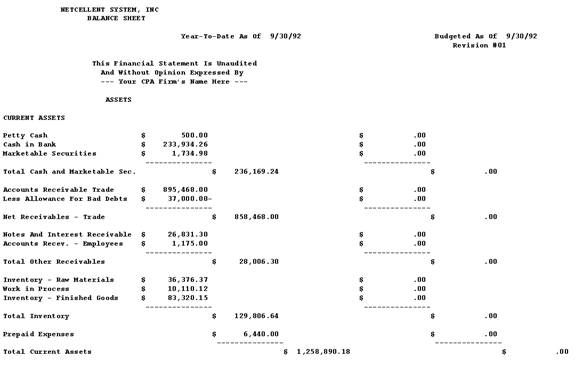

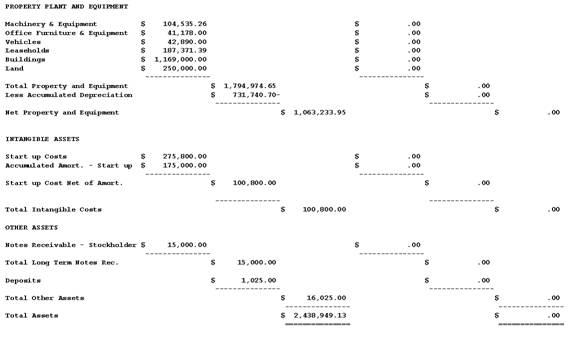

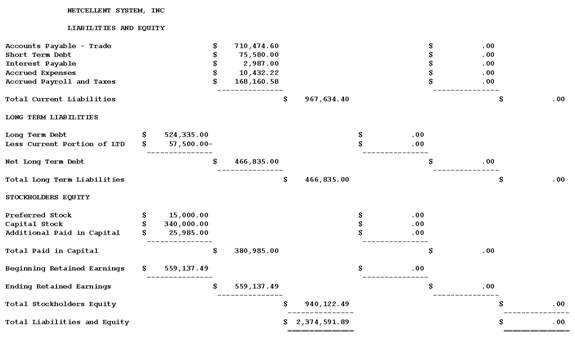

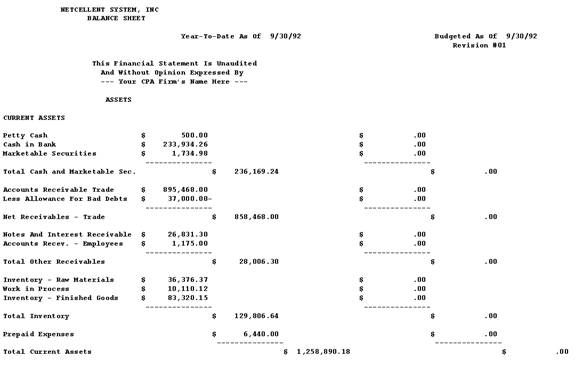

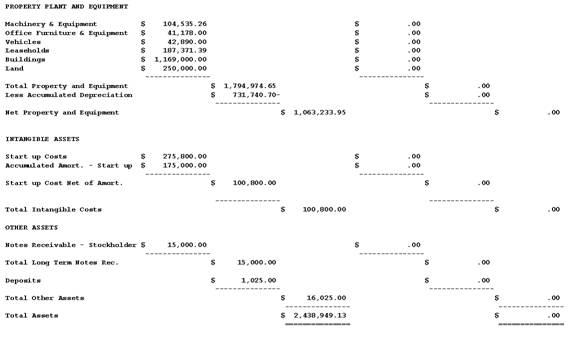

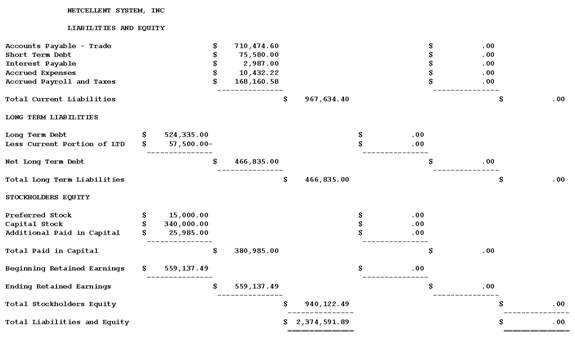

Financial Statement Printing

The second process prints Standard or Custom statements

that were specified in the previously discussed applications.

Print Standard Statements

In Print Standard Statements you will first enter

the appropriate range of starting and ending dates for the period in which the

statements are to be printed. Then the net income figures and account balances

accessed by the financial statement programs are automatically calculated.

Once this process is complete, your statements are printed according to the

selections made in the Standard Specifications application.

When you enter the start and end dates the program looks

up the dates entered to see if they have been entered in the last run. If both

dates are the same, a question is also asked whether you have posted entries

since last printing statements. If no new transactions have been posted to the

General Ledger Transaction file there is no need to recalculate account

balances.

Budgets or comparatives will not be calculated or printed

on any financial statement, even if requested, if you are running the

statements for a set of start and end dates which are not contained in the Period

File.

The net income balances for the whole company and for each

profit center are calculated, as well as the balances for every account. These

are written into a Period work file. These balances are derived from the

values that are reflective of the Period Account Balance File for each account.

The balances are for current period (within the dates selected), year‑to‑date

(from the beginning of the year up to and including transactions dated on the

ending date selected), and a final balance derived from all transactions on

the General Ledger Transaction file date on or before the ending date

selected. These total balances for each account can then be used for any

financial statement in which the accounts might appear.

Needlessly answering yes to the recalculate question will

slow down processing time in getting the first financial statement. It will

only be necessary to recalculate the balances if you run statements for a

different period than the previous run or if new transactions have been added

since the balances were last calculated.

The application will process all the financial statements

from the specifications you have selected to print for the run.

Print Custom Statements

When you are ready to Print Custom Statements

select the appropriate option from Select And Print Financial Statements

menu bar. The resulting custom financial statement is then calculated according

to the accounting periods of your Period File, and reflects the bucket

or period account balance of each account.

Please Note: The period work is recalculated prior

to printing each custom financial statement. This is due to the ability to

custom select period and year-to-date information on each custom financial

statement. Generally speaking, custom financial statement printing will most

likely run longer than standard statement printing. You will not be asked for

the date range when printing custom statements. The current period in the

Accounting period file is the date range that will print.

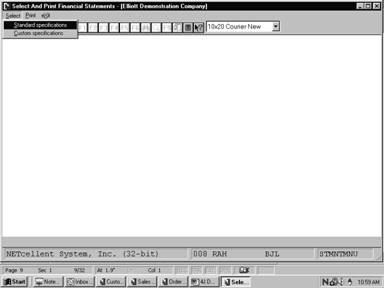

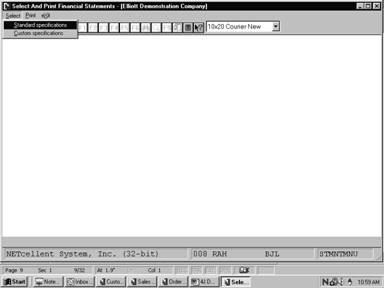

Select Select And Print Financial Statements from

the pull down G/L Processing window. The following screen will

then be displayed:

Select and Print Financial Statements Entry Screen

The following options are available:

* Select

the desired mode from the Select And Print Financial Statements menu bar

* Enter the data requested on the

screen

* To

exit press the ESC or F10 key when the cursor is positioned for

entry of the first field on the screen

To return to the menu Bar, press the ESC or F10

key. To leave this application, press X for EXIT when positioned

at the menu Bar.

Entry Field Descriptions

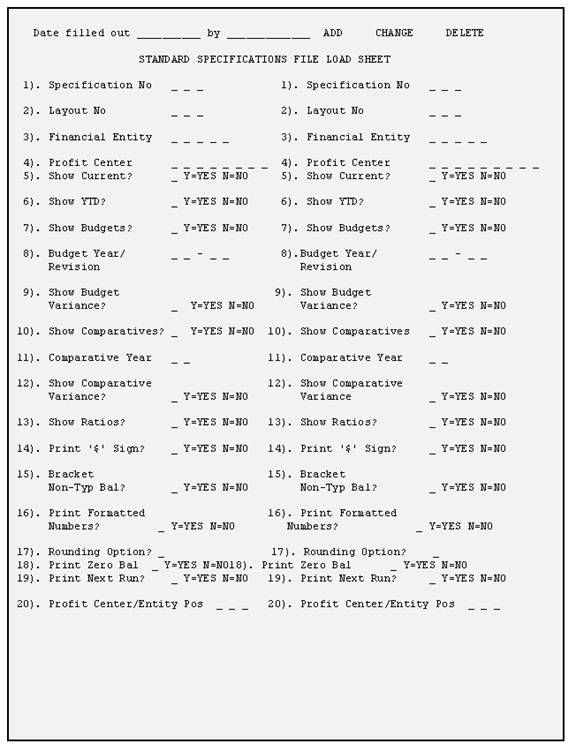

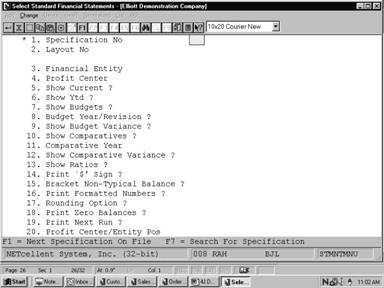

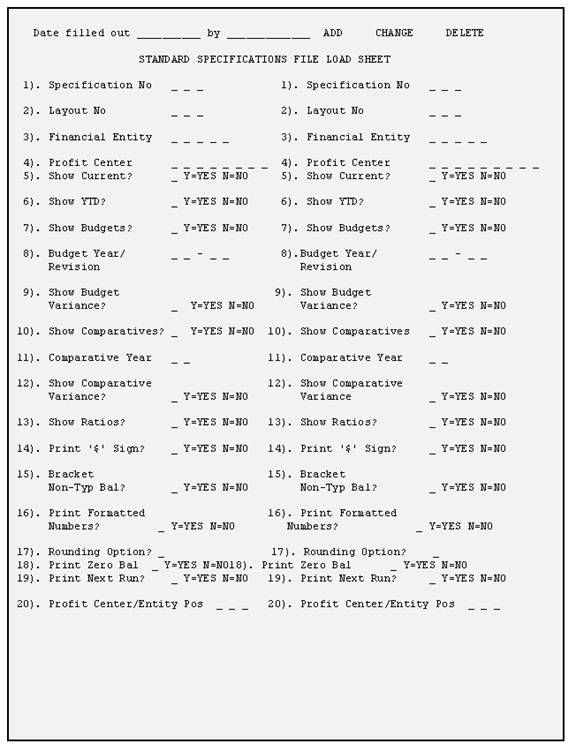

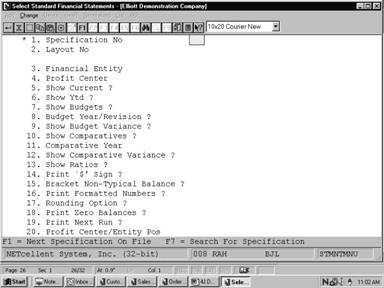

Standard Specifications

|

Name

|

Type

and Description

|

|

1.

Specification No

|

3

numeric digits. This identifies the specification.

Press

the RETURN key in the change or delete mode for next specification on

file or press the F7 key in the change or delete mode for

specification search by number.

|

|

2.

Layout No

|

3

numeric digits. In order to use this application you must first define an

appropriate layout in the Statement Layout File application.

When

you enter a specific layout number this application defaults to the

description and settings that define the layout.

Press

the F7 key in add, change, or delete modes to search for a layout.

|

|

3.

Financial Entity

|

5

alphanumeric characters. The entity must already be on file in the Financial

Entity file. Entry of a non‑blank financial entity will override

any entry of an individual profit center in the next field.

See

also the description in 4 below, which is applicable to financial entities as

well as profit centers.

Press

the F7 key in add, change, or delete modes for search for financial

entity.

|

|

4.

Profit Center

|

A

standard profit center number in the standard profit center number format.

The profit center must have a record defining it in the Chart of Accounts

file. Press the RETURN key to default to All profit centers.

Selection

of a profit center is allowed in order to reduce the number of layouts that

are required to be on file. A single layout may be created that includes all

accounts for a particular statement type ("P", for

instance). If you wish that layout to be printed with all accounts ignored

except those for a specific profit center you may do so by specifying here

the profit center that is to be printed. You may print a consolidated profit

center statement by pressing the RETURN key for a default to All

profit centers.

|

|

Profit Center (continued)

|

When

a specific profit center is entered, only those accounts in the layout with a

number matching the profit center are considered during the printing of the

financial statement.

The

financial statements program will print a special legend whenever it

encounters a legend code in the Statement Layout file. This legend

will identify the profit center. For consolidated statements there will be

no such special legend.

A

specification may be created in the Statement Layout File for each

version of a particular layout that you might routinely select. For

example, the layout for your Profit and Loss Statement contains all accounts.

You may define one specification for the consolidated statement ("All"

profit centers) and one additional specification for each of the profit

centers represented in the layout. You must then select which of these

specifications is to be considered during the next financial statement run by

answering Y to the question PRINT NEXT RUN ? associated with

each specification.

|

|

5.

Show Current?

|

Y or N. RETURN

defaults to Y.

If

you answer Y to this question, figures for the current period will be

shown on the financial statement. This only applies to the Profit and Loss

Statement and its supporting schedules.

An

entry for this field will not be requested if the layout is not a P&L

format.

|

|

6.

Show Ytd ?

|

Y or N. Press RETURN

to default to Y.

This

question only applies to P&L format layouts. See the description for

the Show Current? field above.

|

|

7.

Show Budgets?

|

Y or N. Enter Y

to show budgets or N to decline.

|

|

8.

Budget Year/Revision?

|

2

alphanumeric characters. If you entered Y in the previous field,

specify the budget year and revision number. This field defaults to CY

for the current year, and no default for the current budget. CY is

assigned by the system to be equal to the last year of the last period in the

period file.

|

|

9.

Show Budget Variance ?

|

Y or N. If you

answer Y to this field, the statement will display the difference

between the amount you entered in the Budget File, and the actual

amount present in the General Ledger File.

|

|

10.

Show Comparatives ?

|

Y or N. Enter Y

to show comparatives or N to decline.

|

|

11.

Comparative Year

|

2

numeric digits. If you entered Y in the previous field enter a year

between 00 and 99 that you want to compare, or PY to indicate the

previous year.

If

your fiscal year differs from the calendar year, calculate the previous year

by subtracting one from the last period in the Accounting Period File. If

the last period in the file is in the year 1991, the previous year will be

assigned a year of 1990.

|

|

12.

Show Comparative Variance ?

|

Y or N. If you

answer Y to this field, the statement will display the difference

between the period balance amounts present in the Comparative File,

and the actual amount in the General Ledger File.

|

|

13.

Show Ratios ?

|

Y or N. RETURN

defaults to N.

Your

response to the Show Ratios ? question will determine whether or not

ratios are to be printed on the financial statement that is defined for the

layout number you entered.

Ratios

are a feature of the Profit and Loss Statement and the P&L Supporting

Schedules only, so if ratios are requested for any other type of statement,

the request will be ignored when the statement is printed.

For

a complete explanation of what ratios are and what effect they have on the

financial statements, refer to the documentation for the Statement Layout

File.

|

|

14.

Print `$' Sign ?

|

Y or N. RETURN

defaults to Y.

The

answer to the Print '$' Sign ? question determines if dollar signs

will be printed on the selected financial statement.

|

|

15.

Bracket Non-Typical Balances?

|

Y or N. Enter Y

to place brackets around non-typical balances, or N to decline.

|

|

16.

Print Formatted Numbers?

|

Y or N. Enter Y

to print formatted numbers or N to decline.

For

example, if you answer Y to this question a formatted number

(99,999,999.99) will appear. If you answer N the same number would

print without the formatting attributes such as 99999999.99.

|

|

17.

Rounding Option?

|

1

alphabetic character. Enter one of the following to delineate a rounding

option.

N = No

Rounding

D = To

Dollar

T = To

Thousand

M = To

Million

This

field defaults to N that indicates no rounding.

|

|

18.

Print Zero Balances?

|

Y or N. Enter Y

if you want to print PAT or SUB accounts with zero balances.

Enter N to decline.

|

|

19.

Print Next Run?

|

Y or N. RETURN

defaults to N.

The

answer to the Print Next Run? question determines if this

specification will be consulted the next time financial statements are run.

If the answer is Y then a statement will be printed for the layout

and financial entity or profit center specified and ratios and budgets or

comparatives will be shown as the instructions dictate.

When

you select to print financial statements there will be a statement printed

for each specification, which has a Y in this field. It is for this

reason that we provide three easy means of changing the field's value. In

addition to utilizing change mode, you may select the CLEAR option

which sets the print answer for all specifications to N or Generalized

Statement Selection which sets the print answer for certain

specifications to Y. See the Application Overview of this

application for more information about these features.

|

|

20.

Profit Center/Entity Pos

|

3

numeric digits. Enter the starting print position of the Profit Center or Entity name. This option is only applicable when printing for a specific Profit Center or Entity and printing the legend using the LEG command on the financial

statements. If 0 is entered, the name will float above the columns.

If 1 is entered, the name will be one position from the left of the

report. A 2 will position the name two spaces from the left, and so

on.

|

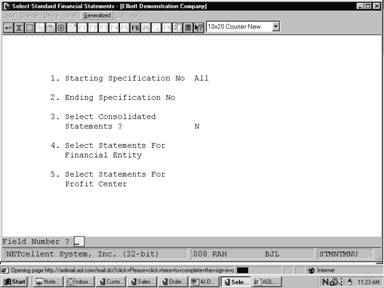

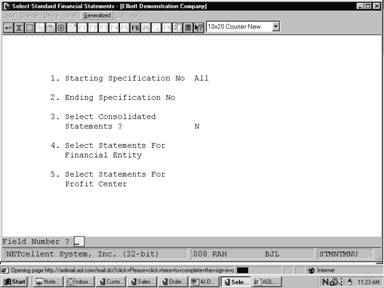

Generalized Statement Selection

|

Name

|

Type

and Description

|

|

1.

Starting Specification No

|

3

numeric digits. Enter the starting specifications no. range, or press RETURN

to default to All specifications.

|

|

2.

Ending Specification No

|

3

numeric digits. Enter the ending specifications no. range, or press RETURN

to default to the same value as entered for the starting specification

number.

|

|

3.

Select Consolidated Statements?

|

Y or N. RETURN

defaults to N.

For

purposes of this accounting package, a consolidated statement is understood

to be a statement for which all accounts, regardless of profit center or

financial entity designation, are included. This would be the statement for

the entire company.

When

the question Select Consolidated Statements? is answered Y,

specifications for which All profit centers have been chosen are

selected to be printed on the next run. Conversely, if the question is

answered N, any specification with All for the profit center

designation will be passed over. This feature allows you to very quickly

select from the specifications you have on file those that pertain to

consolidated company activity.

|

|

4.

Select Statements For Financial Entity

|

5

alphanumeric characters. Press the RETURN key to default to All

financial entities (i.e., all specifications within a non‑blank

entity).

The

financial entity is looked up on the Financial Entity file, and the

description is automatically displayed. The entry will not be allowed if the

entity is not on file.

Similar

considerations apply here as do for the entry for 5 below.

|

|

5.

Select Statements For Profit Center

|

A

standard profit center number in the standard profit center number format.

Press the RETURN key to default to All profit centers.

If

you wish to select statements for a specific profit center, enter the number

of that profit center here. All specifications within the range that you

entered with that profit centers designation will be selected.

For

example, if you wish to print out all statements and supporting schedules for

profit center 0010, you must enter 0010 in this field. In order for the

entry to be accepted, profit center 0010 must be defined in the G/L

Account File. Refer to the Run Instructions for G/L Account File

Maintenance if you are not sure how to do this.

Pressing

the RETURN key here defaults the entry to All. This means that

all specifications with the designation of a particular profit center will be

selected.

This

is not to be confused with the selection of consolidated statements. For

instance, there are specifications on file for three profit centers (00100,

00200 and 00300) as well as specifications for consolidated statements. All

specifications for profit centers 00100, 00200 and 00300 would be selected.

Specifications for consolidated statements (All profit centers) would

be ignored, as well as specifications for specific financial entities.

This

feature allows you to select from the file of Statement Specifications

each and every financial statement and supporting schedule that pertains to a

specific profit center without requiring you to step through the entire file

in change mode to set the Print Next Run ? response to Y for

the desired specifications.

|

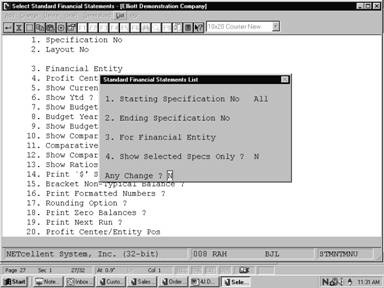

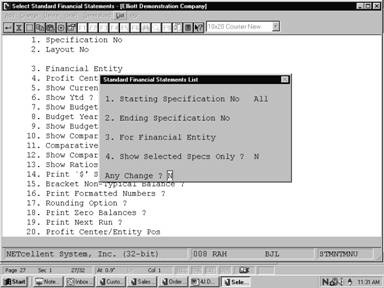

List

|

Name

|

Type

and Description

|

|

1.

Starting Specification No

|

3

numeric digits. Enter the starting specifications range or press RETURN

to default to All specifications.

|

|

2.

Ending Specification No

|

3

numeric digits. Enter the ending specifications range or press RETURN

to default to the same value as entered for the starting specification number.

|

|

3.

For Financial Entity

|

5

alphanumeric characters. Press RETURN if you wish to print all

specifications in the above range regardless of financial entity.

If

a financial entity is entered, it must exist on the Financial Entity file.

|

|

4.

Show Selected Specs

Only ?

|

Y or N. RETURN

defaults to N.

If

you answer Y to the question Show Selected Specs Only? the

report will show only those specifications for which the answer to Print

Next Run ? in the Statement Specifications file is Y. This

allows you to see very easily which specifications will be considered on your

next financial statements run.

|

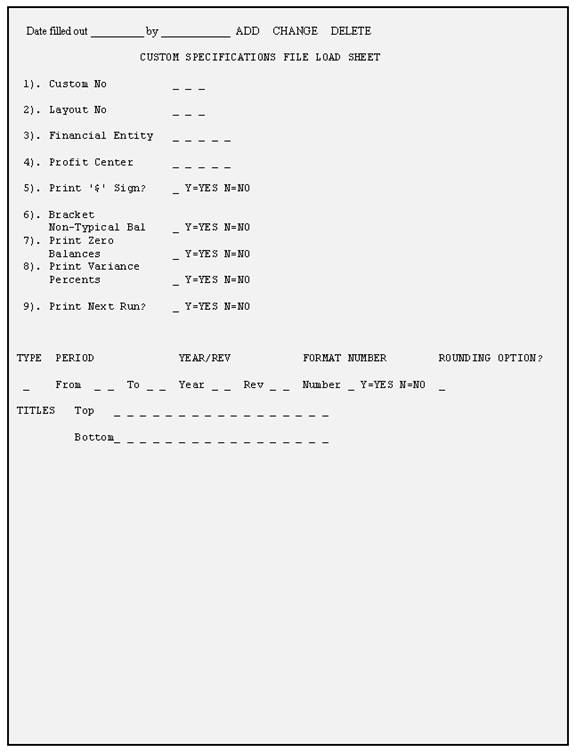

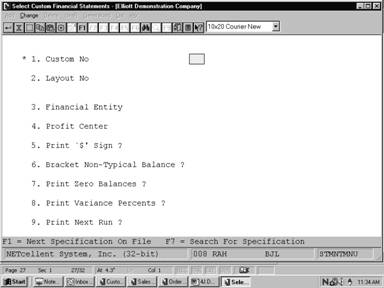

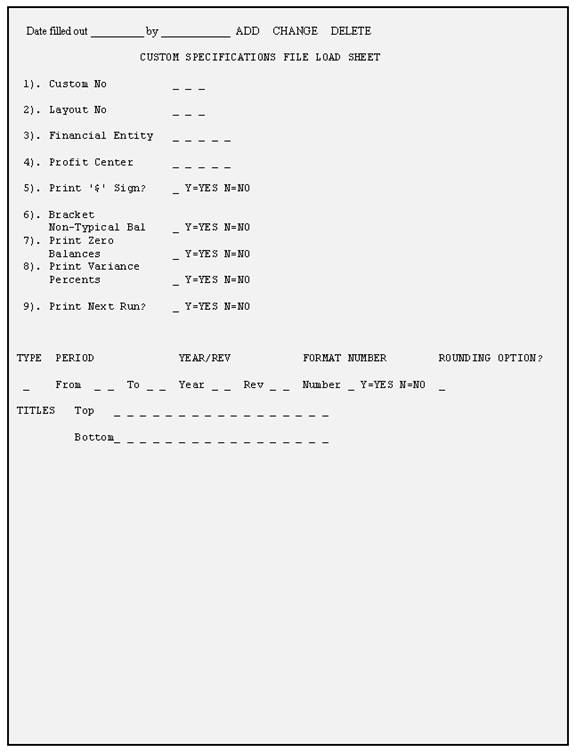

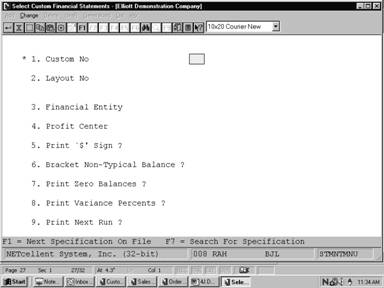

Custom Specifications

First Screen

|

Name

|

Type

and Description

|

|

1.

Custom No

|

3

numeric digits. This identifies the custom specification.

Press

the RETURN key in the change or delete mode for next specification on

file or press the F7 key in the change or delete mode for

specification search by number.

Note: You are not permitted to

enter a valid standard specification number.

|

|

2.

Layout No

|

3

numeric digits. This identifies the layout that corresponds to this

specification. The custom layout must already be on file.

Press

the F7 key in add, change, or delete modes for search for layout.

|

|

3.

Financial Entity

|

5

alphanumeric characters. The entity must already be on file in the Financial

Entity file. Entry of a non‑blank financial entity will override

any entry of an individual profit center in the next field.

See

also the description in 4 below, which is applicable to financial entities as

well as profit centers.

Press

the F7 key in add, change, or delete modes for search for financial

entity.

|

|

4.

Profit Center

|

A

standard profit center number in the standard profit center number format.

The profit center must have a record defining it in the Chart of Accounts

file. Press the RETURN key to default to All profit centers.

Selection

of a profit center is allowed in order to reduce the number of layouts that

are required to be on file. A single layout may be created that includes all

accounts for a particular statement type ("P", for

instance). If you wish that layout to be printed with all accounts ignored

except those for a specific profit center you may do so by specifying here

the profit center that is to be printed. You may print a consolidated profit

center statement by pressing the RETURN key for a default to All

profit centers.

When

a specific profit center is entered, only those accounts in the layout with a

number matching the profit center are considered during the printing of the

financial statement.

The

financial statements program will print a special legend whenever it

encounters a legend code in the Layout file. This legend will

identify the profit center. For consolidated statements there will be no

such special legend.

A

specification may be created for each version of a particular layout that

you might routinely select. For example, the layout for your Profit and Loss

Statement contains all accounts. You may define one specification for the

consolidated statement ("All" profit centers) and one

additional specification for each of the profit centers represented in the

layout. You must then select which of these specifications is to be

considered during the next financial statement run by answering Y to

the question Print Next Run? associated with each specification.

|

|

5.

Print `$' Sign?

|

Y or N. RETURN

defaults to Y.

The

answer to the Print '$' Sign? question determines if dollar signs are

allowed on the selected financial statement.

|

|

6. Bracket

Non-Typical Balances

|

Y or N. Enter Y

to place brackets around non-typical balances, or N to decline.

|

|

7.

Print Zero Balances

|

Y or N. Enter Y

if you want to print accounts with zero balances or N to decline.

|

|

8.

Print Variance Percents

|

Y or N. Enter Y

to print percents with variance amounts on the financial statement or N

to decline.

|

|

9.

Print Next Run?

|

Y or N. RETURN

defaults to N.

The

answer to the Print Next Run? question determines if this

specification will be consulted the next time financial statements are run.

If the answer is Y then a statement will be printed for the layout and

financial entity or profit center specified and ratios and budgets or

comparatives will be shown as the instructions dictate.

When

you select to print financial statements there will be a statement printed

for each specification, which has a Y in this field. It is for this

reason that we provide three easy means of changing the field's value.

In

addition to utilizing change mode, you may select Clear Statement

Selections which sets the print answer for all specifications to N

or Generalized Statement Selection which sets the print answer for

certain specifications to Y. See the Application Overview of

this application for more information about these features.

|

Second Screen

|

Column Name

|

Type

and Description

|

|

(Type)

|

1

alphabetic character. Enter one of the following to delineate the Custom

Statement Type.

P = Present

B = Budget

C = Comparative

V = Variance

R = Ratio

Note

: Type R Ratio is valid for Profit & Loss Statements only.

In

change mode if a space is entered for an existing TYPE the following message

will be displayed.

Entering

Space In Type Will Delete Entry. Ok to Continue? "Y" to delete

the column.

|

|

(Period)

From

|

2

alphanumeric characters. Enter CP to delineate the Current Period

or the Period Number (1-13) that you want to define.

If

type V (Variance) was entered in the previous field, specify the

column numbers to be included in the variance.

The

"To" column should contain the base value for the variance

calculation.

|

|

(Period)

To

|

2

alphanumeric characters. Enter CP to delineate the Current Period

or the Period Number (1-13). that you want to define.

|

|

(Year/Rev)

Year/Rev

|

2

alphanumeric characters. Enter one of the following:

PY = Previous

Year

CY = Current

Year

NY = Next

Year

Or

If

the column has been defined as a Type C (comparative) enter the

Year that you want to compare. For example, 89 for (1989), and 90 (1990) or PY

for Previous Year. If the column has been defined as a type P, R

or C this field entry is skipped.

If

a relative year assignment of PY, CY or NY is used it is

referenced to the year of the last period in the period file. For example if

the year of the last period was 1991 then CY would equal 1991, PY

would equal 1990 and NY would equal 1992.

Note: The information entered

into the REV field applies to budgets only, since comparatives do not

have revisions.

|

|

(Format

Number)

Print

Formatted Numbers?

|

Y or N. Enter Y

If you want to print formatted numbers or N to decline.

An

example of a formatted number is 9,999,999,99.

An

example of an unformatted number is 9999999.99.

|

|

(Rounding)

Option

|

1

alphabetic character. Rounding enables you to decrease the column width to

conserve horizontal space.

Enter

one of the following:

N = No

Rounding

D = To

Dollar

T = To

Thousand

M = To

Million

If

this column is an R statement Type (Ratio), entry is not permitted.

|

|

(Titles)

Line

1

|

17

alphanumeric characters. Enter the title to appear on the first line of the

column each time an LEG command is encountered in the layout file.

|

|

(Titles)

Line

2

|

17

alphanumeric characters. Enter the title to appear on the second line of the

column each time an LEG command is encountered in the layout file.

You

may additionally specify a period ending date by entering the % sign followed

by the period date. For example, %99/99/99.

If

you are working in a B (Budget) type column, enter % RR to reference a budget

revision number.

|

Generalized Statement Selection

|

Name

|

Type

and Description

|

|

1.

Starting Specification No

|

3

numeric digits. Enter the starting specifications no. range, or press RETURN

to default to All specifications.

|

|

2.

Ending Specification No

|

3

numeric digits. Enter the ending specifications no. range, or press RETURN

to default to the same value as entered for the starting specification

number.

|

|

3. Select

Consolidated Statements?

|

Y or N. RETURN

defaults to N.

For

purposes of this accounting package, a consolidated statement is understood

to be a statement for which all accounts, regardless of profit center or

financial entity designation, are included.

This

would be the statement for the entire company.

When

the question Select Consolidated Statements? is answered Y,

specifications for which All profit centers have been chosen are

selected to be printed on the next run. Conversely, if the question is

answered N, any specification with All for the profit center

designation will be passed over.

This

feature allows you to very quickly select from the specifications you have on

file those that pertain to consolidated company activity.

|

|

4. Select Statements

for Financial Entity

|

5

alphanumeric characters. Press the F1 key to default to ALL

financial entities (i.e., all specifications within a non-blank entity).

The

financial entity is looked up on the Financial Entity File, and the

description is automatically displayed. The entry will not be allowed if the

entity is not on file.

Similar

considerations apply here as do for the entry for 5 below.

|

|

5.

Select Statements For Profit Center

|

A

standard profit center number in the standard profit center number format.

Depending on the format of the profit center in the G/L account

number. Press the F1 key to default to ALL profit centers.

If

you wish to select statements for a specific profit center, enter the number

of that profit center here. All specifications within the range that you

entered with that profit center's designation will be selected.

For

example, if you wish to print out all statements and supporting schedules for

profit center 0010, you must enter 0010 in this field. In order for the

entry to be accepted, profit center 0010 must be defined in the G/L

Account File. Refer to the Run Instructions for G/L Account File

Maintenance if you are not sure how to do this.

Pressing

the RETURN key here defaults the entry to All. This means that

all specifications with the designation of a particular profit center will be

selected. This is not to be confused with the selection of consolidated statements.

For

instance, there are specifications on file for three profit centers (00100,

00200 and 00300) as well as specifications for consolidated statements. All

specifications for profit centers 00100, 00200 and 00300 would be selected.

Specifications

for consolidated statements (All profit centers) would be ignored, as

well as specifications for specific financial entities.

This

feature allows you to select from the file of Statement Specifications

each and every financial statement and supporting schedule that pertains to a

specific profit center without requiring you to step through the entire file

in change mode to set the Print Next Run? response to Y for the

desired specifications.

|

List

|

Name

|

Type

and Description

|

|

1.

Starting Specification No

|

3

numeric digits. Enter the starting specifications range or press RETURN

to default to All specifications.

|

|

2.

Ending Specification No

|

3

numeric digits. Enter the ending specifications range or press RETURN

to default to the same value as entered for the starting specification

number.

|

|

3.

For Financial Entity

|

5

alphanumeric characters. Press RETURN if you wish to print all

specifications in the above range regardless of financial entity.

If

a financial entity is entered, it must exist on the Financial Entity file.

|

|

4.

Show Selected Specs

Only?

|

Y or N. RETURN

defaults to N.

If

you answer Y to the question Show Selected Specs Only ? the

report will show only those specifications for which the answer to Print

Next Run ? in the Statement Specifications file is Y. This

allows you to see very easily which specifications will be considered on your

next financial statements run.

|

Print Standard Statements

|

Name

|

Type

and Description

|

|

1.

Starting Date

|

A

standard date in the standard date format.

The

starting and ending dates entered will determine for which date the financial

statement will print.

The

date will default to the current period starting date contained the G/L

Accounting Period file if you press RETURN. You will be warned if

the starting date entered does not correspond to a regular accounting period

entered in the G/L Accounting Period file.

|

|

2.

Ending Date

|

A

standard date in the standard date format. This is the ending date for which

financial statements will be printed.

It

will default to the current period ending date contained in the G/L

Accounting Period file.

|

Select Standard Financial Statements

Select Standard Financial Statements (Generalized)

Standard Financial Statements (List)

Select Custom Financial Statements

Select Custom Column Definitions

Select Custom Financial Statements (Generalized)

Select Custom Financial Statements (List)

Print Standard Financial Statements