| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

Copyright ©

2020

NETcellent System, Inc

4030 Valley Blvd. STE 100

Walnut, CA 91789-0931

|

|

|

|

Elliott

2014 Year-End Updates (W-2 & 1099)

Introduction

There are no programming changes required in Elliott 7.5 or 8.0 to support the 2014 year-end process. If you already have the Elliott 2013 Year-End update, then you are not required to update to any later version of Elliott to perform the following tasks:

|

Printing of 2014 W-2 Form |

|

Creating 2014 W-2 Electronic File |

|

Printing of 2014 1099-MISC Form |

Having said that, we would like to remind you of the following:

Printing of 2014 W-2 Form

Go to Elliott 7.5 or 8.0 and choose Payroll -> Processing -> Print/Create W-2 Forms -> Print -> Print W-2 Forms. Don't use a laser form template. The alignment will work perfectly without the laser form template as long as your laser printer has the following default margins:

|

Top Margin: 0.50" |

|

Bottom Margin: 0.50" |

|

Left Margin: 0.25" |

|

Right Margin: 0.25" |

You should be able to order W-2 forms that conform to the IRS published standard from any major office supplier. As long as the W-2 forms are letter size and designed for the laser printer, then it should work. In house, we tested against Deluxe Forms Item# TF5650.

Creating a 2014 W-2 Electronic File

For the exact W-2 filing requirements, refer to the IRS or SAA publications. If you are required to file W-2s electronically, you can go to Elliott 7.5 or 8.0 and choose Payroll -> Processing -> Print/Create W-2 Forms -> Create -> Create W-2 File. There is no change to the file layout from last year. Some of the fields formerly became required fields, and we made requirement for that with the past update. The only potential issue that you should be aware of is the requirement to supply the employee's first name and last name.

As you may be aware, the Elliott Payroll Employee file prompts for Employee Name. We do not separate first name and last name. During the time that the W-2 electronic file is created, our system will parse the first name and last name based on the following algorithm:

|

If there's a "," (comma) in the Employee Name field, then the name before the comma is considered the last name and the name after the comma is considered the first name. Everything else is considered a middle name.

|

|

If there's no comma in the Employee Name field, then the first word is considered the first name and the last word is considered the last name. Everything else in between is considered a middle name. |

Since there was no requirement for first name and last names in the W-2 electronic file in the past, you may have an employee name format that does not conform to our parsing logic without being aware of it.

The only way you can know for sure if there's any issue with the W-2 electronic file is to download the 2014 AccuWage program from the www.socialsecurity.gov Web site. You may need to disable the popup blocker in order to download. Once you download and install 2014 AccuWage successfully, you should use it to test your W-2 electronic file before submitting it to Business Service On-line (BSO). The Social Security Administration will not accept any W-2 electronic file that has errors starting with tax year 2014.

Printing of 2014 1099-MISC Form

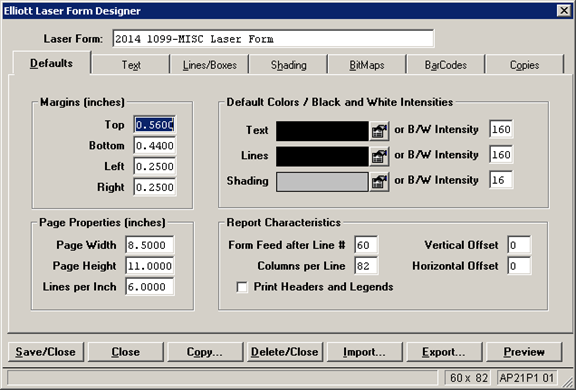

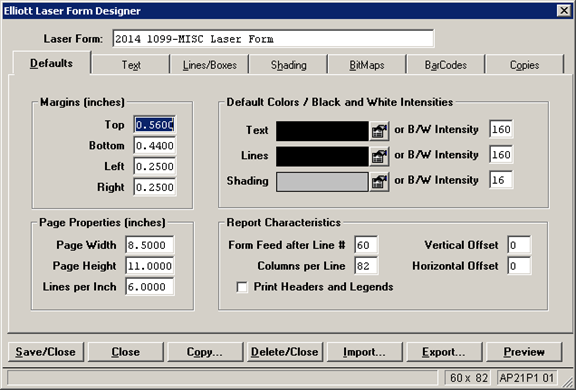

Go to Elliott 7.5 or 8.0 and choose Accounts Payable -> Processing -> Print 1099 Forms -> Print -> Print 1099 Forms. For best results, you should use a laser form template to modify the top and bottom margins. You can either modify the existing laser form or create a new laser form with the following margins:

|

Top Margin: 0.56" |

|

Bottom Margin: 0.44" |

See the screen below as an example.

You should be able to order 1099-MISC forms that conform to the IRS published standard from any major office supplier. As long as the 1099-MISC forms are letter size and designed for the laser printer, then it should work. In house, we tested against Deluxe Forms Item# TF6103.

If you have any questions about the year-end updates, feel free to contact us at 888-595-3818, or email us at sales@netcellent.com.

|